IRS officials have described how they expect to enforce the ACA coverage reporting rules for 2019 in IRS Notice 2019-63. (Credit: IRS)

IRS officials have described how they expect to enforce the ACA coverage reporting rules for 2019 in IRS Notice 2019-63. (Credit: IRS)

The Internal Revenue Service today announced that it will make small cuts in employers' Affordable Care Act (ACA) coverage reporting requirements for 2019, and big cuts insurers' coverage reporting requirements.

Related: Employers: Don't forget about ACA coverage reporting requirement

IRS officials have described how they expect to enforce the ACA coverage reporting rules for 2019 in IRS Notice 2019-63.

The Affordable Care Act

ACA drafters tried to cut the average per-person cost of health coverage by pushing and pulling young, healthy people into health plans.

The ACA:

- Provided an exchange system, or web-based health insurance supermarket, to make it easy to sign up for health coverage.

- Provided a premium tax credit subsidy to help moderate-income people pay for coverage, to increase the odds that healthy people would get covered.

- Imposed an "individual shared responsibility" penalty on many people who failed to get covered.

- Imposed an "employer shared responsibility" penalty on many employers that failed to provide what the government classified as affordable coverage with a minimum value.

The ACA employer coverage reporting form family

The ACA added two major employer coverage reporting provisions to the Internal Revenue Code (IRC): IRC section 6055 and IRC Section 6056:

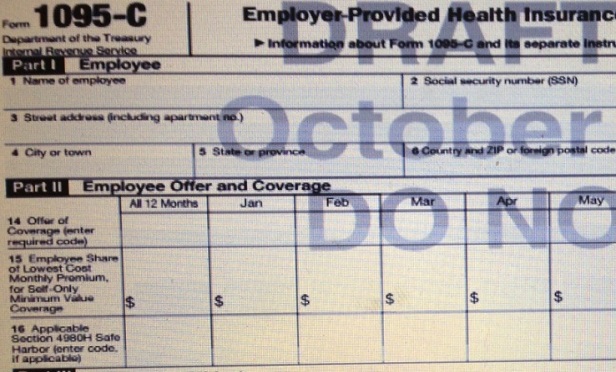

IRC Section 6055 requires a health insurer to provide coverage statements that the insureds can use to show the IRS that they've met the individual shared responsibility requirements. Insurers meet the Section 6055 coverage reporting requirements with IRS Form 1095-B.

IRC Section 6056 requires a large employer to provide coverage statements that show whether it's met the ACA employer shared responsibility standards. Employers meet the Section 6056 coverage reporting requirements with IRS Form 1095-C.

Self-insured employers usually meet the Section 6055 requirements along with the Section 6056 requirements by sending out 1095-C forms.

A taxpayer that sends out 1095-B forms to the insureds is supposed to send copies of those forms, along with a 1094-B cover sheet form, to the IRS.

Similarly, a taxpayer that sends out 1095-C forms is supposed to send copies of those forms, along with a 1094-C coverage sheet form, to the IRS.

Under the standard ACA rules, insurers and employers are supposed to get 1095-B and 1095-C forms to the insureds by Jan. 31.

The compliance background

Since the ACA system came to life, in 2010, Congress has zeroed out the ACA individual shared responsibility penalty. The penalty will not apply for months beginning after Dec. 31, 2018.

But people who want ACA exchange plan coverage still need coverage forms to apply for the ACA premium tax credit subsidy.

The 2019 IRS rules

The IRS says that, for 2019, it let will coverage providers stop sending 1095-B forms out to all of the insureds automatically, if the coverage providers make it easy for the insureds to get 1095-B forms within 30 days, upon request.

To avoid having to send out 1095-B forms automatically, an insurer must put a prominent notice on its website giving an email address, a physical address and a telephone number that individuals responsible for coverage can use to ask for 1095-B forms.

The IRS says it will also ease the reporting burden on employers with self-insured health plans, by letting an employer with a self-insured plan stop sending 1095-C forms to any employees in the health plan who were part-time employees throughout 2019.

In addition, the IRS says it will:

- Push the deadline for the 1095-C forms going out to the insureds to March 2, 2020, from Jan. 31, 2020.

- Keep the regular deadlines for filing 1094-B, 1095-B, 1094-C and 1095-C forms with the IRS in place, but continue a policy of providing automatic deadline extensions.

- Continue to require senders of 1094-B, 1095-B, 1094-C and 1095-C forms to file those forms with the IRS.

- Continue to require employers to send out most of the 1095-C forms they had to send out for 2018.

- Continue to go easy on insurers or employers that try to get the information about the insureds right but make some mistakes.

But IRS officials say they will provide coverage information filers with relief for mistakes only if those filers have made "a good-faith effort to comply with the regulations."

"In determining good faith, the Service will take into account whether an employer or other coverage provider made reasonable efforts to prepare for reporting the required information to the Service and furnishing it to employees and covered individuals, such as gathering and transmitting the necessary data to an agent to prepare the data for submission to the Service or testing its ability to transmit information to the Service," officials write in the new IRS notice. "Reporting entities that fail to file an information return or furnish a statement by the extended due dates, except as otherwise provided in this notice, are not eligible for relief."

The IRS lists Danielle Pierce of the IRS Office of the Associate Chief Counsel as the principal author of the notice.

The future

The IRS is asking for comments on how it should handle ACA employer coverage reporting rules for years after 2019.

Related

A copy of IRS Notice 2019-63 is available here.

Read more:

- IRS 226J letters: What they are and how to respond

- How new HRA regs impact Affordable Care Act compliance

- Next steps for employers that received ACA penalty notices

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.