Allowing insurers to sell plans that don't meet ACA standards could undermine the health law by siphoning healthy consumers from insurance pools. (Photo: Getty)

Allowing insurers to sell plans that don't meet ACA standards could undermine the health law by siphoning healthy consumers from insurance pools. (Photo: Getty)

(Bloomberg) –Thousands of people have applied for new health plans in Idaho that revive insurance-industry practices banned by the Affordable Care Act, including charging sick people higher premiums and limiting coverage for pre-existing conditions.

Early demand exceeded expectations at Blue Cross of Idaho, the first carrier to sell the plans. The company got about 3,000 applications since it began marketing the plans Dec. 1; it had expected 800 at the most. The insurer covers about 575,000 statewide.

Related: 5 questions sparked by Idaho's rogue ACA stance

"It flooded our underwriters," said Peter Sorensen, vice president for individual and government markets at Blue Cross of Idaho, the state's largest health insurer. About 1,500 members accepted the insurer's rate quotes and paid for policies that took effect Jan. 1, the company said. An additional 150 have already paid for coverage beginning in February.

With the debut of the policies in January, Idaho has gone further than any other state in loosening requirements on health insurers that the ACA imposed in 2014. It plans to offer low-cost insurance to people priced out of Obamacare and draw them back into the insurance market.

Allowing insurers to sell plans that don't meet ACA standards could undermine the health law by siphoning healthy consumers from insurance pools, which would further raise premiums for those who remain. Idaho officials think they can prevent that by requiring insurers to continue selling ACA coverage, while accounting for the total medical costs in both types of plans when setting rates.

Allowing insurers to sell plans that don't meet ACA standards could undermine the health law by siphoning healthy consumers from insurance pools, which would further raise premiums for those who remain. Idaho officials think they can prevent that by requiring insurers to continue selling ACA coverage, while accounting for the total medical costs in both types of plans when setting rates.

Another insurer in the state, SelectHealth, said it will offer similar plans in the coming months.

