Employer HSA contribution? Nah; 49 percent of employees would prefer to have an extra week of vacation, while 25 percent would opt for free daily lunches. (Photo: Shutterstock)

Employer HSA contribution? Nah; 49 percent of employees would prefer to have an extra week of vacation, while 25 percent would opt for free daily lunches. (Photo: Shutterstock)When you apply for a new job, the company will likely include a list of competitive perks and benefits at the bottom of the position description. It might include things like generous vacation time" 401(k) matching, flexible work arrangements, commuter benefits, etc. And health care? Maybe it's described as "comprehensive" or "competitive," despite being the biggest line-item benefit and employer offers.

There's a reason for this: Companies know that it's these short-term benefits that really resonate with potential candidates.

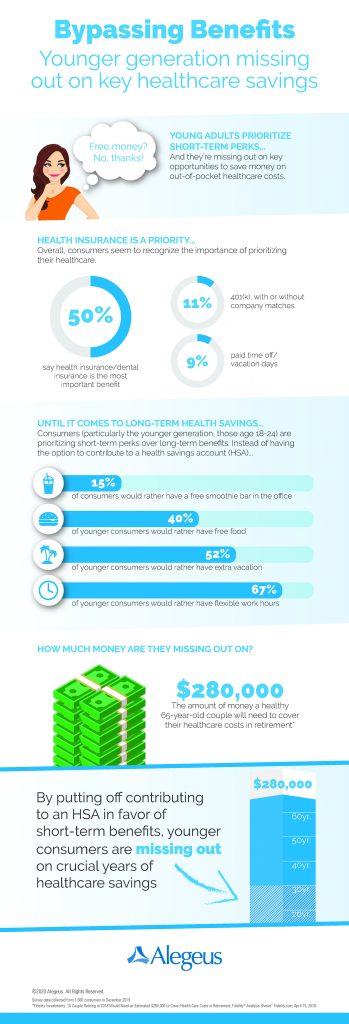

A recent survey from Alegeus examined consumers' interest in various employee benefits. Though half of all respondents say that health and dental insurance was the most important, they appear to be less interested in what it entails, just as long as the box is checked.

Related: How happy are consumers with their health insurance plans?

Instead, when asked whether they would rather receive contributions to a health savings account or flexible savings account on behalf of an employer, 49 percent would prefer to have an extra week of vacation, while 25 percent would opt for free daily lunches.

"Recent figures show that the average 65-year-old couple will need at least $285,000 to cover health care and medical expenses in retirement," Alegeus CEO Steven Auerbach says of the findings. "So while it's encouraging to see consumers understand the need for health insurance, we also want to spread awareness of the importance of enrolling in tax-advantaged accounts like HSAs to maximize the value of every health care dollar spent or saved."

The survey also highlighted that these preferences are strongest among consumers aged 18 to 24, where the preference for extra vacation time increases to 52 percent, and the hunger for free lunch rises to 40 percent.

Click to enlarge (Source: Alegeus)

Click to enlarge (Source: Alegeus)Read more:

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to asset-and-logo-licensing@alm.com. For more information visit Asset & Logo Licensing.