A lack of wage gains has been a major blemish on an economy that President Donald Trump has called the strongest ever — and is currently being boosted by his tax-cut stimulus. (Photo: Shutterstock)

A lack of wage gains has been a major blemish on an economy that President Donald Trump has called the strongest ever — and is currently being boosted by his tax-cut stimulus. (Photo: Shutterstock)

American wages unexpectedly climbed in August by the most since the recession ended in 2009 and hiring rose by more than forecast, keeping the Federal Reserve on track to lift interest rates this month and making another hike in December more likely.

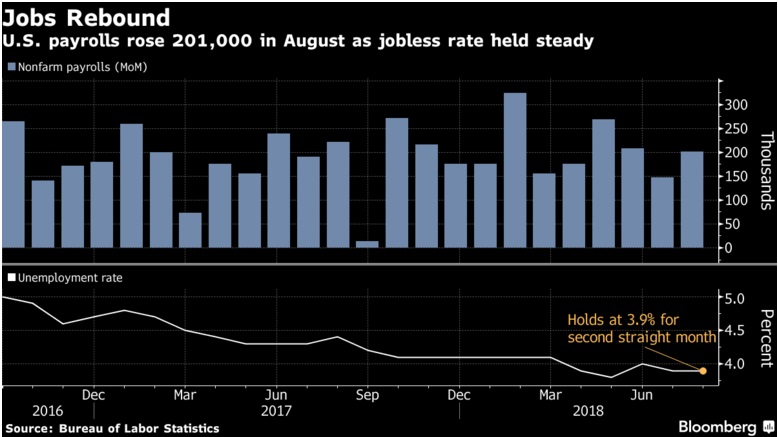

Average hourly earnings for private workers increased 2.9 percent from a year earlier, a Labor Department report showed Friday, exceeding all estimates in a Bloomberg survey and the median projection for 2.7 percent. Nonfarm payrolls rose 201,000 from the prior month, topping the median forecast for 190,000 jobs. The unemployment rate was unchanged at 3.9 percent, still near the lowest since the 1960s.

Related: What hourly workers want, aren't getting in the job market

Treasury yields and the dollar jumped after the report, while U.S. stocks opened lower as investors saw the data as encouraging Fed Chairman Jerome Powell to keep tightening monetary policy beyond this month.

A lack of wage gains has been a major blemish on an economy that President Donald Trump has called the strongest ever — and is currently being boosted by his tax-cut stimulus. Some investors had speculated the Fed would pause after this month given an escalating trade war and turmoil in emerging markets.

“The labor market looks great,” said Ward McCarthy, chief financial economist at Jefferies LLC in New York. Weak wage growth “had been the one fly in the ointment in the last few years. Perkier wages are the final confirmation the labor market is back to normal.”

The latest data “might move the needle for the doubters in the market” about a December Fed hike, he said. “The biggest concern is the effect of tariffs,” though McCarthy said he thinks at this point it may only affect some sectors of the economy.

Here are the highlights of the three most closely watched components of the report: payrolls, wages and unemployment.

Payrolls

Revisions subtracted a total of 50,000 jobs from payrolls in the previous two months, according to the figures, resulting in a three-month average of 185,000.

The details across industries showed manufacturing payrolls fell by 3,000 in August, breaking an almost yearlong streak of solid gains and missing the median estimate for a 23,000 increase. Construction added 23,000 jobs.

Service providers increased payrolls by 178,000 workers, a three-month high. Gains were led by education and health services at 53,000 jobs, professional and business services with 53,000 and wholesale trade at 22,400.

Government payrolls decreased by 3,000. Private employment rose by 204,000, compared with a median estimate of 194,000.

The payroll gain ends a seven-year streak where the first reading for August has been below the median analyst estimate. The August figure has been revised upward in six of the past seven years.

Wages

Average hourly earnings rose 0.4 percent from the prior month following a 0.3 percent gain, the report showed. The annual gain followed a 2.7 percent advance in July.

A separate measure, average hourly earnings for production and non-supervisory workers, increased 2.8 percent from a year earlier, after a 2.7 percent gain.

The average work week for all private employees was unchanged at 34.5 hours in August.

The lackluster pace of wage gains ahead of the latest data has become a contentious issue for Republicans and Democrats heading into midterm congressional elections in November. The White House issued a report Wednesday arguing that compensation looks better when accounting for factors such as employment benefits, retiring baby boomers and this year's tax cuts.

Unemployment

The jobless rate remains well below Fed estimates of levels sustainable in the long run. The latest figure reflects a decrease of 46,000 unemployed people in August and a 423,000 drop in the number of people with jobs.

That lowered the participation rate, or share of working-age people in the labor force, to 62.7 percent from 62.9 percent the prior month. The employment-population ratio, another broad measure of labor-market health that central bankers like to watch, fell to 60.3 percent from 60.5 percent.

Another measure showed diminishing labor-market slack. The U-6, or underemployment rate, fell to 7.4 percent, the lowest since 2001, from 7.5 percent. That gauge includes part-time workers who'd prefer a full-time position and people who want a job but aren't actively looking.

— With assistance by Chris Middleton, and Sophie Caronello

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.