The U.S.'s great social divide — non-college people in small towns and educated people in cities — has its root in deep economic forces. (Photo: Shutterstock)

The U.S.'s great social divide — non-college people in small towns and educated people in cities — has its root in deep economic forces. (Photo: Shutterstock)

David Autor, a labor economist at the Massachusetts Institute of Technology, has a record of attacking the biggest and most important issues. He has raised alarms about disappearing middle-skilled jobs, pointed to the downsides of trade with China, warned about increasing industrial concentration and attacked the question of whether automation will kill jobs.

In a recent lecture at the American Economic Association meeting in Atlanta, Autor attempted to weave many of those threads together into a single story. Paraphrasing heavily, that story goes something like this: Forty years ago, Americans who didn't go to college could move to cities and get good jobs in manufacturing or office work. But starting in about 1980, these jobs began to disappear, thanks in part to offshoring and automation. By 2000, manufacturing was in steady retreat:

Workers without a college education were increasingly shunted into low-skilled service jobs — cleaning, security, retail, food service and manual labor. Fortunately, more Americans went to college than before, but the ones who didn't were increasingly marginalized.

Workers without a college education were increasingly shunted into low-skilled service jobs — cleaning, security, retail, food service and manual labor. Fortunately, more Americans went to college than before, but the ones who didn't were increasingly marginalized.

Related: Where does a college degree have the biggest impact on income?

Even as educational inequality was growing, geographic inequality was growing as well. High-skilled occupations increasingly clustered in cities, while low-skilled service jobs have become more plentiful outside of urban centers. At the same time, wages for mid-skilled jobs like manufacturing and office work equalized between cities and rural areas — workers in these jobs can no longer get much of a pay bump by moving into town.

Thus, a major route to middle-class prosperity has been closed off. In the old days, even people without a college education could move into the big city and work in a factory or office for a good salary — now, they might as well stay in their hometowns. As a result, Autor shows, the urban-rural education gap has widened — in 1970, an American in a rural area was only 5 percent less likely to have a college degree as someone in an urban area, but by 2015 that gap had grown to 20 points. In other words, the U.S.'s great social divide — non-college people in small towns and educated people in cities — has its root in deep economic forces.

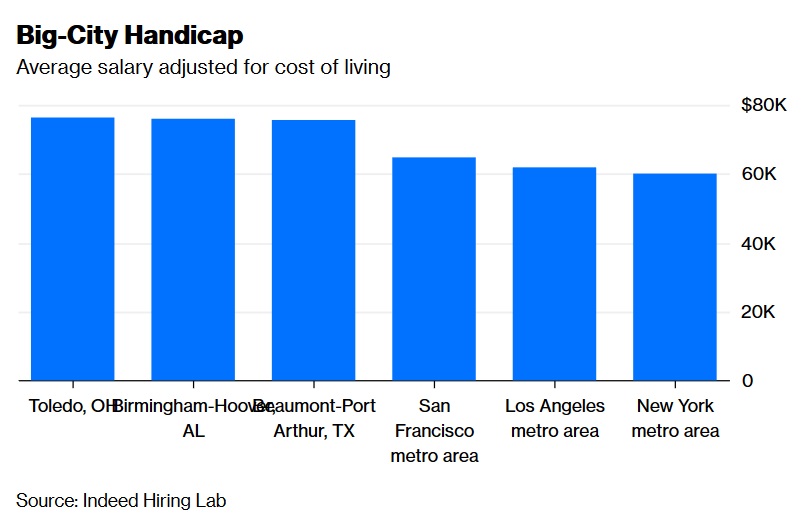

Actually, Autor's wage data probably understate how bad prospects are in big cities for people without college degrees. Rent and other costs of living are much higher in urban areas, meaning a paycheck doesn't go nearly as far there. Jed Kolko, an economist at the job-search company Indeed, finds that when salaries are adjusted for local costs of living, the average worker actually makes less in New York City or Los Angeles than in Toledo, Ohio or Birmingham, Alabama:  Meanwhile, a map by the Hamilton Project at the Brookings Institution, a think tank, shows little variation in cost-of-living-adjusted wages across the U.S.

Meanwhile, a map by the Hamilton Project at the Brookings Institution, a think tank, shows little variation in cost-of-living-adjusted wages across the U.S.

For college-educated workers, the picture is probably much different. Autor shows that these workers still get a huge pay raise by moving to dense areas — probably more than enough to overcome the increased cost of living.

Why are cities no longer lands of opportunity for middle-skilled workers and those without college degrees? The economic forces driving urbanization are changing, as the U.S. economy shifts from manufacturing to knowledge industries like software and finance.

Some of this can be explained by virtue of the two basic economic reasons for cities to exist in a modern economy — agglomeration, and clustering. Agglomeration refers to the tendency of businesses of all types, but especially manufacturers, to locate near each other. This happens because employers want to be near to employees, who want to be near to the businesses they work for and buy goods from. The result is a city with lots of different industries.

Clustering, on the other hand, refers to the tendency of companies within a single industry, such as technology, to want to be near each other. Clustering effects are much stronger in knowledge-based industries like tech and finance, because ideas are their lifeblood, and workers who live near each other tend to share ideas with each other (and with various different employers). Clustering also arises because of the need for employers to have access to a deep pool of skilled workers. These are the forces that power Silicon Valley and other tech clusters.

As the U.S. economy has transferred manufacturing overseas or automated it, and as consumers have moved from buying more physical goods to buying more digital goods and services, agglomeration has become less important relative to clustering. The smokestack cities of the last century have given way to tech hubs and financial centers. Economist Enrico Moretti has documented this development in great detail in his book “The New Geography of Jobs.” This shift can probably explain many of the trends Autor observes.

So what's to be done in order to help mid-skilled and non-college workers live decent, middle-class lives? And how can the emerging divide between small towns and big cities be arrested or mitigated? Moretti's idea, which has been echoed by some urban development activist groups, is to build lots more housing in cities, driving down rents and making cities more livable for everyone. Another idea is to use research universities to revitalize flagging regions by dispersing knowledge workers to less-populated areas.

But in the end, the government may simply have to step in and intervene on behalf of the services class. Wage subsidies, government health care, income support, portable pensions, pro-union policies, and various other incentives for higher wages can be deployed to make today's low-skilled jobs more like the good office and factory jobs of yesteryear. The alternative may be to watch non-college workers and small towns fall further behind.

Read more:

- Millennial education, finances driving plummeting divorce rate

- Lifestyles, tech, globalization driving specific job growth

- U.S. income inequality rising most among Asians

Noah Smith ([email protected]) is a Bloomberg Opinion columnist. He was an assistant professor of finance at Stony Brook University, and he blogs at Noahpinion. This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners. To contact the editor responsible for this story: James Greiff at [email protected]

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.