voluntary benefits communicating with employees facts and details emotional cues Related: Benefits enrollment: up close and personal

voluntary benefits communicating with employees facts and details emotional cues Related: Benefits enrollment: up close and personal

The insurance gap

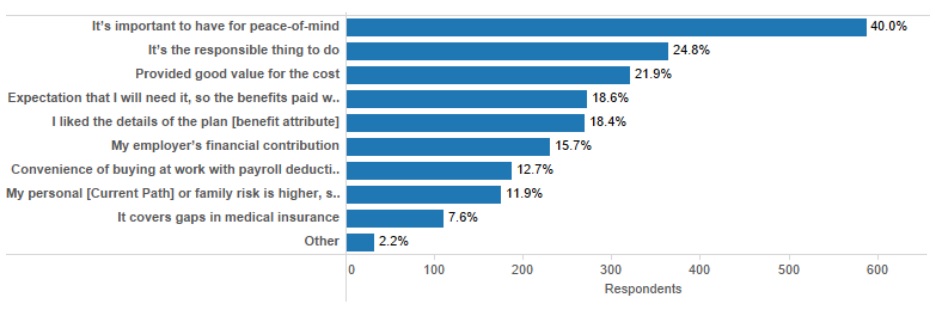

high-deductible health plansPlay to employee peace of mind

Dan Johnson is vice president of sales and marketing for Trustmark Voluntary Benefit Solutions and has more than 30 years of experience in the insurance industry. Dan has spoken to various industry groups such as Voluntary Employee Benefits Board, National Association of Health Underwriters, and Million Dollar Round Table.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.