Traditionally, small businesses have faced more challenges in providing health benefits to employees, lacking both size for bargaining power and extensive HR resources. (Photo: Getty)

Traditionally, small businesses have faced more challenges in providing health benefits to employees, lacking both size for bargaining power and extensive HR resources. (Photo: Getty)

Despite feeling optimistic about the economy, small business owners continue to struggle with the cost of providing health care coverage to their employees, a new study finds.

The report by the Commonwealth Fund was based on surveys, focus groups and interviews of small business owners. The findings indicated that business owners are looking for ways to cut costs and interested in policy changes that would make health care more affordable.

Related: 3 ways to position your small business benefits offering for success in 2019

The importance of this group to the nation's economy cannot be overstated. Small businesses, defined as those with fewer than 500 employees, employ approximately 60 million Americans, make up more than 99 percent of U.S. employers, and create 66 percent of new private sector jobs. Traditionally, small businesses have faced more challenges in providing health benefits to employees, lacking both size for bargaining power and extensive HR resources, in many cases.

Challenged by costs

The survey finds that costs continue to be a challenge for small business owners, even in a strong economy. Although 85 percent of those surveyed said their businesses were doing well, they also listed health care costs as a main concern.

When asked to name the two biggest challenges for their business, 37 percent included the cost of providing health care to employees as their first or second choice. That was the top answer, with attracting new customers coming in second at 33 percent.

The smaller the employer, the bigger the problem, the study found. Among employers with 2-25 employees, 45 percent said the cost of providing health care was a major problem. With larger employers (26-500 employees) 39 percent said cost was a major problem.

"The price tag on health insurance is a significant pain point for small employers," the report's authors said. "The problem extends to recruiting and retaining talent. To compete with larger employers, small employers are hard-pressed to offer benefits like health insurance, even as the benefit takes up a larger share of the bottom line."

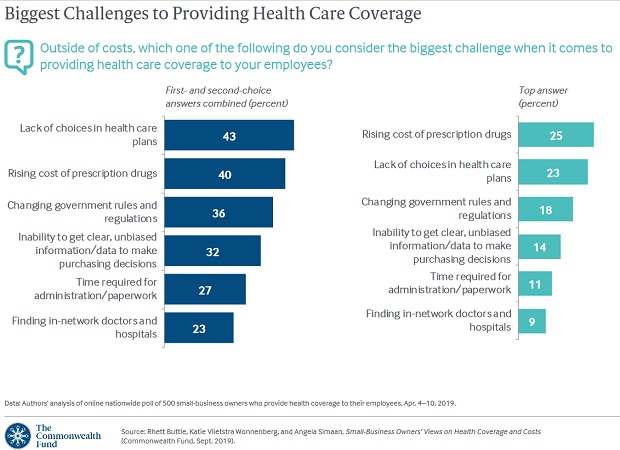

When asked about specific challenges, small business owners listed rising drug costs as a top worry: 25 percent said drug costs were the biggest challenge in providing health care to employees. This was followed by lack of choices in health care plans (23 percent) and changing government rules and regulations (18 percent).

The trap of cost-shifting

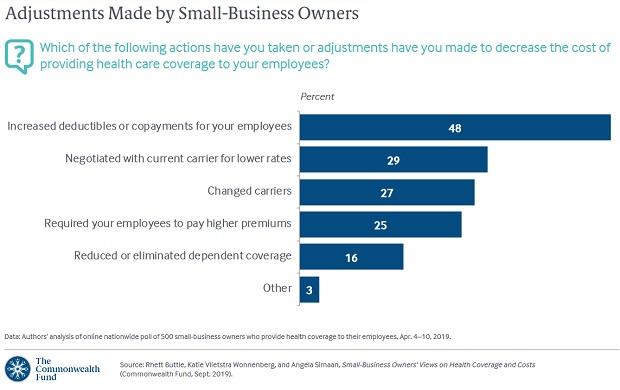

To deal with rising costs, small business owners often have few attractive options. Many are shifting more health care costs to their employees: 48 percent said they have increased deductibles or copays for employees. The second most popular option was negotiating with their current carrier for lower rates (29 percent); changing insurance carriers came at third (27 percent). Other options included charging higher premiums (25 percent) or cutting back on dependent coverage (16 percent).

These findings underline the dilemma faced by smaller companies: strategies for dealing with costs can be counterproductive, as cost-sharing, higher premiums and cutting back on dependent coverage will make them less competitive in the employment market.

Seeking solutions, not ideology

The report concludes by noting that small business owners, although a conservative group in general, are somewhat apolitical when it comes to dealing with health care benefits. It notes that 58 percent said they either strongly or somewhat supported Medicare for all; a solution favored by the left. But a more conservative proposal, having small companies band together to purchase insurance, also had support: 92 percent said that solution would be either somewhat helpful or very helpful.

"Increasing health care costs is not sustainable for small employers," the report said. "They want change and are willing to take pragmatic steps. This desire for change does not adhere to party lines; across the ideological spectrum, small-business owners are open to a range of possible solutions."

Read more:

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.