Although often underestimated by benefit professionals, savvy advisors (i.e., brokers and agents) recognize the big potential within the small case (99 or fewer employees) market. This segment accounts for 98 percent of all private U.S. businesses and employs one-third of the nation's private workforce.

Insurance benefits have become increasingly available at small businesses since 2012. This trend coincides with an improved business climate for small employers. Three in 10 of these firms say that they are expanding, up from 19 percent expressing similar optimism six years earlier.

Related: 3 ways to position your small business benefits offering for success in 2019

According to new LIMRA research, approximately 70 percent of small employers offering insurance benefits obtained coverage via an agent or broker. However, this person has not necessarily achieved “advisor status” in the employer's mind.

Only 53 percent of these businesses indicate that they presently have an insurance benefit advisor. Several factors likely contribute to this disconnect, though advisors clearly need to go beyond facilitating the purchase process in order for employers to consider them a trusted business partner.

Small businesses are also uncertain about the necessity of the advisor role. Despite having fewer benefits resources (e.g., Human Resources staff) than larger organizations, 45 percent believe that they could obtain insurance benefits without the help of an insurance professional. This perception is even higher among employers that already offer insurance to their workforce.

In spite of this skepticism, most clients appear satisfied with their present relationships. More than 4 in 5 believe that their insurance benefit professional provides valuable insight and advice, not just transactional support. When looking forward, many of these businesses envision this relationship remaining stable or expanding. One in three expects their advisor to become more important over time (Figure 1).

Figure 1: Employer outlook for their advisor relationship

Small Businesses Currently Using Insurance Advisors

A trusted advisor relationship is likely developing at these firms. How do they compare to employers holding a less optimistic outlook? Our research identifies three important differences. Small businesses anticipating an enhanced relationship with their advisor:

- More often work with other advisors, specifically, for retirement or pension benefits, executive benefits, and annuities and investments. These employers are more likely to use agents and brokers for other business needs. A positive experience with an advisor in one facet may prompt them to seek out similar partnerships in other areas.

- Appear more open to working with advisors affiliated with a single carrier. While these employers still favor independent brokers, this preference is subdued compared to the less enthusiastic small businesses. This underscores an opportunity for the agents representing one insurer to compete in the small businesses segment. Keep in mind that many of these employers do not yet offer any insurance benefits, suggesting significant untapped market potential.

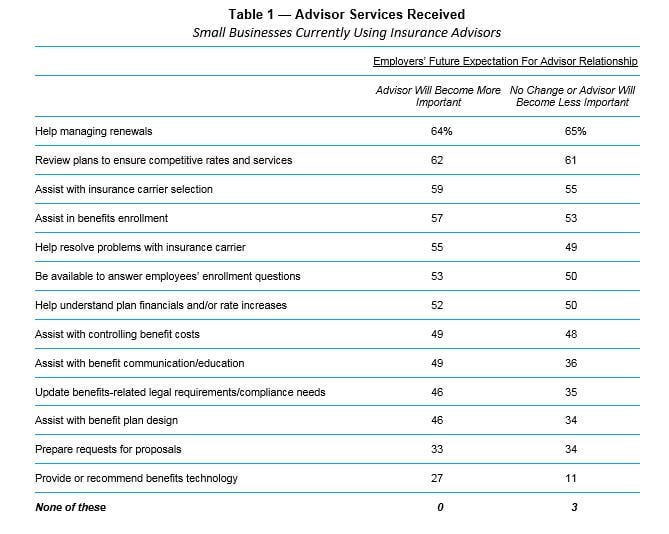

- Are more connected to certain advisor services. A LIMRA study examined 13 services related to insurance benefits that employers sometimes receive from their advisor. On average, small businesses receive six of these services. Helping employers manage renewals and reviewing their existing plans are the most widely available items, with no one service provided to more than 2 in 3 employers (Table 1).

However, firms that expect their advisor's importance to grow have greater access to:

- assistance with benefits communication

- legal/compliance updates

- help with plan design, and

- benefits technology access/recommendations

When delivered effectively, these items can help advisors cement bonds with existing clients, and likely, generate additional opportunities in the future.

Ron Neyer's area of expertise is monitoring and communicating trends in workplace insurance distribution. He manages carrier practice studies, as well as research projects focusing on employers, employees, and brokers/advisors.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.