With an eye toward drafting legislation, politicians on both sides of the aisle have been consulting with billing experts, as well as state and local officials, about the biggest challenges and most promising approaches. (Photo: Shutterstock)

With an eye toward drafting legislation, politicians on both sides of the aisle have been consulting with billing experts, as well as state and local officials, about the biggest challenges and most promising approaches. (Photo: Shutterstock)

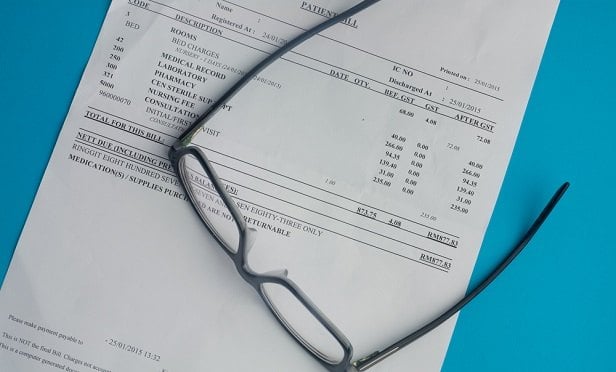

Surrounded by patients who told horror stories of being stuck with hefty bills, President Donald Trump recently waded into a widespread health care problem for which almost everyone — even those with insurance — is at risk: surprise medical billing.

Trump's declaration that taming unexpected bills would be a top priority for his administration echoed through the halls of Congress, where a handful of Republican and Democratic lawmakers have been studying the problem the past couple of years.

Recommended For You

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking benefits news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.