90 percent of sponsors surveyed report at least some employees are delaying retirement. (Photo: Shutterstock)

90 percent of sponsors surveyed report at least some employees are delaying retirement. (Photo: Shutterstock)

Employers are utilizing retirement plan advisors at a record rate, according to Fidelity's 10th annual Plan Sponsor Attitudes study.

Of the more than 1,200 retirement plan sponsors surveyed, 93 percent are working with an advisor, up from 68 percent in 2010.

Two-thirds of employers say they are very satisfied with the service, up from just 19 percent in 2010.

"The data from the last couple of years shows sponsors are much more aware of whether their retirement plan is working for them from a cost perspective and whether it's helping people retire," said Jordan Burgess, head of specialist field sales at Fidelity.

"Sponsors are balancing both company and employee needs, and they're looking to plan advisors to help them better understand the complexities of plans in order to meet those combined goals," he added. "We did hear from sponsors that they feel that balance is increasingly complex."

While advisor satisfaction is high, employers still remained concerned over the retirement prospect of their workforce. Only 55 percent of sponsors believe their employees are saving enough for retirement.

And 90 percent report at least some employees are delaying retirement.

"That's creating business issues," said Burgess. "It increases the cost of benefits, can lower productivity, and reduce mobility for younger workers."

Sponsors cited the need to better understand how well plans are working as their top reason for using an advisor, said Burgess.

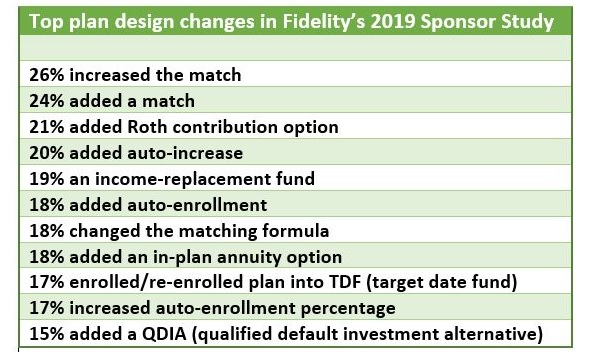

And that need is leading to proactive plan management. (See chart 1 below.)

Chart 1: Plan design changes. (Data: Fidelity)

Chart 1: Plan design changes. (Data: Fidelity)Three-quarters of sponsors made active changes to plan design or investment lineups last year.

One quarter increased their match, and one quarter added a match—the top design changes sponsors made.

One-fifth added an automatic escalation savings feature, and 18 percent added an in-plan annuity option.

Sponsors continue to be aware of their fiduciary obligations and dependent on advisors to help define their obligations.

Fiduciary responsibilities ranked as a top concern of employers, the study found. Employers said helping with fiduciary requirements was the top impact advisors were having on plans. One-third of sponsors said they were unsure if they fully understand their fiduciary obligations.

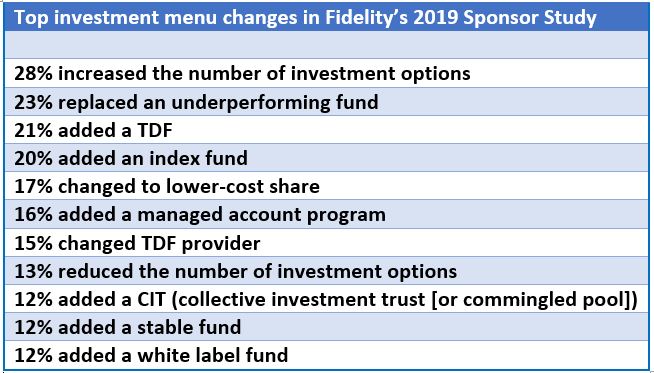

But on balance, Burgess sees plan advisors providing real value and driving positive changes. (See chart 2 below.)

Chart 2: Investment menu changes (Data: Fidelity)

Chart 2: Investment menu changes (Data: Fidelity)"The changes we are seeing in plan design are tied to the things that we know as an industry are the right thing to do," he said. "Sponsors are also more rigorously reviewing investment lineups. We're seeing less annual reviews, and more quarterly reviews. That infers that sponsors and advisors are doing a good job considering their fiduciary obligations."

Advisors are also driving the financial wellness meme. Two-thirds of sponsors said their plan advisors have raised the issue. And over half of the sponsors surveyed offer some type of financial wellness programs.

"We see advisors advancing the conversation around wellness," said Burgess. "Sponsors need to be competitive, and there are real business implications when people don't have enough money saved," said Burgess, who noted Fidelity research showing 36 percent of employees have less than three months salary saved in an emergency fund.

Relationships with recordkeepers are also vital to improving plan efficiency and outcomes—the study included sponsors of plans whose recordkeepers are Fidelity and others.

"The relationship with the recordkeeper is really important," added Burgess. "When all three are working together–plan advisor, sponsor, and recordkeeper—we see the best outcomes."

READ MORE:

Why Americans are waiting longer before retiring

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.