A challenge continues to plague human resource practitioners, solution providers, policymakers, and academics alike: How do we get employees to engage and measure the progress? (Photo: Shutterstock)

A challenge continues to plague human resource practitioners, solution providers, policymakers, and academics alike: How do we get employees to engage and measure the progress? (Photo: Shutterstock)After the Pension Protection Act of 2006, automation emerged as a standard that delivered impressive results—but we as an industry aren't done with automating the 401(k).

Most employers are beyond debating whether retirement readiness and financial wellness are important. While ROI attribution for many programs has been a challenge, it's intuitive that focus in these areas should result in increased productivity and improved workforce management (i.e., attracting, retaining, and retiring employees), metrics that matter to the C-suite.

However, a central challenge continues to plague human resource practitioners, solution providers, policymakers, and academics alike: how do we get employees to engage and measure the progress?

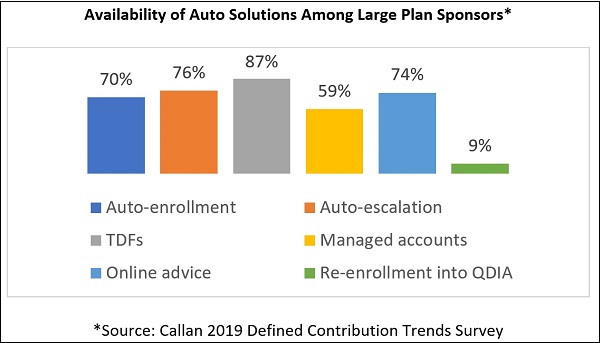

Experts draw on lessons from marketing, psychology, behavioral economics, and other fields to attempt innovation, but the truth is that we've had the answer for a while—or at least post-2006, after the Pension Protection Act, which paved the way for mass adoption of auto-enrollment, auto-escalation, and auto-asset allocation (e.g., target date funds and managed accounts) in 401(k) plans.

The answer? More automation.

Automation is now the norm in modern life—and it works.

At a time when artificial intelligence enabled by "big data" is all the rage, it shouldn't be hard for executives, rank-and-file employees, and other stakeholders to see the benefits of automation. As consumers, we have come to expect "smart" products and services. Netflix picks your Friday night movie, Spotify chooses what you listen to on the way to work, and Amazon does your holiday shopping for you. Soon, your car might drive you to work.

Back to the world of employee benefits. Not just in retirement, but in the health arena as well, what's worked best is improving performance by taking human behavior out of the equation: defaulting employees into consumer-directed health care plans with HSAs; auto-enrolling new hires into 401(k)s; auto-escalating savings; and leaving asset allocation to the experts with target date funds, online advice, and managed accounts.

The retirement industry should continue to push the limits of automated solutions that not only take the decision-making burden off participants' shoulders, but also meet personalized needs. For example, consider "dynamic QDIAs," some of which transition participants automatically from a target-date fund to a managed account later in a career when financial pictures have likely gotten more complex, or auto-retirement income features which protect from downside risk and facilitate drawdown.

The old paternalistic era of rich PPO health plans and traditional DB plans is over, and it will never return. However, employers can still put their employees first by being progressive in their uptake of auto features.

The next frontier for 401(k) automation is preventing retirement leakage.

The DOL recently passed new regulations laying the groundwork for auto-portability of 401(k) accounts when participants change jobs — one step in the right direction. Cash-outs following job changes are one of the big leaks in the proverbial bucket.

The next opportunity to dramatically improve retirement outcomes is to tackle America's $2.5 trillion loan default problem with automated 401(k) loan insurance, a solution that protects employees from default on their loans upon involuntary job loss.

Today, nearly nine out of 10 participants who terminate with a loan outstanding default, and as a result the average defaulting borrower will take a $300,000 hit in long-term retirement security, according to Deloitte. Low-cost, automated loan insurance solves this problem, and unlike other "solutions" is easily measurable in terms of the value, in dollars, of the long-term retirement security that it preserves.

Automation is still the answer, and given its effectiveness, we as an industry—across stakeholder groups—should be bold in applying it across the employee experience.

Aaron E. Tabela is Custodia Financial's Chief Marketing Officer, responsible for driving awareness of 401(k) loan defaults as an important financial wellness and fiduciary challenge and positioning Retirement Loan Eraser in the institutional retirement marketplace. Tabela is part of the leadership team at Custodia, a unique consortium of retirement industry experts who embrace a clear vision: Improving retirement outcomes by eliminating 401(k) loan defaults.

Aaron E. Tabela is Custodia Financial's Chief Marketing Officer, responsible for driving awareness of 401(k) loan defaults as an important financial wellness and fiduciary challenge and positioning Retirement Loan Eraser in the institutional retirement marketplace. Tabela is part of the leadership team at Custodia, a unique consortium of retirement industry experts who embrace a clear vision: Improving retirement outcomes by eliminating 401(k) loan defaults.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to asset-and-logo-licensing@alm.com. For more information visit Asset & Logo Licensing.