President Donald Trump's crusade against high drug prices will face some tests in 2019. (Photo: Shutterstock)

President Donald Trump's crusade against high drug prices will face some tests in 2019. (Photo: Shutterstock)

For the biopharma industry, 2018 was a year marked by generally robust profits and a handful of superlatives. These include Takeda Pharmaceutical Co.'s $62 billion bid for Shire Plc — the biggest announced drug deal in more than a decade — as well as a record number of approvals of new and generic medicines by the U.S. Food and Drug Administration and the most aggressive drug-pricing proposal to ever emerge from a Republican administration.

No promises on another megadeal in 2019, but I can guarantee that drug pricing will still be a thing. Here are a few areas I'll be keeping an eye on:

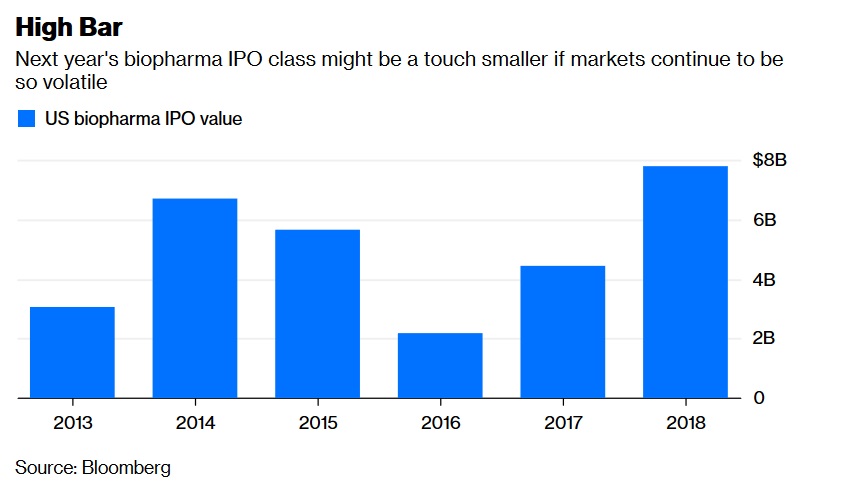

Closing window? In 2018, strong demand for biotech IPOs allowed firms that don't even have drugs in the testing phase to go public at rich valuations. Companies raised a record $7.8 billion, including Moderna Therapeutics Inc., whose $604 million initial stock sale this month was the biggest the industry has ever seen. But Moderna has stumbled out of the gate – shares are down more than 40 percent from their offer price – which is a worrying sign for the year to come. Part of the under-performance reflects risks specific to Moderna.

But biotech isn't immune to the broader market malaise, and the IPO environment will most likely be correlated with the industry's overall stock performance. This will also have implications for the ability of already public firms to tap capital markets for funds. A down year would be rough for younger companies, but it might allow bigger, more established drugmakers to take advantage of cash crunches and buy up assets at more attractive valuations

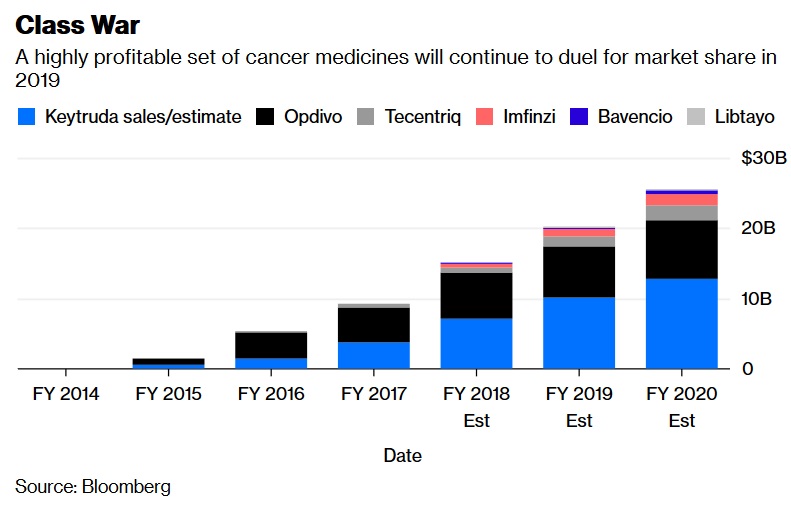

Cancer crowding: The sixth drug in a new and promising class of immune-boosting cancer drugs was approved this year. The treatments, called PD1-L1 inhibitors, are expected to generate more than $15 billion in sales in 2018 and $20 billion next year. A series of trial wins has cemented Merck & Co.'s Keytruda as the dominant drug in the class. The next 12 months will tell us if any of the other five medicines can mount a serious challenge.

