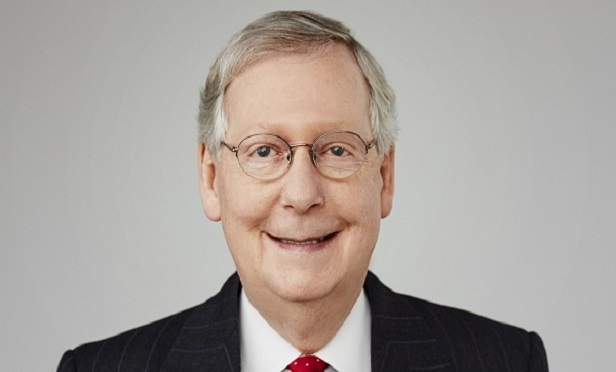

The bill passed the House 417-3, but McConnell has yet to put it to a vote in the Senate.

The bill passed the House 417-3, but McConnell has yet to put it to a vote in the Senate.

Republican senators are urging Senate Majority Leader Mitch McConnell to bring the Setting Every Community Up for Retirement Enhancement (SECURE) Act up for an immediate vote.

In a Tuesday letter to McConnell, Sen. Tim Scott, R-S.C., pressed for immediate Senate consideration of the bipartisan bill, which was passed the House by a 417-3 vote on May 23.

Scott was joined by Sens. Susan Collins, R-Maine; Joni Ernst, R-Iowa; Cory Gardner, R-Colo.; Rob Portman, R-Ohio; Martha McSally, R-Ariz.; and Thom Tillis, R-N.C.

The Secure Act "will make significant strides in fixing the nation's retirement crisis and helping workers of all ages invest and save for their futures," the senators wrote.

The senators added in their letter that the bill "would expand access to retirement plans for millions of Americans, allow older workers and retirees to contribute more to their retirement accounts, increase 401(k) coverage to part-time employees, prevent as many as 4 million people in private-sector pension plans from losing future benefits, protect 1,400 religiously affiliated organizations whose access to their defined contribution retirement plans is in jeopardy."

The bill would make it easier for small businesses to offer retirement plans and would raise the required minimum distribution age to 72 from 70 1/2.

It also paves the way for more annuities in retirement plans and aims to raise revenue by changing the withdrawal rules on inherited IRAs by curtailing the "stretch IRA" strategy.

"We encourage the Senate to take action on the Secure Act as soon as possible," the senators wrote. "Doing so demonstrates to our constituents that the Senate can lead in a bipartisan way for workers saving for retirement, tax fairness, and family financial security."

READ MORE:

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.