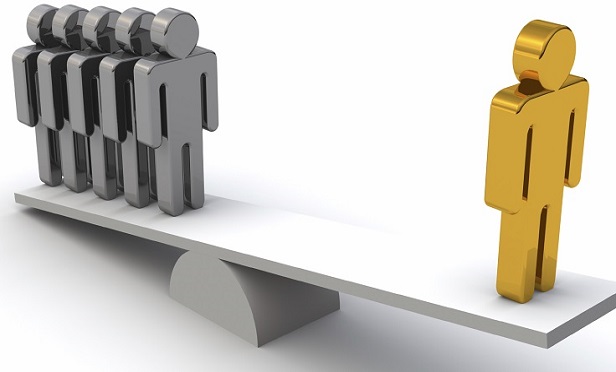

The third ACA risk management program, which was supposed to be permanent, is a risk-adjustment program that's similar to the risk-adjustment program used for the Medicare Part D prescription drug plan program. (Credit: iStock)

The third ACA risk management program, which was supposed to be permanent, is a risk-adjustment program that's similar to the risk-adjustment program used for the Medicare Part D prescription drug plan program. (Credit: iStock)

A three-judge panel at the 10th U.S. Circuit Court of Appeals has sided with the federal government in a dispute over how the government has administered the Affordable Care Act risk-adjustment program.

The 10th Circuit panel has thrown out a district court summary judgment in favor of New Mexico Health Connections, an Albuquerque, New Mexico-based insurer that opposed the government's risk-adjustment formula.

Related: Why some issuers hate the ACA risk-adjustment program

The district court had ruled that the U.S. Department of Health and Human Services (HHS) and the Centers for Medicare and Medicaid Services (CMS), an HHS agency, had acted in an arbitrary and capricious way when they developed the formula.

The 10th Circuit panel reversed the summary judgment ruling and told the district court to take another look at the case.

Resources

- A copy of the 10th Circuit opinion is available here.

- An earlier article about the New Mexico Health Connections suit is available here.

- An earlier article about the ACA risk-adjustment battle is available here.

The district court had argued that HHS and CMS had not adequately explained why they had adopted the formula they had adopted.

The 10th Circuit panel said HHS had provided an adequate explanation of why it was using the formula.

It's possible that the district court could still end up ruling in favor of New Mexico Health Connections on other grounds.

An ACA risk-management program primer

Health insurers in many states once held rates down by refusing to cover people with health problems, such as diabetes or obesity, and by charging higher premiums for enrollees with health problems.

The drafters of the ACA tried to get rid of medical underwriting by developing many mechanisms to push and pull young, healthy people into paying for major medical insurance, even when they felt healthy.

The drafters also created three programs to help insurers that ended up with more older, sicker insureds than other carriers did.

A temporary ACA reinsurance program used a broad tax imposed on almost all carriers to help issuers of individual major medical insurance who ended up covering insureds with catastrophic claims. That program was popular with carriers, but it lasted only three years. Some states have found ways to replace that reinsurance program with state-run reinsurance programs of their own.

A temporary ACA risk corridors program was supposed to use cash from thriving ACA exchange plan issuers to help struggling issuers. Thriving issuers failed to pay in much cash. Insurers and HHS are still fighting over risk corridors program payments in the federal courts.

The third ACA risk management program, which was supposed to be permanent, is a risk-adjustment program that's similar, in some ways, to the risk-adjustment program used for the Medicare Part D prescription drug plan program.

CMS and coverage issuers are supposed to give all of the insureds risk scores. CMS is supposed to collect cash from plans that end up with unusually low-risk insureds and pay the cash to plans that end up with the high-risk insureds.

Insurers like the concept, but some have objected to how the risk scoring works, and how CMS is calculating what the transfers to and from the program ought to be.

Program managers use a formula that bases payments partly on statewide average health coverage premiums, rather than solely on an issuer's own premiums.

New Mexico Health Connections and some other carriers have objected to use of statewide average premiums in the formula. New Mexico Health Connections, in particular, has been fighting the formula in court since 2016. HHS officials said when they developed the formula that they included the statewide average to bring in a factor that appeared to be independent from carrier-by-carrier allocation of health risk. The 10th Circuit panel said it believes that explanation is adequate.

The fight began with procedure-drafting efforts that started during the administration of former President Barack Obama. Officials in the administration of President Donald Trump have developed emergency regulations and procedures to keep the ACA risk-adjustment program going while the court fight is under way.

The future

Before major ACA programs came to life, in January 2014, many thought that the risk-management programs, the ACA individual health coverage ownership requirements and some other provisions would be essential to keeping the ACA exchange program, and the ban on medical underwriting in the individual major medical market, sustainable.

At this point, the only market stabilization measures that are still in effect are the ACA risk-adjustment program, ACA premium tax credit subsidy program, the HealthCare.gov and state-based exchange programs, and the requirement that many employers provide a minimum level of health benefits or else face the risk of having to pay penalty bills.

Read more:

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.