“If you believe you have a foolproof system, then you have failed to take into consideration the creativity of fools,” Abagnale says.

“If you believe you have a foolproof system, then you have failed to take into consideration the creativity of fools,” Abagnale says.

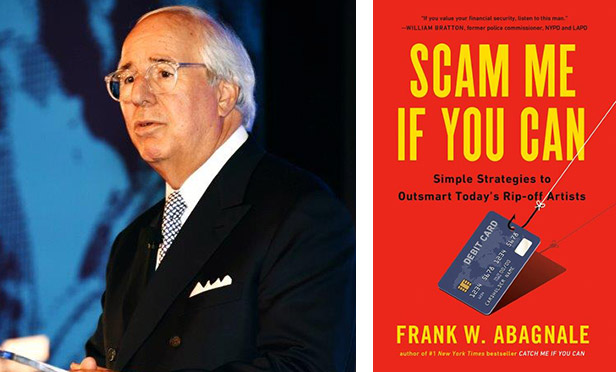

To outwit con artists, take advice from one of the most famous people who used to be one. “Think like a predator,” counsels Frank Abagnale, whose life as a professional imposter and conman from ages 16 to 21 inspired the film “Catch Me If You Can,” starring Leonardo DiCaprio. Abagnale knows all too well how scammers operate.

In an interview with BenefitsPRO’s sister site, ThinkAdvisor, the former fraudster, 71, reveals some M.O.s and tells how to avoid being had.

The consultant to the Federal Bureau of Investigation for more than 43 years also explains how the biggest scam of all time, Bernie Madoff’s Ponzi scheme, operated, while evincing astonishment that the disgraced financier admitted wrongdoing instead of “play[ing] it [the scam] to the end.” That’s not what he’d have done, Abagnale allows.

In the interview, the cybersecurity expert forecasts a few ominous trends, such as cyberattack warfare, which he calls “the wave of the future.”

“I’m sure the U.S. has the power to shut off all the traffic lights in Beijing tomorrow if they want to,” he argues.

Likewise, he “guarantee [s]” that a potential cyberattack could shut down America’s entire banking system.

In his new book, “Scam Me If You Can: Simple Strategies to Outsmart Today’s Rip-off Artists” (Penguin Random House-AARP-Aug. 27), Abagnale explains how new, remarkably useful technologies have, at the same time, made scams and cybercrime easier to execute. All proceeds from the book go to AARP, who commissioned him to write it.

Punished for posing as an airline pilot, doctor, lawyer, FBI agent and more, and for cashing $2.5 million in forged checks in 27 countries, Abagnale served four years of a 12-year jail sentence.

Imprisonment was reduced by his becoming an unpaid consultant to the FBI. Later, he opened Abagnale & Associates, which has advised on fraud prevention to more than 14,000 financial institutions, corporations and law enforcement agencies. Clients include the American Bankers Association, Experian, Marriott Hotels and Visa.

We recently interviewed AARP’s Fraud Watch Network ambassador on the phone from his office in Washington, D.C. He noted that, surprisingly, more millennials than seniors are victims of scams, though, unsurprisingly, seniors lose more money.

“As I always remind people — including myself — anybody can be scammed,” Abagnale says. Here are highlights of our conversation:

A survey by Putnam Investments found that 98% of financial advisors use LinkedIn for personal and business purposes. Do scammers target people on LinkedIn?

FRANK ABAGNALE: LinkedIn is just another link in how scammers get information about you. Let’s say your profile indicates that you graduated from New York University. I go to that website for the year you graduated, look at the yearbook and see who you befriended. Maybe you married a girl you met there; so I can see your wife’s maiden name. Every piece of information leads to another piece of information.

Has the internet increased the amount and frequency of scams?

It’s made scams so easy, plus it’s so global.

Most of the scams I wrote about involve some guy sitting in his pajamas sipping a cup of coffee at his laptop in his kitchen in Moscow. But we don’t have the ability to go there and arrest the guy, charge him with a crime and bring him back to the U.S. That’s why you have to be a smarter consumer and wiser businessperson today.

So “think like a predator,” you recommend. Please explain.

In every scam, no matter how sophisticated or amateurish, there are two red flags: One, the scammer says they need the money immediately; two, they ask for personal information, like your Social Security number and date of birth.

If you learn these red flags and act on them, you’ll never be scammed.

“Practice defensive computing,” you also advise. What’s that?

If you get a phone call or see a popup on your computer screen that says, “This is Microsoft. We’ve detected some malware. Call this number, and we can clear it up,” when you call, it’s not Microsoft but some boiler room in Miami. Microsoft doesn’t send popups or make calls like that.

But folks are so gullible.

People are basically honest; so they don’t have a defensive mind and easily fall for these things.

You write about cyber fraud’s becoming an important part of the weaponry systems of “rogue nations” but that “governments like our own” use cyberattacks too. The U.S., for example, reportedly employed a malicious virus to target and destroy a fifth of Iran’s nuclear centrifuges in 2010, you say. Please elaborate.

This is a different type of warfare from sending missiles and planes and ships: You screw up [enemies’] intelligence programs. We [generally] rely on computers to operate every piece of equipment. So you leave yourself open to having someone getting into that system, manipulating it and causing harm — no matter which side you’re on.

There’s little reported on the U.S. waging cyberwarfare.

Right – they’re not going to make that real public unless it’s after the fact when we’re accused of getting into some system. But I’m sure the government has the power to shut off all the traffic lights in Beijing tomorrow if they want to.

