Saving $500 on a $6,000 purchase is obviously not as good as saving $100 on $4,500, but does your PBM evaluation process recognize that?

Saving $500 on a $6,000 purchase is obviously not as good as saving $100 on $4,500, but does your PBM evaluation process recognize that?

For many health benefit plan sponsors and their advisors, the evaluation process used to compare pharmacy benefits managers (PBMs) keeps drug costs higher than they should be by measuring their value with metrics that reward rebates rather than net costs. An RFP process that "spreadsheets" acquisition discounts, rebates per prescription, and administration costs typically lacks the information that plan sponsors need to recommend the option with the lowest overall costs and doesn't account for utilization management or improved clinical outcomes.

Related: PBMs lose out to pharmacists in Ohio budget deal

While the medical health care industry is transitioning from the broken fee-for-service model by incorporating capitated payments and responsible risk-assumption, pharmacy pricing structures still very much value volume.

During RFP evaluations and annual contract reviews, plan administrators and advisors can uncover better costs and better clinical outcomes by stepping back to review the metrics they use to evaluate PBM performance. (See the PBM Evaluation Process Self-Assessment below.)

By balancing the historical emphasis on rebates with new metrics that account for net costs and clinical outcomes, and by incorporating auditable calculations of avoided costs via proactive utilization management, plan sponsors can bring their PBM structures into alignment with the rest of the health care industry in transitioning from pay-for-volume to pay-for-quality.

Expanding pharmacist roles ensures alignment and lower-cost clinical effectiveness

Crucial to the success of programs based in these realigned metrics is the role of the pharmacist in the PBM. A clinical approach that centers pharmacists and evidence-based approaches to treatment not only controls costs over the long run, but can also improve efficacy, safety, and may even reduce adverse effects of medication. This approach brings plans into balance and aligns the incentives of the PBM with the incentives of the plan and the needs of participants.

In addition, by focusing on clinical management, PBMs can support treatment adherence, which can shorten the length of time that medication is needed and greatly improves member outcomes as well as quality of life.

Indeed, plans that leverage pharmacists who collaborate with doctors to adjust medication duration, or recommend generic or branded drugs to specialty drugs, where medically appropriate, will substantially lower long-term plan costs.

