Despite the health care industry's emphasis on “medical homes,” younger patients who only need services on an infrequent basis may prefer urgent care clinics. (Photo: Shutterstock)

Despite the health care industry's emphasis on “medical homes,” younger patients who only need services on an infrequent basis may prefer urgent care clinics. (Photo: Shutterstock)

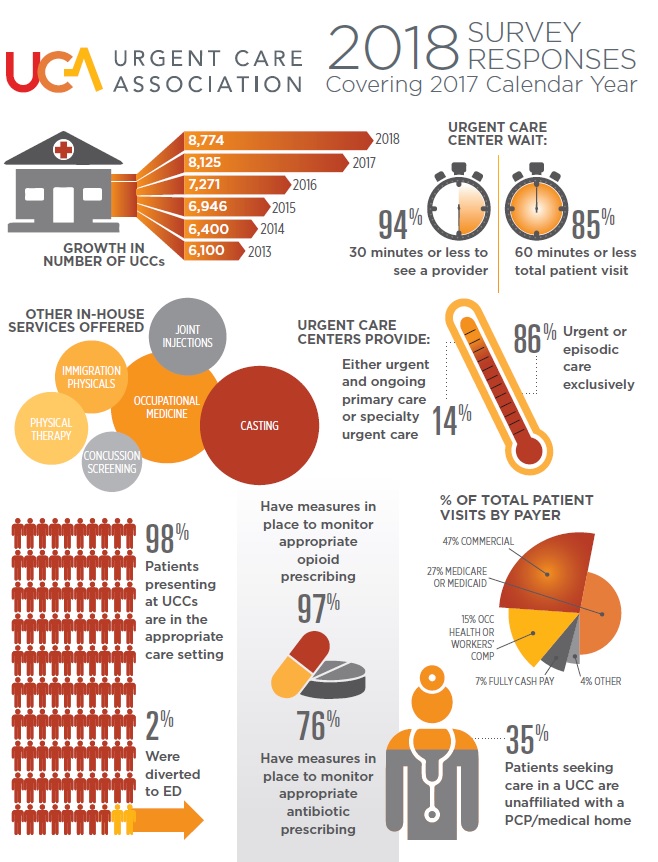

The growth of urgent care clinics continues to be strong, with an 8 percent growth rate in the past year, according to a new report. The Urgent Care Association's (UCA) 2018 Benchmarking Report finds that the number of urgent care clinics in the U.S. grew from 8,125 in November 2017 to 8,744 in November 2018.

Urgent care centers provide a range of health care services to people on a walk-in basis, and are seen as a less-expensive option for urgent health matters than hospital emergency rooms.

Related: The cost of unnecessary ER visits for chronic conditions? $8.3 billion

“Urgent care centers play an increasingly vital role in the continuum of care, providing services for a wide array of patients who may be unable to see a primary care physician for various reasons, including simply not yet affiliating with one,” said UCA CEO Laurel Stoimenoff. “As a result, the patient populations utilizing urgent care centers are evolving, with Millennials leading the way in driving demand and increased utilization. And as Baby Boomers are aging into Medicare, we are also seeing year-over-year growth in that sector as well.”

The UCA study found that more than 70 percent of patients waited 20 minutes or less to see a provider at urgent care centers, and 94 percent had a wait time of less than half an hour. The group said that the total visit time for nearly 85 percent of patients was less than an hour at urgent care clinics.

The UCA study found that more than 70 percent of patients waited 20 minutes or less to see a provider at urgent care centers, and 94 percent had a wait time of less than half an hour. The group said that the total visit time for nearly 85 percent of patients was less than an hour at urgent care clinics.

The growth of such clinics shows consumer demand for and acceptance of quicker, more convenient health care, and the growing market is gaining the interest of industry giants such as Walgreens and CVS. Walgreens has been partnering with UnitedHealth Group in offering urgent care clinics under the MedExpress brand.

In a statement to HealthExec, Stoimenoff said urgent care clinics can supplement primary care but that patients should have a regular primary care provider. “Urgent care is ideal for episodic, non-emergency events, but should not be considered a replacement for a patient's medical home, particularly when there are chronic conditions such as hypertension or diabetes needing ongoing oversight,” Stoimenoff said. “Rather, urgent care helps bridge the gap between primary care providers and emergency departments, offering immediate access to services in between visits to primary care providers.”

An article in Medical Economics last summer said that the urgent care industry saw 89 million patients in 2017, and the $18 billion industry estimates it is accounting for about 30 percent of primary care visits annually.

The article said there are a number of reasons for the popularity of urgent care beyond the convenience. A 2017 Annals of Emergency Medicine study found that for the same type of medical visits, emergency room visits were 10 times more costly than urgent care visits. At a time when many consumers have high deductibles and copays, the lower costs can make a big difference to patients.

Despite the health care industry's emphasis on medical homes, younger patients who only need services on an infrequent basis may prefer urgent care clinics. The Medical Economics article said rural areas are also benefiting from having more urgent care centers.

Medical Economics cited a report by FAIR Health, which found a 2,308 percent increase in insurance claims from rural urgent care facilities between 2007 to 2017, compared to a 1,675 percent increase in urban areas.

Read more:

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.