However, employers that are positioning HSAs as an investing option should make sure to choose an HSA provider that aligns with that strategy. (Photo: Getty)

However, employers that are positioning HSAs as an investing option should make sure to choose an HSA provider that aligns with that strategy. (Photo: Getty)

For employers struggling to contain rising health care and health insurance costs, as well as provide employees with attractive retirement savings options, HSAs and qualified consumer-driven health plans (CDHPs) are a powerful, comprehensive solution. In 2018, nearly one in three employers offered a consumer-driven health plan option, according to the Kaiser Family Foundation's most recent Employer Health Benefits survey.

However, employee understanding of HSAs and CDHPs is woefully behind. According to a recent report by the LIMRA Secure Retirement Institute and Insured Retirement Institute (IRI), half of respondents considered themselves either "not at all knowledgeable" or "not very knowledgeable" about HSAs' features and benefits. In addition, 40 percent of respondents incorrectly believed HSA funds must be spent by the end of the year to keep them from being forfeited, like a flexible spending account (FSA).

Related: HSAs: Moving from spending to saving to strategizing

For employers looking to implement a CDHP/HSA solution, education is essential to helping employees understand why they should enroll. Here are five simple tips to help implement an effective CDHP/HSA solution that employees will understand and get excited about.

1. Reframe HSA-qualified health plans

Traditionally, the type of health plans needed to open and contribute to an HSA have been known as "high deductible health plans" (HDHPs). However, seeing "high deductible" can lead employees to believe that that plan is more expensive and disincentivize them from enrolling. A simple way to reframe expectations is to refer to your HSA-qualified plan as a "consumer-driven health plan" (CDHP) or, even better, a "low premium health plan." By shifting the focus to the plan's lower monthly premiums or ability for participants to better own their healthcare experience, employers can help employees better understand the holistic benefits of an HSA-qualified plan.

2. Holistically compare CDHP and traditional plan costs

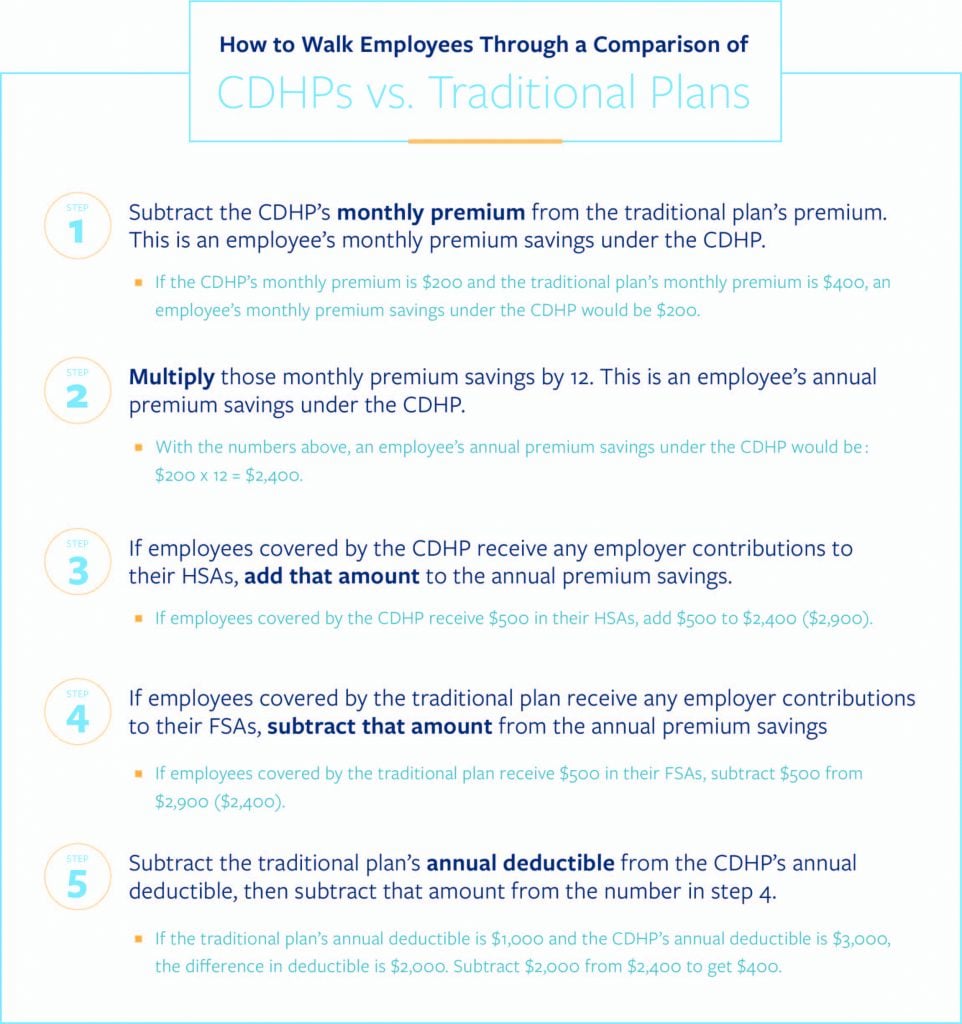

For employers offering a CDHP/HSA alongside a more traditional health plan, the responsibility is on them to show employees why the CDHP/HSA is a better option. And in many cases, employees may believe CHDPs are more expensive because of their higher deductibles. By comprehensively comparing total costs of a CDHP alongside a traditional plan, employers can dispel those doubts and help employees make a fact-based decision about their health coverage.

