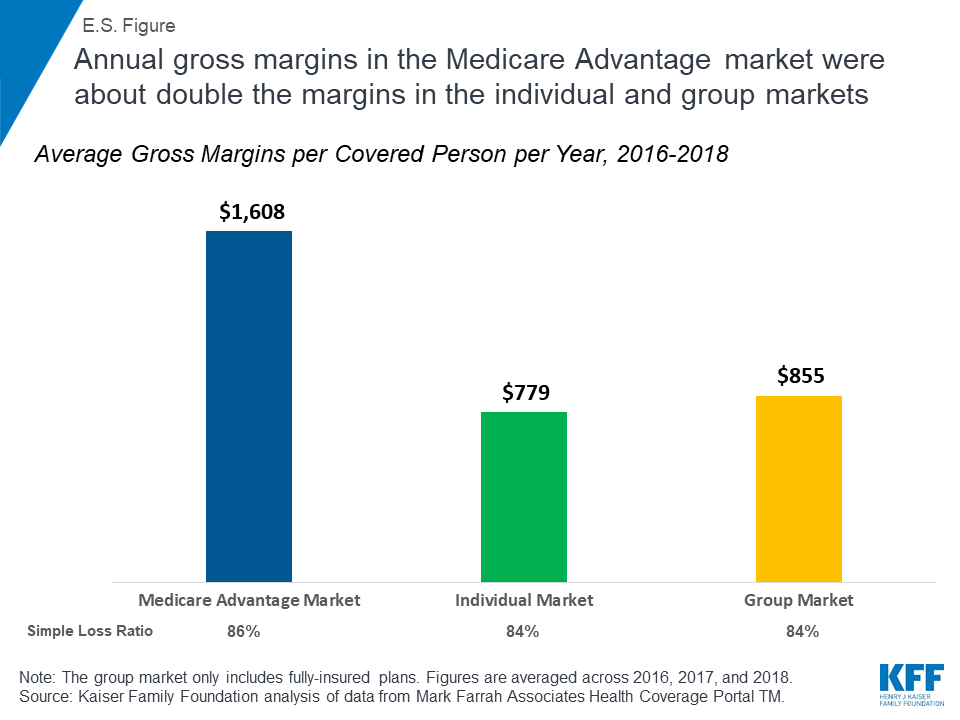

Annual gross margins of Medicare Advantage plans averaged $1,608 per covered person between 2016 and 2018–about double the gross margins for the ACA and employer-based group markets.

Annual gross margins of Medicare Advantage plans averaged $1,608 per covered person between 2016 and 2018–about double the gross margins for the ACA and employer-based group markets.

As some presidential candidates have begun proposing Medicare Advantage-type plans as a way to implement Medicare for All, a new study finds those plans are likely more profitable for private insurers than employer-sponsored plans or the plans on Obamacare’s individual market.

The report by the Kaiser Family Foundation (KFF) looked not at actual profits—since these different models have different levels of administrative costs—but at gross margins, the difference between premiums taken in and medical costs per individual.

One of the primary findings of the study is there are currently healthy gross margins for all three types of plans—Medicare Advantage, private insurance through an employer (group insurance), or plans on the individual marketplace with the Affordable Care Act (ACA), which is often called Obamacare.

“Each of these three health insurance markets now appear to generate high gross margins per person, particularly for insurers of Medicare Advantage plans,” the KFF report said.

Relevance to the Medicare for all debate

The report comes as the debate over Medicare for all, a concept supported by many of the Democratic candidates for President, has taken some interesting turns. More than one of the candidates has backed away from a single-payer, government-controlled version of Medicare for all, as polls have shown that many voters do not want to lose the option of buying private insurance.

Instead, candidates like Kamala Harris have begun talking about a Medicare Advantage-type version of universal health care. Medicare Advantage, financed by the federal government and member contributions, is administered by private insurance carriers and provides a wider range of services than traditional Medicare. Another idea being discussed, primarily by candidate Joe Biden, is re-introducing the ACA’s “public option” concept, which would work more like traditional Medicare.

The KFF study finds that annual gross margins of Medicare Advantage plans averaged $1,608 per covered person between 2016 and 2018. This was about double the gross margins for the ACA and employer-based group markets.

A period of adjustment

The KFF study noted that health insurance markets have seen some swings in recent years. For example, the ACA’s individual market was initially unstable, the report said. “There has been significant volatility in individual market margins, due in part to underpricing in the early years of ACA implementation and more recent overcorrections amid uncertainty about ACA repeal, enforcement of the individual mandate, and in response to the Trump Administration’s decisions to cease cost-sharing subsidy payments and reduce funding for outreach,” the report said. “Premiums fell slightly on average for 2019, as it became clear that some insurers had raised 2018 rates more than was necessary, and margins will likely be lower for 2019.”

Among the three types of plans, the ACA markets saw the most variation in gross margins over time, followed by Medicare Advantage plans. Group plans showed the least variation in gross margins. “The group market may have less variation in gross margins in part because of less uncertainty and because it has not been as subject to changes in policy,” the study said. “In all markets, 5 percent to 10 percent of insurers had negative gross margins, with medical expenses exceeding premiums, indicating that some insurers are losing money in the same markets where other insurers are making profits.”

Overall, the study concluded, expanding the Medicare Advantage model to cover more of the US population could be “lucrative” for private insurers who administer the plans. However, the report said much would depend on how rates were set, for either Medicare Advantage-type plans or an expansion of the ACA through a public option. “Based on the history of Medicare Advantage plans, setting payments to private plans at the appropriate rate remains a challenge, given competing goals of broadening plan choice and fiscal accountability,” the report said. “With a new public program or option, policymakers are likely to face similar challenges, depending on their goals and priorities.”

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.