Lying on an insurance application could result in fraud charges, fines and even jail time. (Photo: Shutterstock)

Lying on an insurance application could result in fraud charges, fines and even jail time. (Photo: Shutterstock)

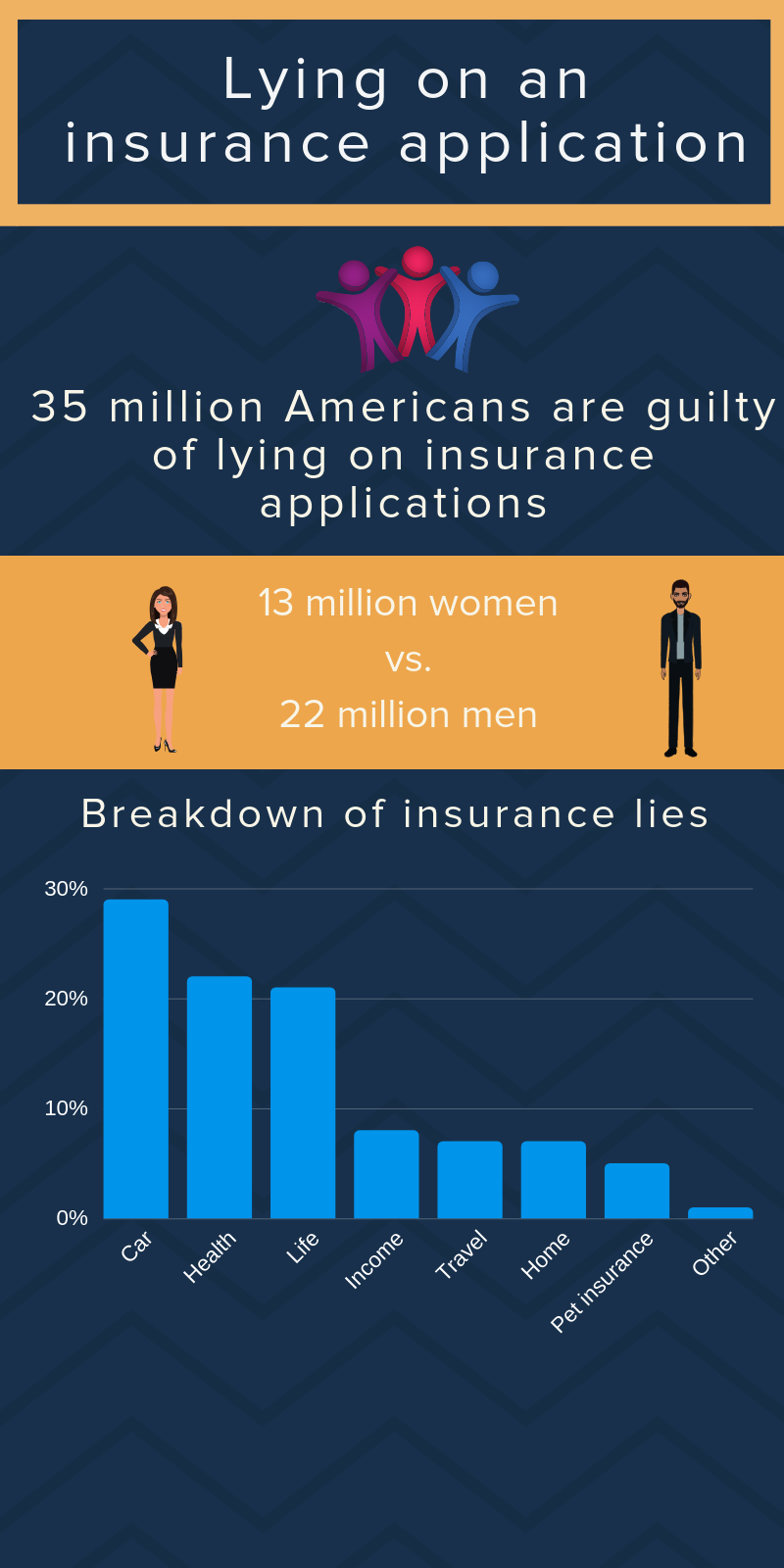

Considering how often the truth is stretched these days in all sorts of situations, from politics to social media, it should come as no surprise that people lie on insurance applications, too—although the percentage of applicants stretching the truth depends on the type of insurance they're applying for and even whether applicants are men or women.

According to a study from finder.com, car insurance seems to attract the most lies, with 29 percent of applicants (10.2 million people) completing their applications with fabricated responses, while health insurance comes in a fairly close second at 22 percent (7.5 million).

After those come life insurance (21 percent), income protection insurance (8 percent), travel insurance (7 percent), home and contents insurance (7 percent) and pet insurance (5 percent).

People may not take into account that such behavior could jeopardize their coverage when they most need it (think denied hospital bills or home repairs after a fire). Even worse, they could also be facing actual fraud charges, which could cost them not only cold hard cash to pay fines but also result in jail time.

Men, incidentally, are more likely to lie to get car insurance and life insurance, while women are more likely to claim the other five categories—although more men overall are willing to lie to get insurance, at 22 million, than women, at 13 million.

Women, by the way, will lie in higher percentages to get the insurance they're willing to fib for; for example, while just 5 percent of men will lie to get their pets insured, 7 percent of women will. And 22 percent of women will lie to get health insurance, while 21 percent of men will—but men, on the other hand, 23 percent of men will lie for life insurance, but just 17 percent of women will.

Interestingly, renters are more willing to lie to get coverage than homeowners, with 32 percent of renters admitting to having lied in the past compared with 29 percent of homeowners and 28 percent of those who live with friends or family.

So which states have the biggest liar populations? Arizona leads the way at 25 percent—they must play a lot of liar's poker out there—followed by California, at 22 percent, and then Ohio, at 20 percent.

Read more:

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.