In light of these poor findings, EBSA has made several recommendations including initiatives with State Boards of Accountancy and the AICPA to improve processes for reviewing and sanctioning CPAs who perform significantly deficient work. (Photo: iStock)

In light of these poor findings, EBSA has made several recommendations including initiatives with State Boards of Accountancy and the AICPA to improve processes for reviewing and sanctioning CPAs who perform significantly deficient work. (Photo: iStock)

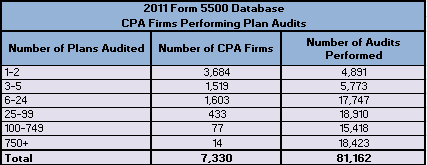

Retirement plan administrators hired a total of 7,330 CPA firms to audit 81,162 retirement plans across the country, according to a study published by the U.S. Labor Department's Employee Benefits Security Administration (EBSA).

These CPA firms, as mandated under ERISA section 103, were required to conduct audits pursuant to the standards established by the accounting and auditing profession, in the pronouncements which define Generally Accepted Accounting Principles and Generally Accepted Auditing Standards.

Michael Auerbach, Chief of the Division of Accounting Services in the EBSA's office of the Chief Accountant, described the study's findings as “disheartening.”

Phyllis Borzi, then the Assistant Secretary of Labor said, “it appears from this study that we are moving in the wrong direction.”

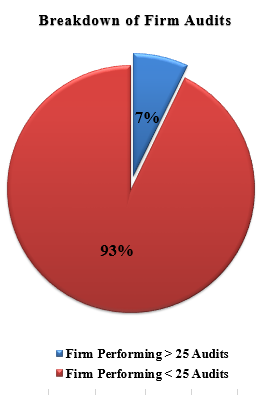

The study began by breaking down the 7,330 CPA firms into six strata based on the number of employee benefit plan audits performed on an annual basis.

These strata included firms performing 1 or 2 audits, 3 to 5 audits, 6 to 24 audits, 25 to 99 audits, 100 to 749 audits and firms performing 750 or more audits.

2011 Form 5500 Database CPA Firms Performing Plan Audits (DOL)

2011 Form 5500 Database CPA Firms Performing Plan Audits (DOL)Fifty percent of all firms performing employee benefit audits fell into the first strata, performing only one or two audits, and 93% of all firms performing employee benefit audits, performed fewer than 25 audits annually.

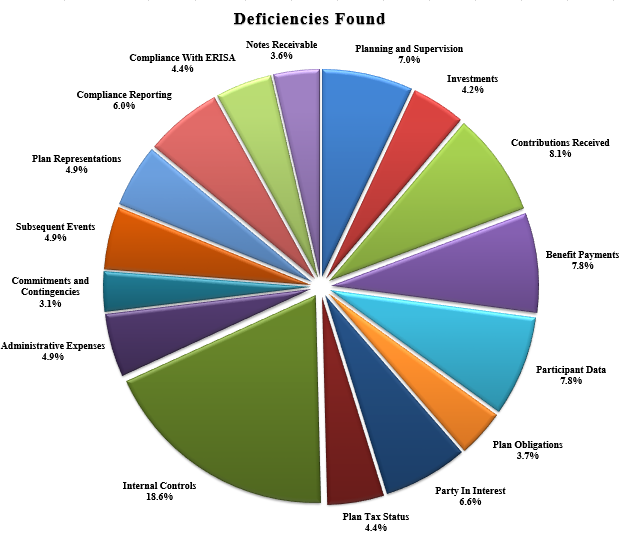

EBSA then reviewed a statistical sample of 400 audit engagements performed by 232 firms across the 6 strata. EBSA defines a major deficiency as a deficiency in audit standards, in which the overall quality of the audit is adversely affected.

Findings showed that 76% of audits performed by firms performing one or two audits annually had major deficiencies.

The next two strata, firms performing 3-5 and 6-24 audits annually, had major deficiencies in 68% and 67% of their audit engagements, respectively.

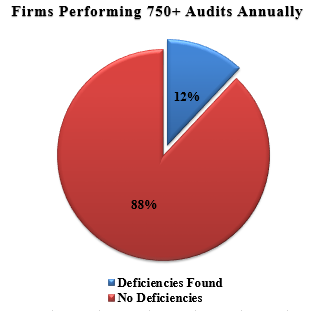

Firms performing 25-100 audits had major deficiencies in 42% of their engagements.

Those firms performing 100 or more audits had major deficiencies in 12% of their engagements.

Upon further review of EBSA's results, the news got even worse for plan administrators that had hired CPA firms whose employee benefit practice included 5 or fewer audits.

Not only did these firms have a significantly higher overall deficiency rate, but they also had a high number of deficient audit areas within each audit that was performed.

The 1-2 audit stratum showed 56% of audits performed, contained major deficiencies in five or more audit areas.

In the 3-5 audit stratum, 42% of plan audits contained five or more audit areas with major deficiencies.

In light of these poor findings, EBSA has made several recommendations including initiatives with State Boards of Accountancy and the AICPA to improve processes for reviewing and sanctioning CPAs who perform significantly deficient work.

Legislative and regulatory recommendations include amending ERISA to repeal the limited-scope audit exemption, in an attempt to incentivize CPAs to take additional ownership of audit opinions.

EBSA has also recommended amending the ERISA definition of “qualified public accountant” to provide plan administrators with additional guidance when hiring a CPA firm to perform their employee benefit plan audits.

Until these oversight and regulatory changes can be finalized, it is imperative that plan administrators perform adequate due diligence, to ensure that the CPA firm being hired possesses the requisite qualifications to perform their audit.

Shawn P. Huxley, CPA, MSA is a Director at Chestnut Hill, MA CPA firm, Samet & Company PC and can be reached at 617-731-1222 or [email protected].

James Alexander is a Supervisor at Samet & Company PC and can be reached at 617.731.1222 or [email protected]

READ MORE:

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.