In addition, Newsom would give an extra $2.9 billion over four years to the California State Teachers' Retirement System, on top of the $3.3 billion payment required for next year. (Photo: Bloomberg)

In addition, Newsom would give an extra $2.9 billion over four years to the California State Teachers' Retirement System, on top of the $3.3 billion payment required for next year. (Photo: Bloomberg)

(Bloomberg) –California Governor Gavin Newsom didn't campaign on bolstering public pensions, but they figure prominently in his first budget.

In the spending plan for the fiscal year beginning in July, he proposed making an extra $3 billion payment to the California Public Employees' Retirement System (CalPERS) to pay down what the state owes to the fund — a debt that grows each year.

That's on top of the $6.8 billion contribution California is required to make to the nation's largest public pension, according to the budget plan released Thursday.

In addition, Newsom would give an extra $2.9 billion over four years to the California State Teachers' Retirement System, on top of the $3.3 billion payment required for next year.

By trying to pay off as much of the unfunded liabilities up front, the state could collectively save about $14.6 billion over 30 years. That's because unfunded liabilities grow at the same rate as the pensions' expected investment returns, which compensates the funds for gains they would have received if the money had been used to buy stocks and other assets.

Newsom, in a Sacramento briefing four days after assuming office, called the additional funding an historic step. His predecessor, Jerry Brown, was the first in 2017 to propose an extra CalPERS payment, though his $6 billion infusion relied on a loan from an internal investment account, not on general-fund budget dollars.

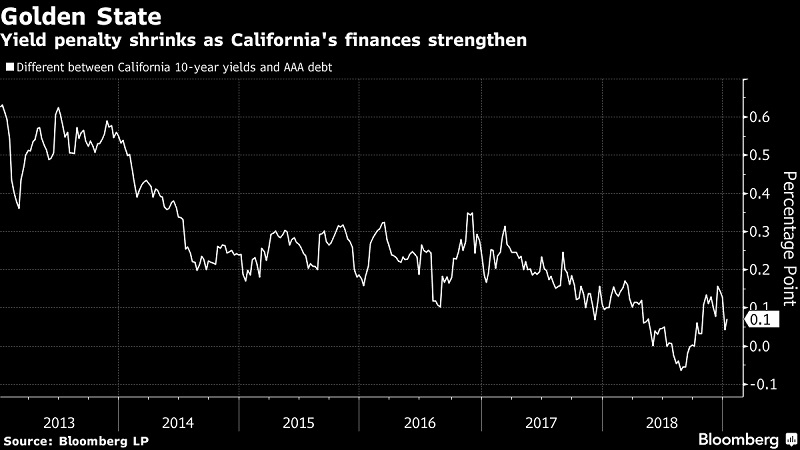

Yield penalty shrinks for California. (Chart: Bloomberg)

Yield penalty shrinks for California. (Chart: Bloomberg)California's finances are prone to booms and busts because of its reliance on taxing the wealthy, and the “key” to dealing with the volatility is to “stack away as much money as you can and pay off as much debt as you can,” Newsom told reporters. “That's about building resiliency.”

The moves continue the work under Brown to curb the growth in California's prodigious pension and retiree health liabilities, which tally $256 billion, budget documents show.

Even as California enjoys rising revenue and surpluses amid an economic boom, pressures to meet promises made years ago continue to mount. The required CalPERS payment for the next fiscal year is more than double the amount a decade ago.

The Democrat would also give school districts relief from their pension payments– $3 billion. This would provide “immediate relief” and reduce their contribution rates by half a percentage point, according to budget documents. California school districts face significant financial obstacles partly because of rising retirement costs, Moody's Investors Service said.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.