A survey of benefits managers by the Pharmacy Benefit Management Institute finds that many employers have shifted to high-deductible health plans but remain concerned about whether the plans are limiting their employees' ability to afford critical medication.

A survey of benefits managers by the Pharmacy Benefit Management Institute finds that many employers have shifted to high-deductible health plans but remain concerned about whether the plans are limiting their employees' ability to afford critical medication.

The survey of 273 benefits managers found that 79 percent offer a HDHP and 44 percent have a separate deductible for pharmacy benefits. Among the respondents, the average family deductible is $3,571. Many of the responding members voiced concerns about their members not being able to afford the deductible and not understanding how deductibles work.

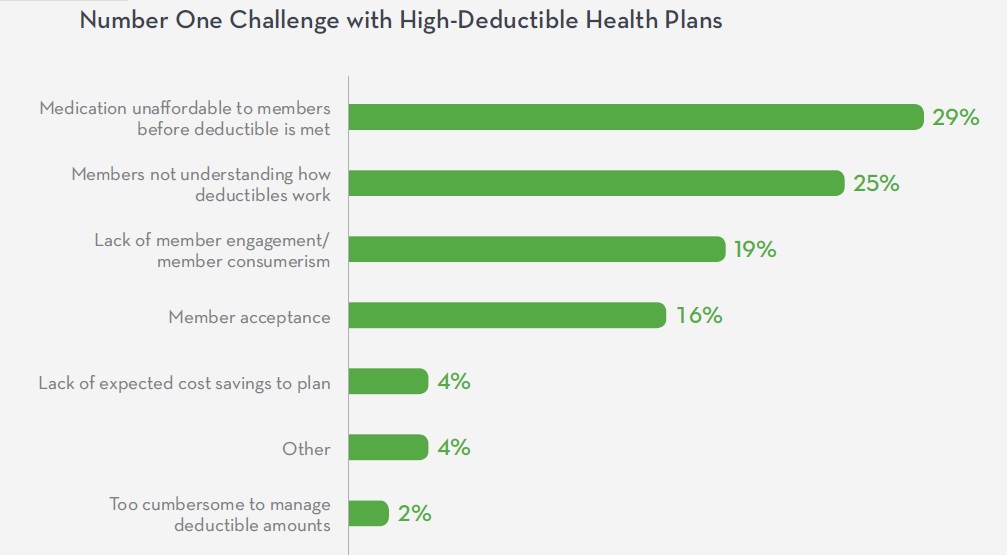

In fact, the top three challenges of HDHPs, as expressed by employers, were employees' inability to afford medications before the deductible was met; lack of member understanding about deductibles; and lack of member engagement.

And yet, employers seem to believe that high deductibles are the least bad option available for the company and its workers. Fifty-eight percent say they are an effective way to help employees become better health care consumers and 44 percent say they are an effective way to reduce the rise in the cost of drugs.

“Health care costs are continuing to rise, and employers have to continue to find ways to help manage these costs while providing affordable benefits for their members,” says Jane Lutz, Executive Director of PBMI.

PBMI is a leading provider of research to help inform, advise and influences the PBM industry, which has recently come under fire from elected officials in both parties over their business practices.

Congress overwhelmingly approved a new law last year barring “gag orders” that PBMs sometimes impose on pharmacists that prevent the pharmacist from telling a patient that buying a drug out-of-pocket would be cheaper than through their prescription drug plan.

Meanwhile, the new health care venture involving Amazon, J.P. Morgan and Berkshire Hathaway has indicated that one of its goals is to cut out “middle men,” such as PBMs.

Read more:

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.