Few want to talk about taxes, but when it comes to disability coverage, a bit of tax understanding puts us in place to make sound decisions. I'm not a tax professional, but I do know that when it comes to employee benefits, surprises are rarely good. So let's dig in. Disability coverage is categorized as income and, as such, is subject to taxation. It's important to understand how taxation will impact a benefit in the event of a disability so that employees can be prepared. Savvy employers will have a 'sick pay' plan in place in case an employee or owner experiences a disability which results in time off work. This benefit/income will then be taxed according to the plan put in place. Paycheck insurance or disability insurance is any amount paid to an employee because of an employee's absence from work due to an injury, sickness or a disability. Disability pay can come from the employer or a third-party, such as an insurance plan. Sick pay benefits paid by an employer or third party are considered the gross income of an employee if the employer pays part or all the premium for coverage. As such, it is subject to taxation.

Few want to talk about taxes, but when it comes to disability coverage, a bit of tax understanding puts us in place to make sound decisions. I'm not a tax professional, but I do know that when it comes to employee benefits, surprises are rarely good. So let's dig in. Disability coverage is categorized as income and, as such, is subject to taxation. It's important to understand how taxation will impact a benefit in the event of a disability so that employees can be prepared. Savvy employers will have a 'sick pay' plan in place in case an employee or owner experiences a disability which results in time off work. This benefit/income will then be taxed according to the plan put in place. Paycheck insurance or disability insurance is any amount paid to an employee because of an employee's absence from work due to an injury, sickness or a disability. Disability pay can come from the employer or a third-party, such as an insurance plan. Sick pay benefits paid by an employer or third party are considered the gross income of an employee if the employer pays part or all the premium for coverage. As such, it is subject to taxation.

What is taxed?

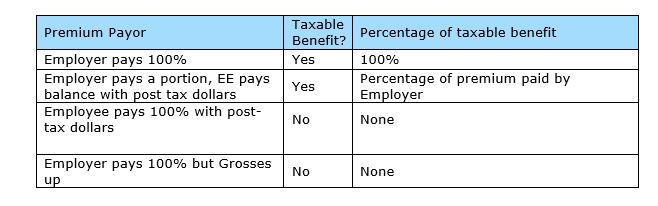

Either the premium or the benefit is taxed. If the employer pays the entire premium, then the employee pays all taxes on the benefit. If the employer pays any part of the premium and the employee pays the remaining balance with post-tax dollars, then the benefit received is taxed in the same proportion. If the employee pays the whole premium with post tax dollars, then the benefit received is not taxed.

Why taxation?

A disability benefit provides an employee with a continued paycheck, which is considered income and must be taxed. Plan payments are tax-deductible by the company as a business expense under Section n162 of the IRS Code. The employer can deduct the premium portion offered, but the employee cannot deduct these insurance premiums.

Taxes impacted

Federal Insurance Contributions Act (FICA) — this tax is paid by both employee and employers to fund Social Security and Medicare.

Which plan is best?

Better or best is not the issue here. What is of tip-top importance is that employees understand the benefit. Unfortunately, employees often don't understand the benefits offered. Effectively communicating benefits to employees is key. Regarding disability, the taxation of the benefit set up in the plan is important information to clearly communicate to those to whom the benefit is offered. As to the best way to set up the plan, the 'best' is unique to each employer. The main factors include: 1. Does the employer want to contribute? 2. If yes, how much? The candid answers to these questions most often will get you going in the right direction to set up a disability plan.

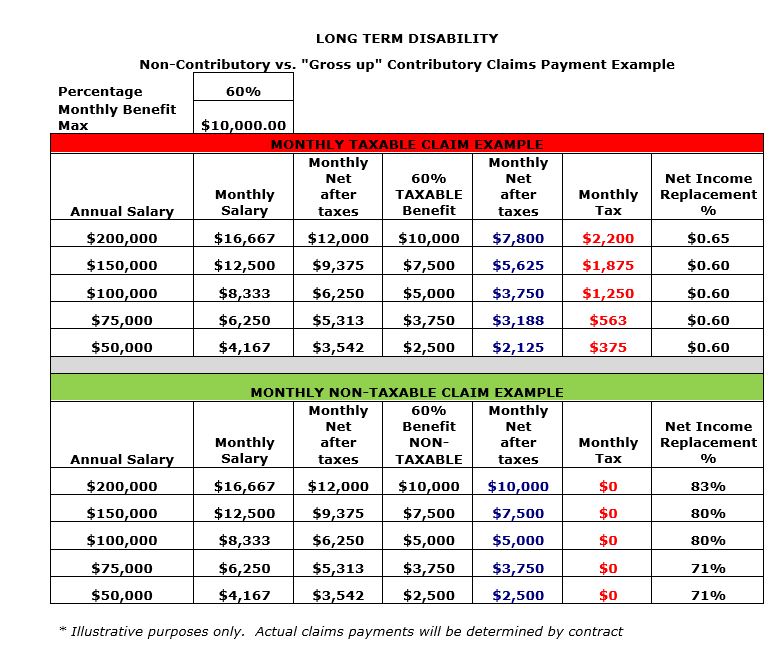

Gross up

There is one last option. Stay tuned, this one is interesting If an employer wants to pay 100 percent of the premium for disability coverage, but also does not want the employee to pay taxes on the benefit, this is called the have your cake and eat it too plan. OK, not really. It's actually called a gross up plan. The chart below is an illustration of how gross up impacts the 'benefit' or pay out to an employee. The comparison shows an employer paid plan versus a grossed-up employer paid plan. The net income replaced is much higher on a 'gross up' type plan.

The premium is increased (gross up) to cover the taxation so when the benefit is received by the employee, the taxes have already been taken.

What gets 'grossed up'?

The employees pay check is grossed up (increased). Then deductions are made from an employee's paycheck to pay for the disability coverage.

Also: Long-term disability insurance gets little attention but can pay off big time

This is a way to have the employer fund this benefit, but ensure the employee will be spared from the sting of taxation on the benefit. The result is experienced when a claim is filed, and the benefit received is a higher payout.

Why LTD?

Should a key person become disabled and there is no DI plan in place, you cannot deduct such payments as a tax-deductible business expense. There must be a qualified sick pay plan in place before a disability. A qualified sick pay plan does not require insurance, but an arrangement must be made. Some of the items to address: • Is the employee disabled? • How much will our plan pay? • How long will our plan pay? • Which employees will be covered? • What will constitute a disability? • Who handles reporting and administration? • + many other questions Michelle J. Smith is a benefits sales specialist at Keystone Insurers Group and can be reached at [email protected].

Information contained in this document is for general information only. Keystone Insurers Group and its Employee Benefits Division does not provide legal or tax advice. For specific advice for your situation, please consult an attorney or other professional.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.