This is the wave of the future. We rely too much on computers, and they’re all hooked together through the Internet. That’s not a good thing.

What do you predict for individuals or groups committing evil acts with technology?

Where we’re going doesn’t look good. We develop all these technologies without ever taking the final step to ask: How would someone use this in the wrong way?

I get a little concerned that now we can shut off someone’s pacemaker from 35 feet and take over a vehicle from within 35 feet. The question is: five years from now, will we be able to do that from 35 miles or 350 miles away?

“I guarantee that … some sort of cyberattack will be used in an attempt to destroy integral parts of the [U.S.] government — fraud of the most dangerous order. It’s just a matter of time,” you write. “Attackers may set their sights on large industrial plants, factory floors, traffic signs and transit systems, and shut down banking systems.” Very ominous, especially about banking.

There’s no question that’s going to happen because look at what just happened at Capital One, one of the biggest banks in the world. Millions of people’s personal information and credit card information were stolen. There is no foolproof system.

If you believe you have a foolproof system, then you have failed to take into consideration the creativity of fools. But a lot of companies aren’t doing what they need to do to keep information safe.

What scams are going around now?

Romance scams have really increased over the last couple of years. And now, because Medicare is issuing new ID numbers [gradually] by region, scammers are calling seniors saying they’re from Medicare and asking if they’ve received their new cards and paid the fee. People say they haven’t paid [because no fee is required]. Then the scammer says, “Just give me your credit card number, and I’ll send out your new Medicare card.” Medicare doesn’t make calls to people once they’ve issued them a Medicare card. They delete individuals’ phone numbers.

What’s another current scam?

One of the most common is called “the grandparent’s scam.” Someone calls you, says they’re the police and have arrested your grandson, who was drunk while driving and needs to post bail within the next couple of hours — so give me your credit card number. They tell you everything about him — it sounds so realistic. That’s because they’ve picked up all the information your grandson has posted on social media.

The world’s biggest scam, a Ponzi scheme, was perpetrated by Bernie Madoff for two decades. How could he get away with it for so long?

The bigger question I’ve always had about Bernie and will have until I die is: I don’t understand why, in the end, he said he did it. Had I been Bernie, when people came to me, I would have said, “You know the market is way down, and I lost a lot of money. I don’t have your money right now.”

I suppose he didn’t want to get sued.

Some would have pressed criminal charges. But the man was in his 70s. He’d probably die of old age by the time [those suits] got to court. I was always surprised that he just came out and admitted to everything and didn’t play it to the end.

But how was he able to scam all those smart, prominent people?

He made you want to give him money. He had people begging to give him their money to invest. That was his scam. Very powerful, prestigious people were dying to give him their money to invest.

That’s how he built the whole thing. He took care of a few very powerful, influential people that were making big money with him. They were convinced he was great, and they were the ones who went out and sold him [to others].

How did they “sell” him?

If someone said, “I’ve got $10 million and have been trying to put money with Bernie for years. I’ve heard amazing things about his return. I really want to invest with him,” [the Madoff client] would say, “I’ll talk to him for you.”

Then he’d come back: “Bernie isn’t really interested in taking [investing] your money.” That may have gone on for three years. The next year, the [client] says: “Bernie said he’ll go ahead and take your money this time and invest it for you.”

But weren’t people ever suspicious of him and the returns he said he was getting?

I read about one very intelligent woman who kept saying to her accountant, at a big firm: “I’ve been with Bernie for ten years and make about 30% every year on my money. But I don’t know how I make it, and I want to be sure everything is legal. Can you look through my paperwork and tell me if there’s anything suspicious.”

The firm looked at it and said, “We don’t see anything suspicious. If you’re making that much return, don’t complain about it.” So Bernie had all his bases covered.

Who else did he fool?

Investment banks were actually encouraging people to put money with him. I know of one elderly woman who lived in Westport, Connecticut, whose banker called her: “You need to come in and remove all your money from the bank. You need to do it right away. Please do what I tell you.” That was because of Madoff. So even investment bankers got caught.

When you were very young, you were a con artist. It began at 15 when you’d used your father’s credit card to buy car parts and then resell them. How did fraud start to become a way of life?

When I was about 16, I had my first car and wanted to go out with girls. My father gave me a gas card. So I’d go to a gas station, tell them I wanted to buy four tires: “Here’s my credit card.” They’d ring up my card for $240. Then I’d say, “I don’t really want those tires. But if you give me $100 in cash, you can keep the tires and you’ll also get the $240 from Mobil.“ They all jumped on it. They all did it. No one ever said, “That would be illegal — that’s not right.”

That year, you ran away from home and ended up on the streets of New York with no money. How did you get along?

I started to get creative. I looked a lot older and altered my driver’s license to make myself 26. Then I started doing all those [fraudulent] things. First it was: How am I going to survive; then, when people were chasing me, it was: How am I going to stay ahead of them? Toward the end, it became more of a game. I always realized that sooner or later I’d get caught.

Today, as an expert on cybersecurity and identity theft, you help the FBI and businesses. The computer password system should be replaced, you say. Why?

Passwords are a 1964 technology. Passwords are for treehouses. They’re certainly not for accessing security and personal information. There’s technology out today — such as Trusona — that eliminates the need for passwords, and you don’t have to answer any questions or give your Social Security number or date of birth [etc.].

In the next few years, you’ll see everyone convert to no passwords and get away from a very old technology that should have been eliminated years ago.

READ MORE:

How to spot signs of workman’s compensation fraud

8 kinds of employee fraud and how to prevent it

5 cybersecurity best practices for anyone with remote employees

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.