The percentage of employers with 20,000 or more workers that offer only a high-deductible account-based plan fell from 22 percent to 16 percent. (Photo: Shutterstock)

The percentage of employers with 20,000 or more workers that offer only a high-deductible account-based plan fell from 22 percent to 16 percent. (Photo: Shutterstock)

As the average total health benefit cost per employee rose 3 percent this year to reach $13,046, many employers are trying additional health care cost management strategies so they don't have to shift as much of the burden to workers—that is, if they can afford to absorb increasing costs, according to Mercer's National Surve my of Employer-Sponsored Health Plans 2019.

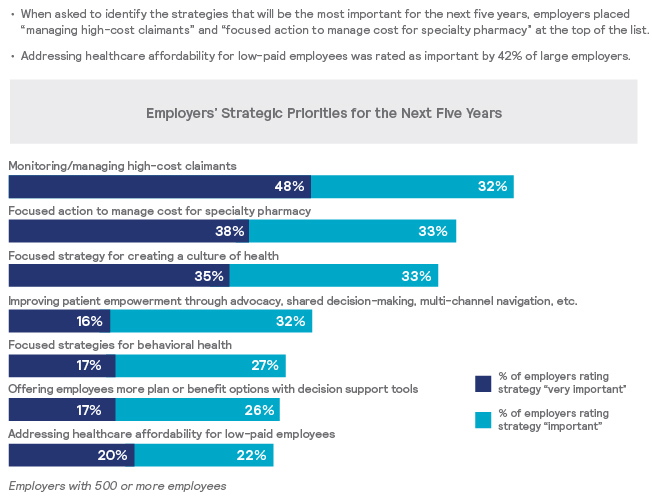

Mercer surveyed more than 2,500 employers and found that the average individual deductible in a PPO offered by large and mid-size employers rose just $10 in 2019, to $992. This jibes well with their priorities for the next five years, as 42 percent of large and mid-size employers say that "addressing health care affordability for low-paid employees" is an important or very important strategy.

Related: Health insurance costs took a big jump for employers and employees in 2017

However, for small employers that typically have less ability to absorb high cost increases and fewer resources to devote to plan management, the average deductible rose by more than $250.

Larger employers are also giving their workers more plan choices other than just a high-deductible plan with a health savings account, according to the survey. Indeed, the percentage of employers with 20,000 or more workers that offer only a high-deductible account-based plan fell from 22 percent to 16 percent.

"This doesn't mean HSA plans are going away, but to meet the various needs and budgets of today's five-generation workforce, employers are increasingly offering an array of health benefit plans," says Tracy Watts, Mercer's national leader for U.S. health policy. "In fact, many employees who do the math at open enrollment find an HSA is a smart financial move. But for those with little savings or significant health issues, another plan might be a better fit."

Such plans are still popular: enrollment in high-deductible account-based plans rose from 33 percent of all covered employees last year to 36 percent in 2019. These plans are offered by 71 percent of large and midsize employers, up from 68 percent in 2018, and by 37 percent of small employers.

Some of the more innovative cost-management strategies now being implemented offered by employers include tech-enabled programs that help employees manage chronic conditions or other health needs, such as musculoskeletal conditions, infertility and insomnia. In 2019, 58 percent of all large and midsize employers, and 78 percent of those with 20,000 or more employees, offer one or more of such solutions.

"Typically the goals of these programs are empowerment, convenience and lower costs," Watts says. "For example, a physical therapy app that reminds patients when to do prescribed exercises, provides instructions, and even counts reps could mean fewer trips to a clinic, less out-of-pocket cost for the employee, and a better outcome."

Telemedicine has become an important strategy to contain costs, with nearly 9 out of 10 employers now offering a program that typically costs less than half the cost of an office visit. The alternative is slowly catching on with workers: Last year, among employers offering telemedicine, on average 9 percent of eligible employees used telemedicine, up from 8 percent the prior year, and about one in seven employers reported utilization of 20 percent or higher.

To mitigate for a shortage of behavioral health providers, particularly in rural areas, teletherapy is now offered by 42 percent of employers with 5,000 or more employees.

Other cost-containment strategies include:

- Managing high-cost claims by offering workers enhanced health advocacy and intensive case management services, as well as programs that make it easy for workers to seek an expert medical opinion on a diagnosis or their treatment plan.

- Curbing the cost of specialty drugs, as spending on such medications rose 10.5 percent this year, compared to the 5.5 percent rise in spending on all prescription drugs. One way is through the use of a specialty pharmacy that typically provides enhanced care management, including offering drug therapies that can be administered at home at less cost.

- Over half of all large and midsize employers (52 percent) and over three-fourths of those with 20,000 or more employees (78 percent) now steer employees to a specialty pharmacy.

Read more:

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.