One thing the researchers found is that private plan payments averaged more than 200 percent of Medicare payments for the same care at the same hospitals. (Chart: RAND)

One thing the researchers found is that private plan payments averaged more than 200 percent of Medicare payments for the same care at the same hospitals. (Chart: RAND)

Chapin White has come up with an explanation for why the United States spends so much more than the rest of the world on health care: private health plans pay wild prices for outpatient care.

White and colleagues have put data supporting that conclusion in a paper distributed by the RAND Corp.

Related: Study: High prices still the cause of ridiculous health care spending

White briefed state insurance regulators on the study findings today, at a session in New York that was organized by the National Association of Insurance Commissioners’ Health Insurance Innovations Working Group.The NAIC started its summer national meeting this weekend in New York.

The NAIC is a group for insurance regulators. Its meeting discussions can shape states’ efforts to write and update Insurance laws and regulations.

White said RAND conducted its research in response to earlier research showing that U.S. residents get about as much health care as residents of other countries but pay much higher prices for the care, and other research showing that most of the gap is due to the high prices private health plans pay.

White’s team looked at the price gap by comparing health care facilities reimbursement data, from states with good data, with traditional Medicare plan reimbursement data.

One thing the researchers found is that private plan payments averaged more than 200 percent of Medicare payments for the same care at the same hospitals.

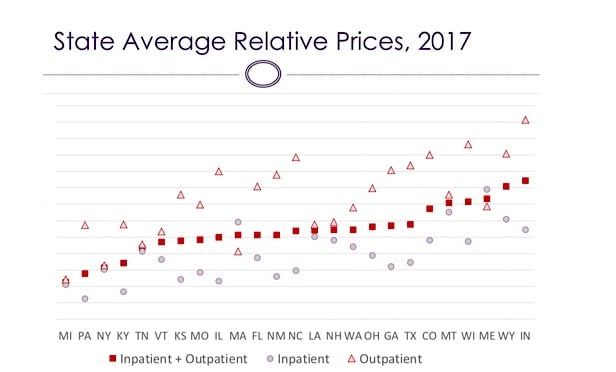

Another thing is that the private plan-to-Medicare spending ratio for facility bills varied widely from state to state.

The ratio ranged from under 175 percent, in Michigan, up to more than 275 percent, in Indiana, with a median between 225 percent and 250 percent.

The researchers found that, in most of the states studied, the ratio was much higher for outpatient care than for inpatient care.

In most states, the ratio for inpatient care was around 200 percent or lower.

The ratio for outpatient care was under 250 percent care in the cheapest states and over 300 percent in the most expensive states.

White said he thinks the size of the gaps is at least partly due to complicated provider payment agreements.

He said two relatively easy things regulators could do to improve the price situation are to make health plans use tougher provider reimbursement agreements and, especially, to limit prices for out-of-network care.

Limits on prices for out-of-network care have a surprisingly big effect, White said.

“That’s why providers really fight those limits,” he said.

Several state regulators at the session asked White to add hospitals’ data on the gap between what Medicare pays and what hospitals say they need to get to break even.

Regulators said they want to know how much of the extra private plan spending might be the result of hospitals trying to make up for losses on Medicare patients.

Related

Links to documents related to the working group’s activities, including the meeting packet with White’s slidedeck, are available here.

Read more:

- How to improve transparency and take control over health care costs

- Lowering health care costs: There’s a better way

- What areas of health care spending increased the most last year?

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.