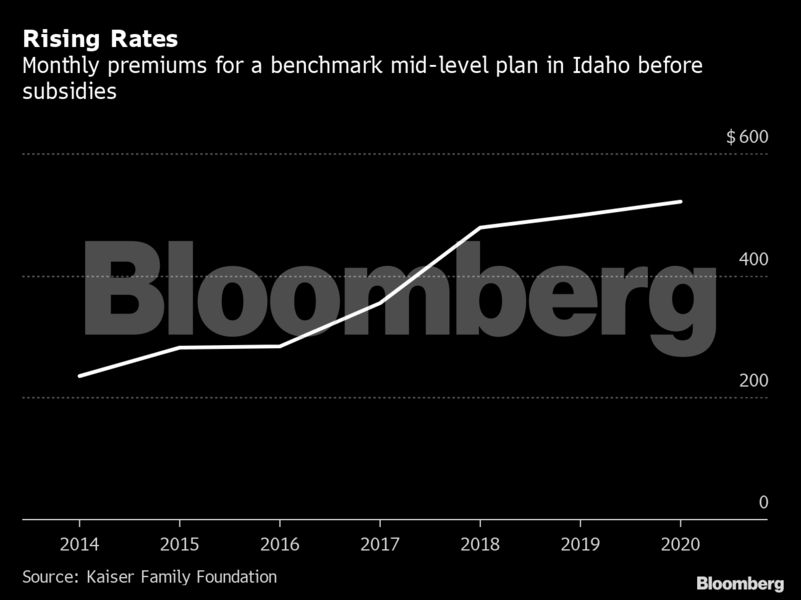

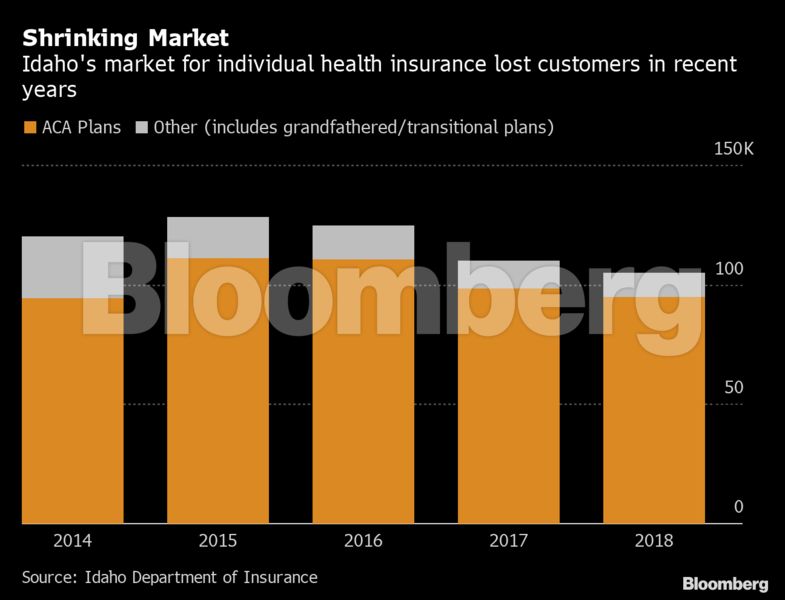

The cost of health insurance has driven away many people who earn too much to receive Obamacare's subsidies. About 95,000 Idahoans had Obamacare coverage in 2018, down from a peak of about 111,000 in 2016, according to state data. Average premiums for mid-level ACA plans in Idaho more than doubled between 2014 and 2020, and 89% of customers on the state's health exchange rely on federal subsidies to lower those costs, according to data from the Kaiser Family Foundation. The subsidies phase out as incomes rise, and a family of four earning more than $103,000 doesn't qualify for help.

Idaho's new plans show how health-care markets are diverging across the U.S. even as a battle over the future of Obamacare plays out in the courts. Some states led by Democrats have taken steps to shore up the ACA amid the Trump administration's efforts to weaken the law. Others, like Idaho, are considering lifting curbs on the types of coverage that insurers can sell.

Idaho officials call the new products enhanced short-term plans. They're authorized under a Trump administration rule promoting health plans that last less than a year and don't have to adhere to ACA rules. Despite the "short-term" moniker, the coverage can be renewed for up to three years.

While ACA plans can only be purchased during limited enrollment windows, Idaho's new plans are sold year-round. People with pre-existing conditions face waiting periods before the plans will cover those illnesses.

State law requires the new "enhanced" short-term plans to be more robust than traditional short-term policies, which sometimes cover very little care. But the new coverage also differs from ACA health insurance in important ways.

