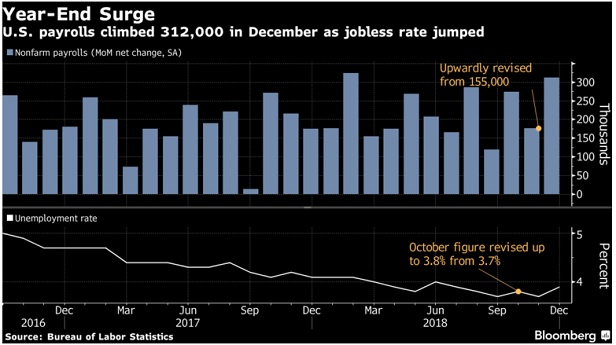

Nonfarm payrolls increased by 312,000 in December, easily topping all forecasts, after an upwardly revised 176,000 gain the prior month.

Nonfarm payrolls increased by 312,000 in December, easily topping all forecasts, after an upwardly revised 176,000 gain the prior month.

U.S. employers added the most workers in 10 months as wage gains accelerated and labor-force participation jumped, reflecting a robust job market that nevertheless faces mounting risks in 2019.

Nonfarm payrolls increased by 312,000 in December, easily topping all forecasts, after an upwardly revised 176,000 gain the prior month, a Labor Department report showed Friday. Average hourly earnings rose 3.2 percent from a year earlier, more than projected and matching the fastest pace since 2009. Meanwhile, the jobless rate rose from a five-decade low to 3.9 percent, reflecting more people actively seeking work.

Related: Power shifts to the job seeker in today's hiring market

The dollar surged, U.S. stock futures remained higher and Treasuries tumbled following the strong report. Hiring and wage increases will support consumer spending and offer some respite after a spate of weak economic data and cuts in corporate revenue forecasts fueled stock-market jitters. Still, it may be hard to replicate such labor-market gains in 2019 amid the U.S.-China tariff war, softening manufacturing, a housing slowdown and a projected cooling in global growth.

Federal Reserve Chairman Jerome Powell is scheduled to speak later Friday morning in Atlanta. While the report is in line with the Fed's view of a healthy job market and officials last month penciled in two interest-rate hikes for 2019, the central bank may need more evidence of strength before moving forward with the next increase following four in 2018.

The data probably brought a “huge sigh of relief on Constitution Avenue,” the site of the Fed's headquarters in Washington, said Torsten Slok, chief international economist at Deutsche Bank AG. The figures take pressure off Powell to downplay the dot-plot rate forecasts of policy makers, and the chairman can “easily justify” additional hikes, Slok said on Bloomberg Television.

Before Friday's report, investors had begun betting that policy makers will instead end up cutting borrowing costs.

Now, “this should give the Fed some comfort that their assessment of the economy is correct and that they're on track for further rate increases this year,” said Michael Gapen, chief U.S. economist at Barclays Plc.

The figures brought the 2018 payrolls gain to 2.64 million, up from 2.19 million in 2017. Economists have expected the pace of gains to ease this year, consistent with their forecasts that gross domestic product growth will moderate amid the trade war and a fading boost from the Trump administration's tax cuts. Even so, President Donald Trump is likely to cheer the results as evidence that his policies are still boosting the economy, rather than dragging it down.

What Bloomberg economists say This is the strongest employment report of this economic cycle — hands down. While we've seen greater job gains in some months, the plus-300,000 number along with another increase in average hourly earnings clearly signals that the economic expansion ended 2018 on strong footing. Perhaps most surprising was the two-tenths rise in the unemployment rate due to an increase in participation. It's one month of data, but talk of the Fed cutting rates in the near future should be off the table for now.

– Tim Mahedy, Bloomberg Economics

The labor strength spanned most industries, including the biggest gain in construction since February, and the most manufacturing jobs added in a year. Private service providers boosted payrolls by 227,000, the most in more than a year, amid gains in education and health services, leisure and hospitality, and retail.

While the unemployment rate increased to a five-month high, it may not be much of a concern because the participation rate rose to 63.1 percent — the highest since September 2017 — from 62.9 percent. The jobless rate remains well below the level that central bankers consider sustainable in the long run.

Average hourly earnings for all private workers rose 0.4 percent from the prior month following a 0.2 percent gain, the report showed. The annual increase followed a 3.1 percent advance.

Another measure, average hourly earnings for production and non- supervisory workers, increased 3.3 percent from a year earlier. While worker pay has risen very gradually during most of the economic expansion, companies have been competing more vigorously in recent months to attract and retain workers.

More details:

- Private payrolls rose by 301,000, well above the median estimate of 185,000. Government payrolls increased by 11,000.

- The employment-population ratio, another broad gauge of labor-market health, was unchanged at 60.6 percent.

- The average workweek increased to 34.5 hours from 34.4 hours in the prior month; a shorter workweek has the effect of boosting average hourly pay.

- The U-6, or underemployment rate, was unchanged at 7.6 percent. This measure includes part-time workers who want a full-time job and people who are less active in seeking work.

- In annual revisions to data based on the household survey, the unemployment rate for October was increased to 3.8 percent from 3.7 percent.

- Labor Department economic releases are proceeding as scheduled, as the agency isn't part of the partial federal- government shutdown.

— With assistance by Chris Middleton, Sophie Caronello, and Christopher Condon

Read more:

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.