The Value-Based Insurance Design (V-BID) project, sponsored by the University of Michigan, has worked for years in helping design plans that match out-of-pocket costs with the value of services. (Image: Shutterstock)

The Value-Based Insurance Design (V-BID) project, sponsored by the University of Michigan, has worked for years in helping design plans that match out-of-pocket costs with the value of services. (Image: Shutterstock)

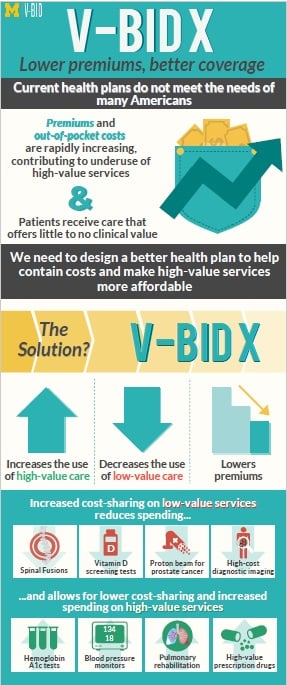

An ongoing effort to bring more value-based practices to health care in the U.S. recently released a new report on improving value in the Affordable Care Act’s (ACA) individual marketplace. The Value-Based Insurance Design (V-BID) project, sponsored by the University of Michigan, has worked for years in helping design plans that match out-of-pocket costs with the value of services—more effective services have lower cost sharing, less-effective procedures and services have higher cost sharing.

According to the University of Michigan’s V-BID program, their new project aims to create a V-BID approach for the ACA’s individual market and illustrate the tradeoffs created by such a plan.

“We create a prototype qualified health plan (QHP) that provides specified non-preventive, high-value services at no cost-sharing, with proven benefits for health outcomes. Because the estimated savings from specified low-value services were minimal, the added coverage generosity for high-value services is financed by increasing beneficiary cost-sharing for targeted service categories likely to be overused, such as high-cost imaging,” the report said.

Related: 3 aspects of value-based care every broker should know

Source: University of Michigan (Click to enlarge)

Source: University of Michigan (Click to enlarge)In other words, to cut cost-sharing for procedures of higher value, lower-value procedures saw cost-sharing raised, in order to keep the overall cost of the insurance product the same.

Serving low-income enrollees

The report said any program to bring V-BID to ACA exchange plans must start with an understanding that low-income enrollees are especially sensitive to cost-sharing such as copays and deductibles, and that imposing financial burdens on those enrollees may result in under-utilization of needed services.

“Although higher cost-sharing like deductibles reduces premiums, it also leads to under- consumption of high-value care – care that can materially improve the well-being of members. The added financial burden imposed on beneficiaries by increased cost-sharing is a blunt tool to reduce health care spending and creates inefficient spending, reducing the use of both necessary and unnecessary services,” the report said.

The study outlines some specific benefits from incorporating V-BID principles. These include:

- Increasing underused high-value services and medications, leading to better health outcomes;

- Decreasing use of low-value care, potentially averting patient harm and better stewarding limited healthcare resources;

- Reducing the net out-of-pocket burden for patients with select conditions, especially chronic conditions; and

- Reducing health disparities.

A range of options for carriers

The report stresses that there is no one way for V-BID principles to be pursued. Researchers note that this approach can be customized to better fit a carrier’s overall pool of enrollees—for example, to address common chronic conditions in a population. Or, a wider or more narrow set of high-value/low value procedures could be created if a plan wanted to change the amount of cost sharing overall.

The conclusion of this latest report is that at a time when health costs are rising, premiums do not have to—V-BID plans can incentivize enrollees to use higher quality services, thereby saving money overall.

“A standard V-BID plan like this one should help carriers implement value-based principles into exchange-based plans,” the report said. “V-BID is one method to increase the efficiency of exchange plans and materially benefit the health of members, mitigating the negative effects (both in terms of out-of-pocket spending and health) of increasingly less generous health plans. A more robust pool of low-value services would aid in financing high-value services without the need to increase cost-sharing with more blunt methods or raise premiums.”

Read more:

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.