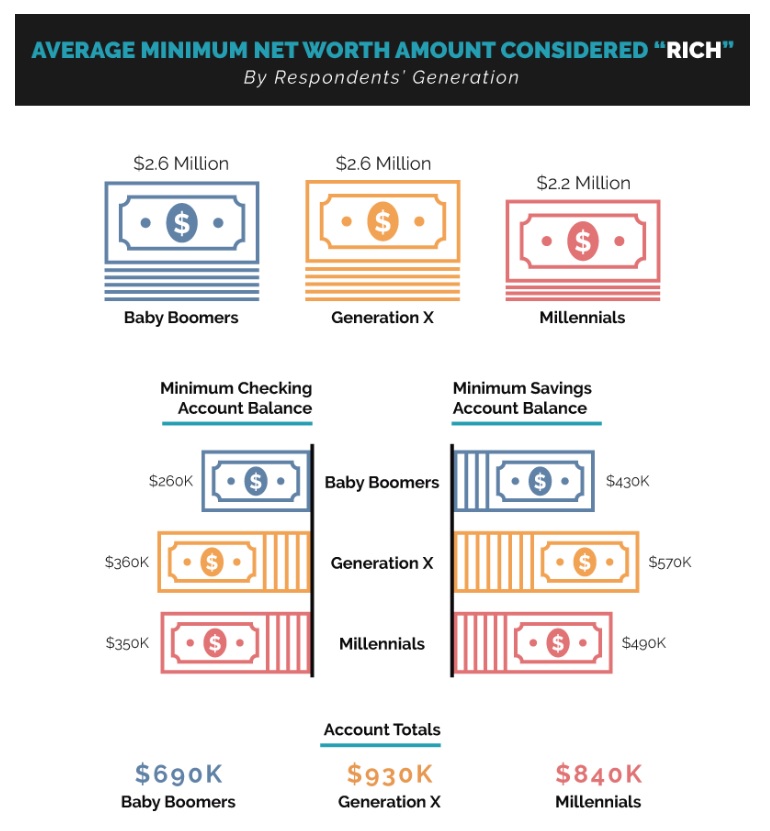

For millennials, just $2.2 million in the bank would qualify someone as rich; boomers and GenXers actually pin that number at more than $2.6 million.

For millennials, just $2.2 million in the bank would qualify someone as rich; boomers and GenXers actually pin that number at more than $2.6 million.

How much money does it take to fall into that hallowed category of “rich”? And who's most determined to get there?

It depends on their generation, but while 49 percent of Americans work with the intent to be rich, according to a survey from Senior Living, millennials are the most focused on it, with 57 percent saying that's their end goal—compared with 41 percent of GenXers and just a quarter of boomers.

Related: How different are millennials' life goals from their parents'?

And when it comes to how much, respondents indicate that a salary of $309,000 and a net worth of $2.3 million would satisfy their definition of rich. But the more respondents actually make themselves, the higher their definition of “rich” moves, with the total rising about $600,000 higher with every boost in income bracket. Interestingly, while boomers and GenXers actually think people have to have more than $2.6 million to be considered rich, millennials figure that $2.2 million is enough to qualify.

Source: Senior Living

Source: Senior LivingOnly 4.2 percent of respondents are satisfied with their current financial situation, although more men are content, at 4.9 percent, than women, at 3.3 percent. And while 62.5 percent of respondents overall would like to have more money, it's probably not surprising that more women, with lower pay, less savings and a higher cost of living (just check the cost of women's products in the supermarket, compared to men's, if you doubt it) feel that way, at 70.5 percent, than men, at 55.3 percent.

It's not a shock that people would like to have more money. After all, in 2018, according to the report, although salaries for 40-hour-a-week jobs went up by 5 percent, the cost of living went up by 2.9 percent, devouring nearly all the ground gained by getting a raise. And that makes it tough to save for the future, or even to live comfortably.

And while 67 percent said they'd be prepared to help out their families financially if they were rich, one out of five believed that if they themselves were rich their significant others would take advantage of them.

So although 50 percent said they believed money could buy happiness, they're not entirely wrong—it can certainly lower stress levels and make it possible to have a more comfortable life—the other 50 percent aren't necessarily wrong, either. After all, how depressing must it be to believe you'll be taken advantage of by the person you're supposed to be closest to in life?

Read more:

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.