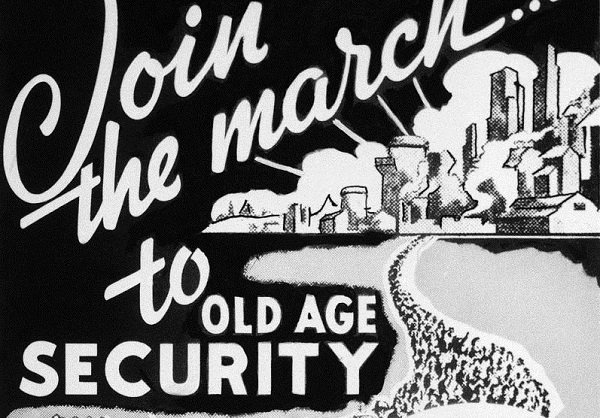

1936 poster issued by the Social Security Board to promote Social Security cards; today's workers have some scary misconceptions about their future Social Security benefits. (AP Photo)

1936 poster issued by the Social Security Board to promote Social Security cards; today's workers have some scary misconceptions about their future Social Security benefits. (AP Photo)

Workers really don't understand Social Security. Not only do they not have a good handle on how much they'll get from it once they retire, when they do estimate the benefit they come up with a number that's substantially higher than what they'll actually get—a Really Bad Thing.

That's according to the sixth annual survey from the Nationwide Retirement Institute, which finds that while current retirees are collecting an average of $1,408 a month, those who haven't retired yet are anticipating a benefit of $1,805 a month—28 percent more. And since that's Not Gonna Happen, a lot of people will be in for a very unpleasant surprise.

Especially since 44 percent of respondents say Social Security will be their main source of retirement income, followed by just 23 percent of older adults who will be relying on their pension.

And to top it off, 26 percent actually believe they can live comfortably in retirement on Social Security alone.

"Social Security is one of the most confusing retirement topics that America's workers are facing today," Tina Ambrozy, president of sales and distribution at Nationwide, is quoted saying in the report. Ambrozy adds, "In fact, our survey reveals fewer than one in 10 older adults know what factors determine the maximum Social Security benefit an individual can receive."

Not only do 70 percent of adults think they're eligible for full Social Security benefits before they actually are (on average they think they can claim full benefits at age 63), 26 percent think that if they claim early those reduced benefits will automatically rise when they hit full retirement age.

Among those already retired, the average age at which retirees started collecting was 62.

Why did they claim early? They needed the money—with 61 percent saying they needed it for living expenses, 36 percent to supplement their income, 26 percent because they were laid off, 24 percent because they had no other income and 22 percent because they had health issues.

Future retirees, on the other hand, expect to work till age 65, but that's not possible for too many people who find themselves retired because of layoffs, ill health, family responsibilities or other reasons. And those who retire early are locked in to that reduced benefit for life.

In fact, 33 percent say that health problems are preventing from them having the retirement they expected, and of those, 78 percent say that health problems came earlier—by as much as 5 years or even more—than they thought they'd have to deal with them. And then there are health care expenses, which keep 24 percent of retirees from having the retirement they expected.

There's not a whole lot of confidence in Social Security—hardly surprising when spending-wary senators keep talking about cutting benefits to make ends meet. Retirees, though, have a different idea: 53 percent believe higher earners should be taxed more, and 47 percent say benefits should be taxed less.

And even those with more investible assets are on the side of taxation, which may surprise their legislators: 55 percent of those with $250,000 or more and 48 percent of those with $1 million or more believe higher earners should be taxed more to increase Social Security funding.

"Many people feel the best way to improve the Social Security program is to raise taxes on high-earners to increase funding," Ambrozy is quoted saying, adding, "Interestingly, our survey reveals that 69 percent of future retirees were surprised to find out a person making $150,000 a year pays as much in Social Security taxes as millionaires."

READ MORE:

Why Social Security's 2019 COLA will be 2.8 percent

Alicia Munnell: The Social Security fix nobody wants

Ward off clients' retirement crisis with Social Security talk

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.