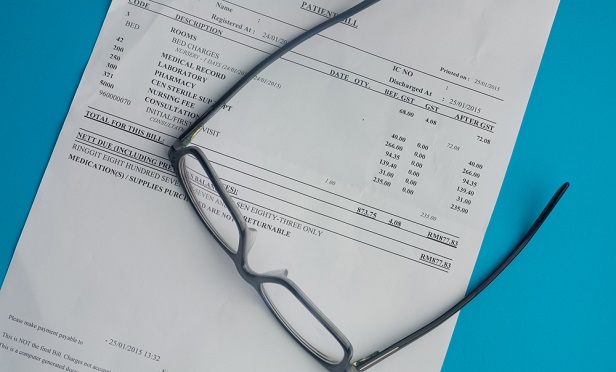

Yes, while out-of-network bills are an unpleasant reality for too many Americans, there is some justification for them. (Photo: Shutterstock)

Yes, while out-of-network bills are an unpleasant reality for too many Americans, there is some justification for them. (Photo: Shutterstock)

When the Senate announced last week a bipartisan bill to put an end to surprise medical bills, it seemed like a slam dunk: finally, something Democrats and Republicans could agree on! Who wouldn't want to put an end to costly, often unexpected out-of-network medical bills burdening health care consumers?

Out-of-network providers who don't want to be beholden to price constraints set by outsiders, that's who.

In response to the Senate proposal, the Association of American Physicians and Surgeons issued a statement shedding light on the other side of the debate: the harm done to independent providers. Such regulations would give too much power to managed-care organizations, AAPS argues, allowing “third-party payers that are effectively accountable to no one” to set prices, which will drive out independent providers who do not participate in a carrier's network.

Related: Managed care, HMOs are making a comeback

Yes, while out-of-network bills are an unpleasant reality for too many Americans, there is some justification for them; they're not just a money-grab by evil, greedy health care systems (well, not all of them, anyway). They are regular providers who, for one reason or another, have opted not to contract with a carrier but whose services are still in demand. As AAPS points out in its press release: “Unacceptable constraints on their professional judgment as well as a desire to have time to work in charity care lead many excellent physicians to refuse to sign insurance contracts.”

The statement also draws on a similar law the organization is fighting in California, arguing that the law is harmful to patients and physicians alike. Legislation limiting a provider's ability to negotiate prices could consequently drive providers out of the market, further limiting consumers' access to care.

“We need a free market with honest price signals, instead of one where managed care and hospitals collude to keep prices and insurance reimbursements secret—and very high,” AAPS states. “Balance billing is not a problem 'ripe for a federal solution.' In fact, it is essential for ensuring availability of needed services for which third parties refuse to pay.”

So while on the surface, a bill protecting consumers from exorbitant health care bills seems like a good idea, the truth is that just another treatment for a symptom, not the disease. Behind out-of-network medical bills is a monstrously complex, inefficient and convoluted health care system that needs fixing.

Not convinced? Read up on our broken health care system:

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.