Conventional de-risking involves selling equities and buying bonds but there are alternative strategies to consider to reduce pension risk, especially for plans that still need equity returns to close their funding gap. (Photo: Shutterstock)

Conventional de-risking involves selling equities and buying bonds but there are alternative strategies to consider to reduce pension risk, especially for plans that still need equity returns to close their funding gap. (Photo: Shutterstock)

Many investors will be familiar with the concept of buying put options to hedge exposure to the equity markets: An investor pays a premium to buy the option to sell equities at a specified level (such as 10% below the current level) at a future date — such as in one year).

Investors may also have the view that using options to hedge equity exposure is costly and complex and that more traditional de-risking strategies, such as selling equities to buy bonds, are better.

This perception may not be valid, especially if some thought is given to how a hedging program is constructed and how to compare it against traditional strategies.

Many long-term investors, such as pension plans, should not need to completely hedge their equity portfolios, which is what you get when you buy a traditional put option. If only partial protection is needed, then a hedging strategy can be implemented in a straightforward and cost efficient way.

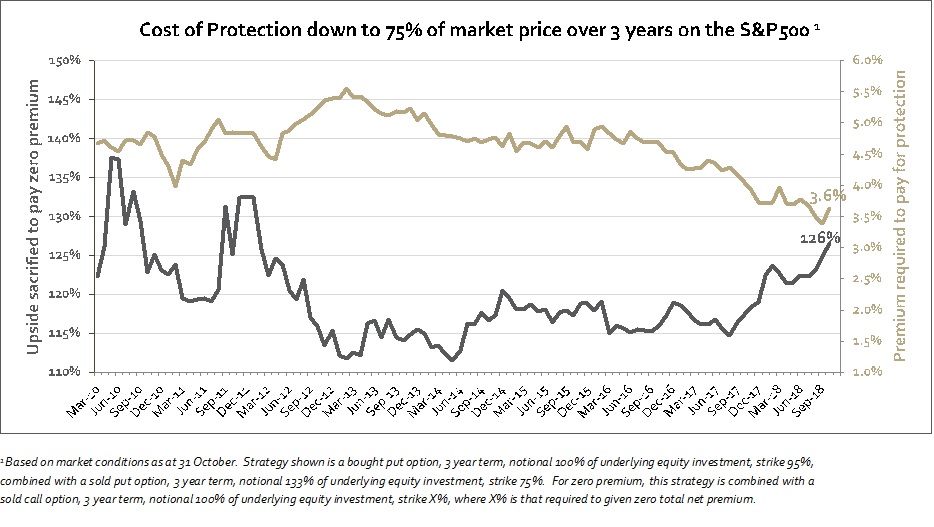

For example, it is possible to buy protection against a fall in the S&P 500 over a three year horizon that starts 5% below the current level (so a 95% strike price) and ends 25% below the current level for a premium of about 3.6%, or about 1.2% per year.

A conventional three year put option that provides protection from -5% all the way to zero would cost about 9%, or about 3% per year. The conventional put would outperform the modified put (or put spread) only in scenarios where equities are lower by more than about 30% in three years' time, which looks quite expensive unless one is very bearish on the markets.

In addition, premiums for partial equity protection have declined significantly in recent years (see chart below). Premiums paid for options can be compared with the potential returns that would be given up for alternative de-risking strategies, such as selling equities and buying bonds.

Many investors believe that equities have a 4%+ per year expected return advantage over bonds.

Assume an investor currently has $100m invested 60% in equities and 40% in bonds, and that she agrees that equities have 4% expected return advantage (7% vs. 3%, total 5.4%). The investor is concerned about market risk over the medium-term.

She can a) buy a 3-year put option protecting against equity market falls between -5% and -25% for 3.6% (about 1.2% per year) on 60% of the portfolio. Alternatively, b) she can re-allocate the portfolio to 40% equities / 60% bonds. In a), the expected return drops to 4.7% and in b) it drops to 4.6%. Either strategy will outperform the current one if equity markets fall, and both will underperform if they rise.

For scenarios where equity markets fall more than about 13% (about -4.5% p.a.) or rise more than about 11% (about 3% p.a.) over three years, then a) will outperform b).

Also, in extreme equity market falls of more than about 40%, then b) will outperform a) again. Using options has allowed the investor to hold more in equities than she otherwise might have given a desire to reduce risk, allowing for more upside potential if market conditions improve.

Rather than paying premium, an investor can trade potential future upside returns for downside protection. For example, corporate defined benefit pension plans that are reasonably well-funded may only need limited returns from equities to reach their funding objectives.

Due to IRS rules, pension risk is highly asymmetric: an additional $1 in surplus past full funding is worth only about $0.30 after tax, while every $1 increase in deficit is worth about $0.79 after tax. A plan sponsor who wishes to reduce downside risk can trade off upside potential that would likely only result in unneeded surplus.

