You know that reference-based pricing is a great cost containment tool. When it's been done right, we've seen huge savings. But there's a lot of misconceptions out there about RBP, and that can make trying to have a real conversation about it as frustrating as fighting the Black Knight of Monty Python fame.

To help you fight this silly knight, here are five common myths about RBP, and the facts and figures you need to disarm them.

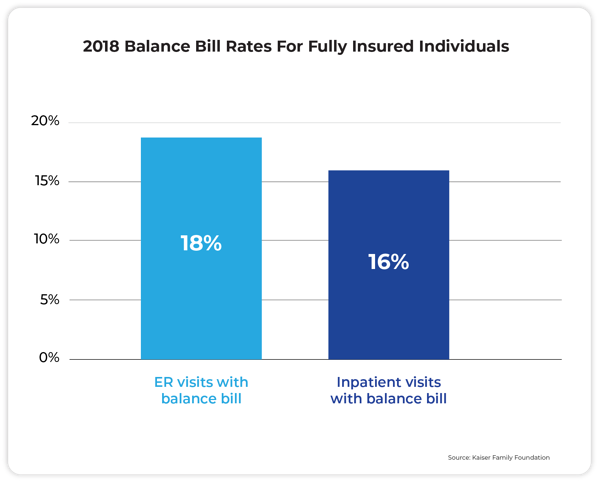

Myth 1: RBP is plagued with balance billing

Fact: Fully insured plans face just as much balance billing as reference-based pricing. In fact, 16 percent of fully insured inpatient visits in 2018 got a balance bill, and 18 percent were balanced bill for ER. If balance billing is the problem, the major carrier networks don't offer as much coverage as people think.

⬆️ One reason balance billing might be so high here is that 70 percent of people surveyed did not know they were out of network.

Myth 2: Balance bills are purely the patient's responsibility

Fact: Maybe this was true in the early days of RBP, but today, co-fiduciary partners typically indemnify patients from any harm. They also provide services such as litigation support, along with traditional bill auditing and pre-certification. Building the right "health stack" of re-pricer, medical manager, and member concierge gives all parties peace of mind. This is important because 8 out of 10 medical bills contain at least one error, even in PPO plans where you can't audit them.

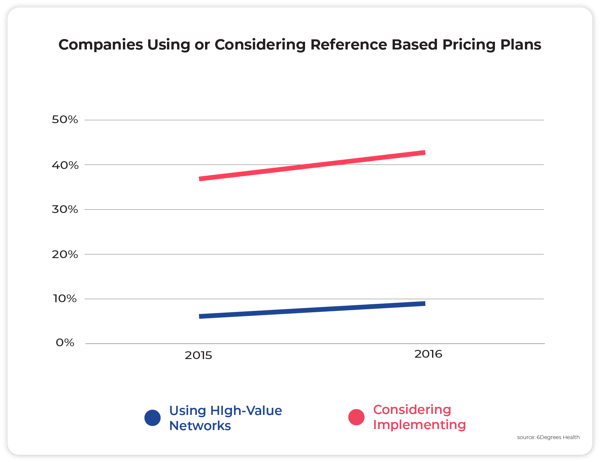

Myth 3: RBP is a fad, not a long-term solution

Fact: "High performance networks" are growing in popularity year-over-year. One key to any successful RBP launch is getting the C-suite, HR, and the advisor on the same page and committed to the change. Up front and continuous member education makes all the difference.

⬆️ From 2015 to 2016, the number of companies running RBP plans grew by 50 percent. The number of companies that said they were considering these plans grew by 16 percent.

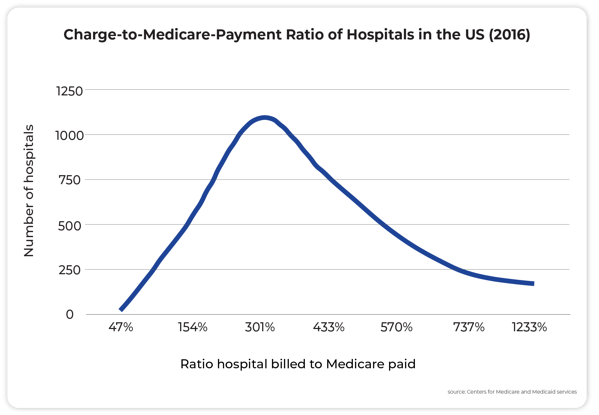

Myth 4: Carriers have better negotiated rates

Fact: Hospital prices are made up, and so are BUCAH discounts. Don't be fooled: Fifty percent off of a 1,000 percent markup is still overpriced by 450 percent. RBP prices are at least related to the cost of a procedure, rather than arbitrary numbers that hospitals and big insurers agree on.

⬆️ There is a huge range in the price that hospitals charge related to Medicare – sometimes as much as 1600 percent!

Myth 5: Only second rate doctors negotiate

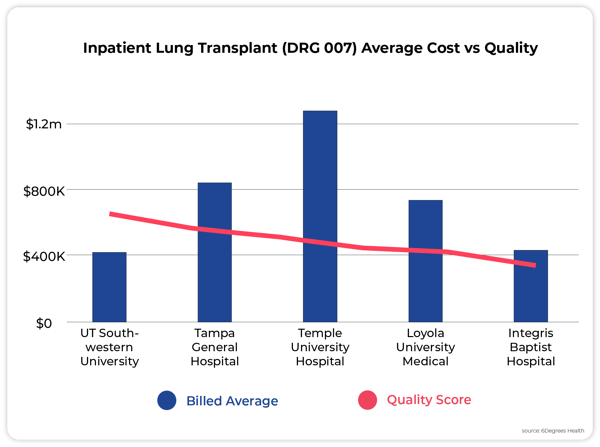

Fact: Hospital quality and hospital billing practices aren't related. According to data shared by 6Degrees Health, hospital quality shows little relationship to the billed price of various surgical procedures.

⬆️ In this instance, the most expensive, Temple University Hospital, is middle quality, while the highest quality, UT Southwestern University Hospital, is among the lowest bill rates

_____________________________________________________________________

Grant Parker is the director of marketing at Flume Health. This piece originally appeared on the Flume Health blog.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.