The ACA has shielded some from rising costs, but for lower-income Americans who have employer-sponsored, private insurance plans, premiums and out-of-pocket costs have continued to rise. (Photo: Shutterstock)

The ACA has shielded some from rising costs, but for lower-income Americans who have employer-sponsored, private insurance plans, premiums and out-of-pocket costs have continued to rise. (Photo: Shutterstock)

Having a job—and the employer-sponsored health insurance that usually goes with it—is not a guarantee that an individual or family won't face financial hardship due to medical costs, according to a new analysis. The study finds that the percentage of income spent on health care by poorer Americans is more than three times the percentage spent by the wealthiest Americans.

The proposition that lower-income workers are more vulnerable to health care costs may not be surprising news, but the brief from the Peterson-Kaiser Health System Tracker provides real numbers in measuring the cost challenges that lower-income Americans face, even within the system of private, employer-based health insurance.

Related: 4 reasons employer-sponsored health insurance won't go away

The website, which aims to monitor the country's performance in terms of health care quality and cost, looked at data from the Current Population Survey. The researchers found that “lower-income families spend a greater share of their income on health costs than those with higher incomes, and that health status of family members is associated with higher out-of-pocket expenses.”

Paying a bigger share

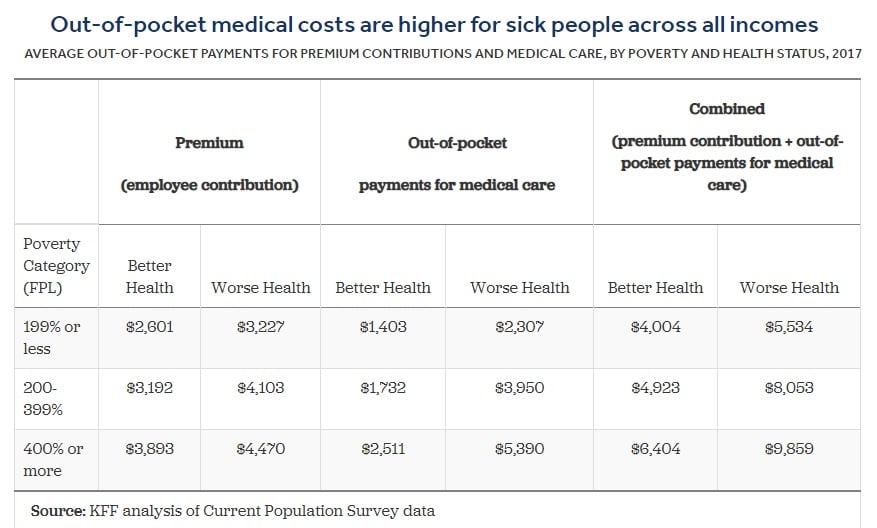

According to the study, people who earned 199 percent of federal poverty level (FPL) or less paid on average 14 percent of their income for health insurance premiums and out-of-pocket costs. For those at 200 percent to 399 percent of FPL, 7.9 percent of their income went to combined premiums and out-of-pocket costs. When individuals earned 400 percent of FPL or more, 4.5 percent of their income went to premiums and out-of-pocket costs.

The report also found that families with at least one sick family member spend even more, across the board: families with 199 percent of FPL or less spent 18.5 of their income on medical care and premiums; those in the middle range spent 12 percent of their income on health care, and the richest Americans spent 7.4 percent of income on health care, when there was at least one sick family member.

“Living with someone in fair or poor health adds significantly to family health care spending, even for people with employer-based coverage,” the study said. “Compared to people who have, or live with people who have, better health, the share of family income going to premium contributions and medical expenses for people in, or living with someone in, fair or poor health is roughly 30 percent to 60 percent higher.”

Will a “health care gap” drive policy changes?

The study's authors note that financial protections built in the Affordable Care Act (ACA) apply mostly to Americans who buy individual plans on the ACA marketplace or in Medicaid plans. For lower-income Americans who have employer-sponsored, private insurance plans, premiums and out-of-pocket costs have continued to rise, taking a larger and larger bite of their paychecks.

High-deductible plans can result in families paying a much higher percentage of income for health costs than the ACA originally envisioned. “A family with income at 200 percent of poverty (just over $50,000 for a family of four) could quite easily spend more than 20 percent of pre-tax income for premium contributions and cost sharing if a family member experienced a serious illness or needed costly treatment,” the study notes.

The authors add that while out-of-pocket costs may be manageable for higher-income Americans, middle-income and lower-income families budgets are being squeezed when devoting more and more resources to health care.

“While the ACA helped to improve health care affordability for many low-income people without access to employer coverage, it did little to provide relief to the much larger group of people offered health benefits at work,” the report concludes. “That may be part of what is fueling interest in proposals like Medicare for All and options for employers and/or workers to buy into Medicare.”

Read more:

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.