Here's how to walk employees through the comparison:

The final number ($400 in the example above) is the amount an employee will save under the CDHP if they reach their annual deductible. If the number is negative, an employee will save under the traditional plan if they hit their deductible.

The final number ($400 in the example above) is the amount an employee will save under the CDHP if they reach their annual deductible. If the number is negative, an employee will save under the traditional plan if they hit their deductible.

Of course, this assumes the employee reaches their annual deductible. If an employee is generally healthy and doesn't incur many medical costs, his or her annual medical expenses will likely stay under the deductible (increasing the amount he or she will save under the CDHP). By looking at their doctor's bills for the last couple of years, employees can estimate how often they use medical care and whether they're likely to reach their annual deductibles.

3. Contribute to employees' HSAs (and use those contributions to incentivize higher employee contributions)

According to the 2018 Kaiser survey, only 55 percent of employers make contributions to their employees' HSAs. Employers who don't contribute to their employees' HSAs are not only missing out on a chance to encourage employee contributions, they're also neglecting an opportunity to save money themselves.

Employers looking to maximize employee contributions should make sure they have a Section 125 Plan (also called a Cafeteria Plan) set up; this enables employees to make HSA contributions via pre-tax payroll withholding. These funds are not subject to federal and state taxes (in most states) and also aren't subject to FICA taxes, giving employees a strong incentive to contribute. In addition, by offering a Cafeteria Plans, employers do not have to follow IRS comparability rules in their contributions to employees' HSAs.

This gives employers more freedom in structuring a contribution system that incentivizes employees to grow their HSAs. For example, employers can offer a base contribution to employees' HSAs, then contribute an additional amount based on employees contributing a certain amount on their own. Employers can even offer additional HSA contributions based on employees' actions, such as completing wellness initiatives. Employers should also strongly consider paying the administrative fees associated with employees' accounts to eliminate any potential frustration.

Lastly, employers also save FICA taxes on HSA contributions employees make via payroll withholding, which can recoup the cost of paying employees' HSA administrative fees.

4. Offer a post-deductible HRA to cover catastrophic events

In addition to frequently having higher deductibles than traditional plans, CDHPs can have higher out-of-pocket maximums as well. This can make employees nervous about the amount they would have to pay in the event of a medical emergency and can steer them towards enrolling in a traditional plan.

To counter this, employers can set up a post-deductible health reimbursement account (HRA) to cover expenses in the event of a catastrophic event. Typically, HRAs cannot be combined with HSA-qualified CHDPs, but post-deductible HRAs are an exception because they don't reimburse medical expenses until the IRS' minimum annual deductible for HSAs is reached. Employers can choose the amount at which the post-deductible HRA begins reimbursing money, as long as it's above the IRS' minimum deductible.

For example, if a CDHP has an out-of-pocket-maximum of $8,000, an employer could set up a post-deductible HRA to reimburse all medical expenses after $5,000. By setting up this safety net, employers can boost employees' confidence about enrolling in a CDHP/HSA, knowing they'll have coverage in the event of a medical emergency.

5. Tout HSAs' investing ability

If employers depict HSAs as similar to FSAs, employees may not see the value of enrolling in CDHPs. However, HSAs are so much more than a way to save taxes on current medical expenses; they can be invested like a 401(k) or IRA and grown to cover retirement healthcare costs. Employers should make sure to explain HSAs' investment potential as a long-term savings vehicle in addition to their ability to save taxes on current healthcare costs.

According to a recent Healthview study, the average 65-year-old couple should expect to pay over $363,000 in non-Medicare-covered medical expenses during retirement. By accumulating HSA funds, savvy investors can build medical eggs to pay for those costs tax-free, rather than using 401(k) or IRA funds and paying taxes on top of the expenses. Depending on the tax rate, these tax savings could be as much as $120,000.

And, while HSA contribution limits are lower than those for 401(k) plans, investors can still build up large balances in them. Assuming a 6 percent rate of return, family health coverage, and a 2 percent annual CPI increase, a 50-year-old could accumulate over $221,000 in his/her HSA by the time he/she reaches 65, and a 30-year-old could amass over $1,069,000. Those funds can then be used to pay for medical expenses tax-free or, once the account holder is 65, spent on non-medical costs with no tax penalty just like a 401(k) or IRA.

However, employers that are positioning HSAs as an investing option should make sure to choose an HSA provider that aligns with that strategy. Some HSA providers don't offer an investment option at all, and many that do require that accountholder maintain a threshold in cash before they can invest. Others offer fund lineups with high expense ratios that subtly erode account holders' balances over time.

By choosing an HSA provider who views HSAs as an essential piece of a comprehensive retirement planning strategy and offers easy access to investing, employers ensure their employees are set up well to grow their funds for a happy, healthy future.

CDHPs/HSAs offer employers an effective means to counter increasing healthcare costs while also provide employees a powerful vehicle for retirement planning. While employees are still learning the benefits of CDHPs paired with HSAs, employers that take the time to educate employees on their advantages offers clear rewards both now and in the future.

Craig Keohan is chief revenue officer for HealthSavings, a leading HSA provider. As Chairman Emeritus of the American Bankers HSA Council and founding executive of the first HSA / MSA administrative companies in the country, his passion is to help those who are confused get it right and stop espousing guidance that only serves the corporate bottom line. He believes the HSA consumer deserves clarity that the HSA account is called a Health SAVINGS Account for a reason.

Read more:

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.