To afford the same -5% to -25% protection over three years as above, the investor would need to sell potential equity price appreciation above 26%. The level at which upside would need to be sold to fully finance downside protection has also increased recently, making this kind of strategy relatively more attractive (see chart below).

For some plan sponsors, a +26% total return on equity markets over three years would already give them all the excess return they need – the prospect of “giving up” additional return on top of that seems like a small price to pay for protection from the first 25% of losses.

In summary, with a simple, transparent strategy it is possible to provide meaningful equity market protection without removing equity exposure entirely.

Such strategies are not too good to be true. Paying a premium for protection will be a drag on returns if markets do not fall, and similarly, forgoing potential upside will cause underperformance if equity markets rise significantly.

However, many investors may be surprised at the current costs of downside protection and may consider this a worthwhile trade off.

Frequently asked questions

Equity options, which are a form of derivative contract, can move in my favor or against me. If it moves in my favor, how do I know I will be paid what I am owed?

The risk expressed in this question is counterparty risk. Derivative contracts are either entered into on an exchange (exchange-traded contracts) or directly with a counterparty (over-the-counter contracts), generally a large investment bank.

In both cases, derivatives used by institutional investors are fully collateralized. This means that if Counterparty A owes Counterparty B $1m on an open derivatives contract, Counterparty A must also set aside (or “post”) $1m in collateral to Counterparty B (or to an exchange if an exchange-traded derivative).

This collateral generally needs to be cash or Treasuries or an equivalent, very conservative, asset. The value of the derivative contract is updated every day and the collateral value must be updated daily as well.

In this example, if Counterparty A were to fail to pay Counterparty B when the derivative contract is closed or matures, then Counterparty B would be able to keep the collateral that was posted to it to cover what is owed, thus offsetting most or all of any potential loss.

Prior to the 2008/09 Great Financial Crisis it was much more common for derivatives positions to be either uncollateralized entirely, for much less conservative collateral to be used, or for collateral to be re-valued and moved much less frequently.

When large financial institutions went insolvent, many more counterparties were left with unsecured claims, than would be the case today. Regulatory changes since the Great Financial Crisis have materially reduced this risk.

I hear that derivatives are expensive. How much do derivatives cost?

Investments generally have two sorts of costs associated with them: bid/offer spreads to trade them and fees paid to an investment firm to manage them.

Derivative contracts have a bid/offer spread just like any other financial instrument like a stock or bond. These spreads can be wider or tighter than physical securities depending on the market and type of derivative.

Management fees for derivative positions used for risk management or to create a synthetic position, as opposed to using derivatives to seek “alpha,” are generally inexpensive, with fees comparable to what are paid for passive index management.

In addition, some derivative positions require premiums to be paid, which some mistakenly see as a source of expense. A premium paid to enter into a position is akin to buying a stock or bond, with initial value of the derivative equal to the premium paid.

If the position is closed out immediately, then the premium is returned, less any bid/offer costs. The premium also shows up as a portion of the derivative contract value on a custody statement – it is not “lost.”

If premiums are paid continuously, such as for a program to hedge equity risk, then this will feel like buying insurance and the cost could seem expensive. But that is quite different to there being an excessive cost to transact derivatives themselves.

Are derivatives contracts liquid? Am I locked in for a period of time?

Derivatives contracts referencing major equity markets, as described in the examples above, are liquid and can typically be closed out at any time.

A contract may have a 'term' of several months running to several years, meaning that the derivative is contractually providing a certain return over that period.

However, the investor is not locked in to holding the contract over this term. It is possible to exit the contract, with the market value of the derivative being realized at that time.

This is very much akin to selling a bond to another investor, without actually holding the bonds the full term which could be years or decades away.

How widely are derivatives used within pension plans?

Currently, derivatives are often directly held by large US pension plans, with adoption relatively low among small pension plans. However, it is a common misconception that derivatives are reserved for only the very largest plans (>$1 bn) as implementation of equity and interest rate derivatives is relatively straight forward.

That said, there is some additional operational complexity and stakeholder education required when holding derivatives directly, which has meant that take-up by plans under ~$50m, has been low.

It is also common for both equity and bond mutual funds, held by pension plans, to use derivatives for risk management purposes. In this case derivatives are held within a fund, and not directly by the plan, and so plans may not be cognizant of the fact they are indirectly holding derivatives.

Outside of the US, it is much more common for pension plans to hold derivatives. In the UK, for example, around 70% of plans use interest rate derivatives to manage risk and around 25% have considered using equity derivatives (about 10% have actually implemented these strategies).

James Walton is an Investment Director in River and Mercantile Solutions' Boston office. James works with clients on financial risk management, develops investment strategies and derivative solutions. He also leads the due diligence of annuity providers and is a member of the US Investment Committee. [email protected]

Ryan McGlothlin is a Managing Director in River and Mercantile Solutions' Boston office. Ryan works with clients on investment strategies and financial risk management. He is a member of the Global and US Investment Committees. [email protected]

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.