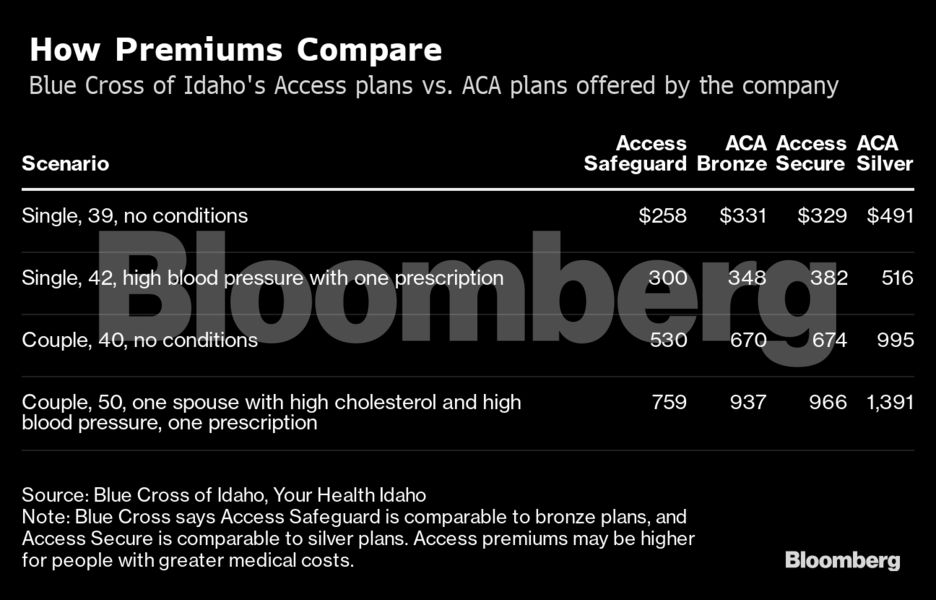

The ACA prevents insurers from charging sick people higher premiums or offering discounts to the healthy. Idaho's new plans can link premiums to health status. That means premiums can be substantially cheaper than ACA plans for relatively healthy people — as much as 50% less, insurers say.

"We're really trying to attract the healthy back in," said Dean Cameron, director of Idaho's Department of Insurance.

To qualify for one of the new plans, applicants must fill out a health questionnaire. Their answers, as well as any claims data the insurer may have on the applicant, are then used to generate a quote. Under Idaho law, insurers can't deny anyone coverage. They can raise prices each January, though the state limits premium increases based upon illness to about 15% a year, Sorensen said.

Idaho's enhanced short-term plans have separate deductibles for maternity care and prescription drugs, and a $2 million annual limit. Some of them also expose buyers to a higher level of risk than ACA plans permit. In the least-generous plan offered by Blue Cross, for example, a family could be on the hook for $50,000 in medical costs in a year. That's triple the out-of-pocket limit allowed under Obamacare.

Those trade-offs let insurers lower premiums. Advocates for the ACA say that risks dividing the market by siphoning off healthy people, driving up ACA premiums.

"When you're only selling insurance to healthy people you can sell it at a very cheap price," said Karen Pollitz, a senior fellow at the Kaiser Family Foundation, a health research group.

Still, Idaho's policy prohibits insurers from entirely separating their ACA customers from the new enhanced short-term market. When insurance carriers propose rate changes, they start with an "index" rate. That rate must reflect the combined medical costs of both their ACA plans and enhanced short-term plans, said Cameron, the Idaho insurance director. If the new plans bring enough healthy uninsured people back to the market, he said it could reduce premiums for ACA plans as well.

The number of people without health insurance in Idaho fell significantly after the Affordable Care Act took effect in 2014, declining from 16% in 2013 to 11% in 2018, according to state data. Idaho requires that insurers selling the new short-term plans also sell ACA coverage. People will still be able to use federal subsidies for ACA plans if they qualify.

The state first proposed allowing health plans that didn't meet the ACA's rules in 2018 under Republican then-Governor Butch Otter, who cited "the overreaching, intrusive nature of Obamacare" in an executive order. The U.S. Centers for Medicare and Medicaid Services blocked that proposal, saying it might violate the ACA. But CMS encouraged Idaho to try again under the authority of Trump's short-term health plan rule.

The American Academy of Actuaries warned that Idaho's earlier proposal "would lead to a deterioration of the state's ACA market." The group said it hasn't yet evaluated the new plans.

The Trump administration tried to repeal Obamacare in Congress and is fighting the law in court. Congress has declined to take up legislation to stabilize the ACA markets and bring down premiums. President Donald Trump has vowed to "let ObamaCare fail;" some of the law's advocates say permitting Idaho's enhanced short-term coverage will further that goal.

"There've been a number of red states with political leadership that just hates Obamacare, that has been looking for ways to undermine the reforms and ultimately kind of blow it up," said Pollitz, the senior fellow at the Kaiser Family Foundation. "Idaho has kind of been at the front of that parade for a couple of years now, but they're not the only ones."

Cameron said such criticism is misguided. "The reality is you've got to bring the healthy people back into the marketplace," he said.

Read more:

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.