Adopting new technology-enabled tools and solutions that addresses the high cost of health care have allowed employers to cut costs without any increases or other financially intrusive measures. (Photo: Shutterstock)

Adopting new technology-enabled tools and solutions that addresses the high cost of health care have allowed employers to cut costs without any increases or other financially intrusive measures. (Photo: Shutterstock)

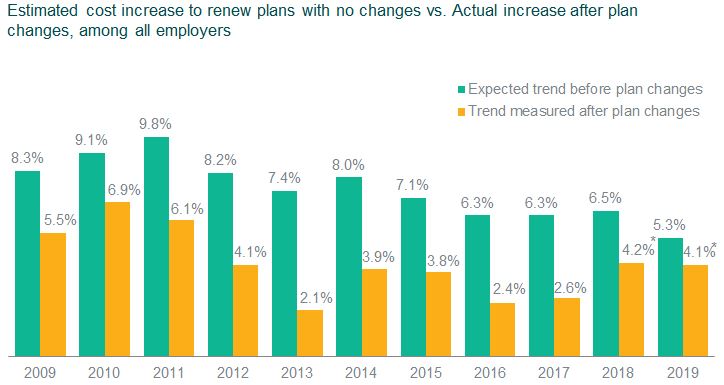

The benefits of technology are being seen in the employee benefits world. According to a new Mercer National Survey of Employer-Sponsored Health Plans, health benefits cost growth will hold steady at 4.1 percent in 2019. The survey shows that medical costs have actually declined from 6.5 percent to about 5.3 percent leading into 2019.

This year, many employers surveyed said that adopting new technology-enabled tools and solutions that addresses the high cost of health care have allowed the costs to be cut or held without any increases or other financially intrusive measures.

“The improvement in the underlying medical plan trend is encouraging because those savings are not solely coming from shifting cost to employees,” said Tracy Watts, Senior Partner and Mercer's Leader for Health Reform. “It suggests that there is a 'quiet revolution' going on in organizations as they deploy more innovative health benefit strategies – and that these have started to pay off.”

Related: As costs soar, could AI and virtual care save the day?

The survey, which looks at responses from 1,566 employers, shows that employers with 500 or more employees (58 percent) now offer one or more “point solutions,” – high-tech, high-touch programs designed to help members with specific health issues. Also, 77 percent of companies with 500 employees ore more already use a data warehouse or get the data they need from plan vendors to inform their health plan strategy. But some of these employers (16 percent) are further ahead, using predictive analytics to identify future opportunities to improve health plan performance – or even health outcomes.

Employers, according to Mercer, also want to make engagement easier for employees and generally offer singles points of contact. In fact, 18 percent of mid-sized and large employers make all or most of their benefit offerings accessible to employees on a single, fully integrated platform. Another 19 percent say they are working towards full integration.

“Employers have realized that it's up to them to solve the problems of high cost, inconsistent quality, and low satisfaction that plague the US health care system,” said Renya Spak, Leader of Mercer's Center for Health Innovation. “Without question, technology is going to be part of just about every meaningful solution.”

Read more about how employers are keeping health care costs in check:

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.