Investors will also get more information on whether combining these drugs with others will be able to expand their use to more patients and more cancers, an idea that firms have thrown billions at with very mixed results. And though cancer drugs have been mostly immune from price competition, this group of very expensive and increasingly overlapping medicines seems like a pretty obvious place for payers to apply pressure. Another crowded cancer class to watch is the group of so-called PARP inhibitors, currently most widely used in ovarian cancer.

Pricing pressure: President Donald Trump's crusade against high drug prices, which reached a fever pitch on Twitter and resulted in some concrete proposals by the Department of Health and Human Services, will face some tests in 2019. Many of the administration's efforts, most notably its plan to index U.S. drug prices to those of lower-priced medicines in other nations, will either make progress or fall apart in 2019. The drug industry is gearing up to lobby its way to the latter outcome, as it did successfully for similar efforts by the Obama administration.

The year to come will also reveal how aggressive Trump's health-care team will be in its efforts to shake up the business model of pharmacy benefit managers, which negotiate drug costs for health plans. They are accused of creating an extra incentive for drugmakers to repeatedly increase prices. Meanwhile, many of the biggest pharmaceutical companies are set to hike prices once again in January after a temporary pause, and if they're too aggressive, they may make what's already likely to be an adversarial year with the Trump administration even worse. On the private side, a series of mergers have tied every major PBM with an insurer, and they may use that market power to put pressure on drugmakers.

Those six-figure cures: Intrinsically tied with the drug-pricing issue is a growing number of incredibly expensive medicines. Drugs have always been costly, but there are going to be more medicines priced in the six figures than ever before. Many of these are intended to be used just once, including potentially curative cell therapies for blood cancers and gene therapies for rare diseases. Gilead Sciences Inc.'s Yescarta, Novartis AG's Kymriah, and Spark Therapeutics Inc's Luxturna are already on the market, and each costs more than $350,000 for a single treatment.

These medicines have yet to make much of a sales dent, in large part because the system has yet to really figure out how to value or pay for them. If drugmakers want patients and payers to pony up price tags edging toward a million dollars, they're going to have to prove that they are worth it, and be willing to be a bit more flexible on how and when they get compensated.

Comeback tour: AbbVie Inc.'s Humira is the world's best-selling drug, while Celgene Corp.'s Revlimid is the biggest seller among cancer treatments, and yet the two companies were among the worst- performing big biopharma firms of 2018. They illustrate the perils of success: Both rely heavily on their lead medicines, and investors are skeptical about their ability to find new ones to replace them before generic competition arrives. Over the last year and a half, Celgene saw a once-promising gut drug fail a significant trial and a multiple sclerosis treatment get rejected by the FDA. as for AbbVie, it's become clear that the pharmaceutical giant's expensive acquisition of cancer drugmaker Stemcentrx may have to be written off entirely, just as Humira begins to face competition in Europe. Both companies badly need to prove that they have the R&D and M&A chops to fill a very large sales gap.

Something fishy: Amarin Corp. shocked the pharma world in September with the rarest of breakthroughs, a medicine that could help millions at a relatively cheap price. The firm's purified fish-oil derivative Vascepa proved able to reduce the risk of cardiovascular events like heart attack or stroke by 25 percent. But a fuller set of results released in November created some doubts about the possible confounding impact of the placebo used in the study, hurting the firm's share price. A review by the FDA next year and the early reaction by the market will say a lot about more about whether Vascepa is going to be a blockbuster that turns Amarin into a premier M&A target, or remain something of a niche product.

These are only some of the variables that will shape the industry in 2019. With health care still very much in focus and the possibility of a drug breakthrough always on the horizon, it promises to be anything but routine.

Max Nisen is a Bloomberg Opinion columnist covering biotech, pharma and health care. He previously wrote about management and corporate strategy for Quartz and Business Insider. To contact the author of this story: Max Nisen at [email protected]

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.