Affordable Care Act guide them Letter 226J Related: Is Obamacare dead? No one told the IRS.

Affordable Care Act guide them Letter 226J Related: Is Obamacare dead? No one told the IRS. Pre-letter file reviews

- Was the offer made through the stability period?

- Was the employee tracked for 3 months and coverage termed the first of the fourth month (if fewer than 130 hours, on average, per month) and COBRA offered?

The ostrich problem

- I was an ALE for calendar year 2015 and filed under the following name.

- I was an ALE and Form 1094-C and 1095-C are enclosed (only for paper filer use).

- I was an ALE for calendar year 2015 and will file with the IRS under the following name.

- I was not an ALE for calendar year 2015.

- Other: Why I didn't file and actions I plan to take.

The New TIN discovery service

- Validate issuer and recipient TINs.

- Discover a TIN based on name and date of birth.

- Discover a TIN based on name and address.

- Determine TIN type and.

- Reattempt to validate TINs that were unable to be previously validated.

Letter 226J risk analysis

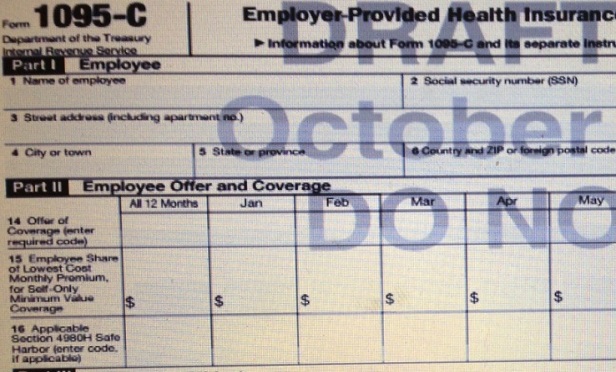

- Did you offer minimum essential coverage to at least 70% of your full-time employees (and their dependents) in 2015?

- If you did, make sure you checked the “yes” box in line 23, or the lines for each month -of the year!

- Best practice: if your employee count in column (b) of Part III of Form 1094-C varied by month, check lines 24-35 in column (a) rather than using the “all 12 months” box.

- Review your affordability calculation – did you accurately use one of the safe harbors – W-2, rate of pay, or federal poverty level?

- If you qualified for 4980H transitional relief based on size (50-99 full-time equivalents (FTEs) or 100+ FTEs), was line 22 box (C) checked?

The future

Lisa Allen is vice president of regulatory affairs at Relph Benefit Advisors, an Alera Group Company. She is chair of the Benefit Advisors Network (BAN) compliance committee. She also sits on the IRS Information Reporting Program Advisory Committee and the IRS Employer Information Reporting and Burden Reduction Subgroup. She can be reached at [email protected].

Lisa Allen is vice president of regulatory affairs at Relph Benefit Advisors, an Alera Group Company. She is chair of the Benefit Advisors Network (BAN) compliance committee. She also sits on the IRS Information Reporting Program Advisory Committee and the IRS Employer Information Reporting and Burden Reduction Subgroup. She can be reached at [email protected].© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.