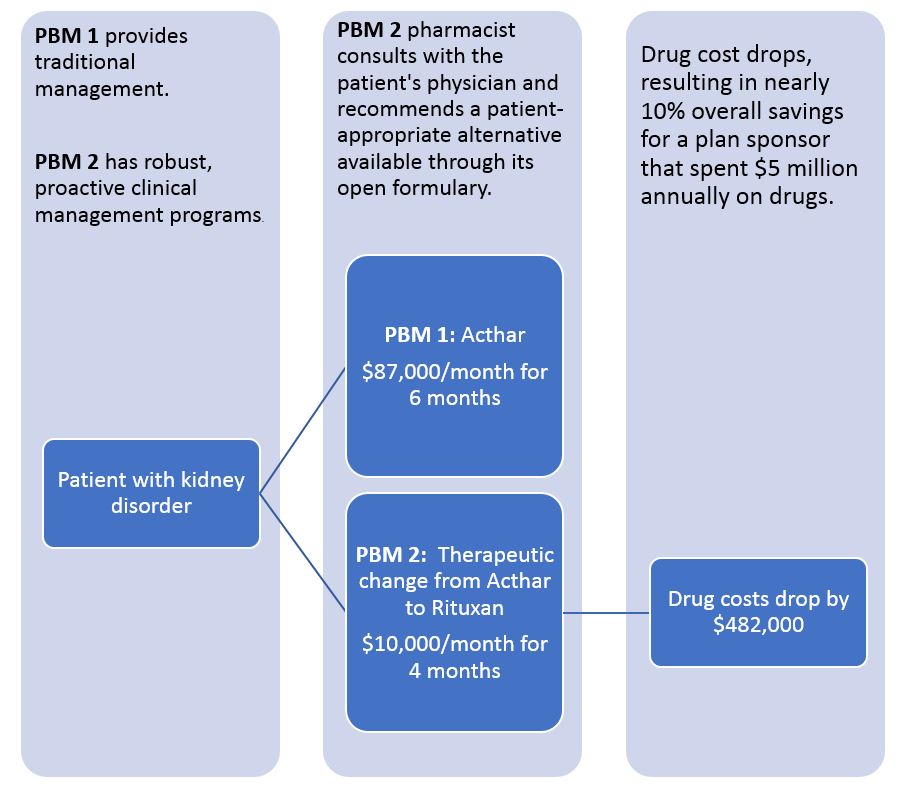

Is your PBM evaluation model smart enough to save $482,000?

A patient with nephrotic syndrome is part of a real-world, self-funded drug plan that switched from PBM 1 to PBM 2. If presented with this scenario during an RFP analysis, is your evaluation process set up to value the larger rebate associated with Acthar, or the overall lower costs associated with Rituxan?

Find value in prior authorization approval rates

Unfortunately, not enough plans review prior authorization approval rates' impacts on their overall costs.

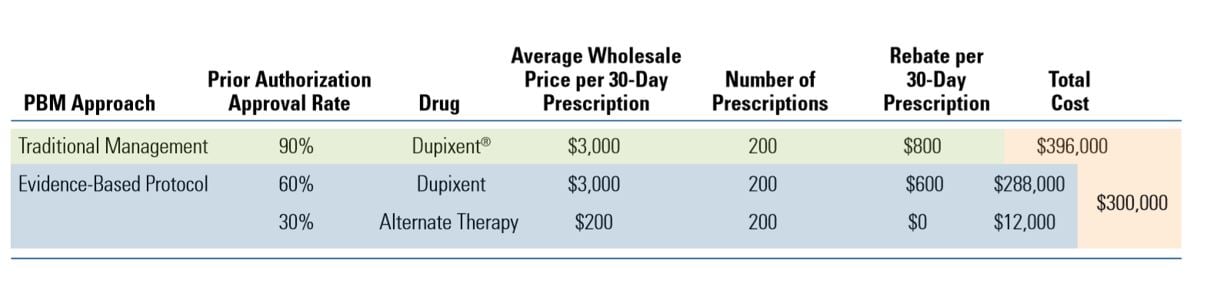

A typical spreadsheet evaluation of the two PBM approaches shown in the table below would (falsely) suggest traditional management as the most cost-effective choice for the plan sponsor because it generates higher rebate dollars ($800 vs $600 per prescription).

Related: What brokers need to know about PBMs and transparency

But a PBM evaluation that takes utilization management factors into consideration clearly shows that the evidence-based protocol would offer 24% savings ($96,000) by guiding appropriate patients to lower-cost eczema therapies.

Comparison of drug costs for a patient with Eczema

PBM evaluation process self-assessment: Answer yes or no

- Does your evaluation assume all PBMs will approve the same drugs in the same amounts?

- Are your PBM's approval rates on step therapy and prior authorization standard and steady?

- Do you receive any rebates from drug companies in exchange for placement on a formulary tier?

- Is you formulary closed?

- Does your PBM evaluation process compare line-items that include acquisition discounts, rebates per prescription, and administration fees?

- Does your PBM evaluation process include a line item for total overall cost minimization?

- Are you confident physicians are not being inappropriately influenced by patient requests for specific brands?

- Do you know how the PBM integrates pharmacists into the drug approval process?

- Does your RFP process include a thorough review of PBM protocols, proposed clinical interchanges, and the proposed savings over an incumbent PBM?

- Does the PBM guarantee payment of any claimed savings?

Tally one point for each "yes" to questions 1-5, and one point for each "no" to questions 6-10. If you scored 2 or more, your client's existing PBM and your RFP process might be missing cost-saving opportunities.

Polina Kogan is a doctor of pharmacy and Chief Pharmacy Officer for the risk-bearing pharmacy benefits manager EmpiRx Health, where she is responsible for clinical strategy, program development and all clinical services.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.