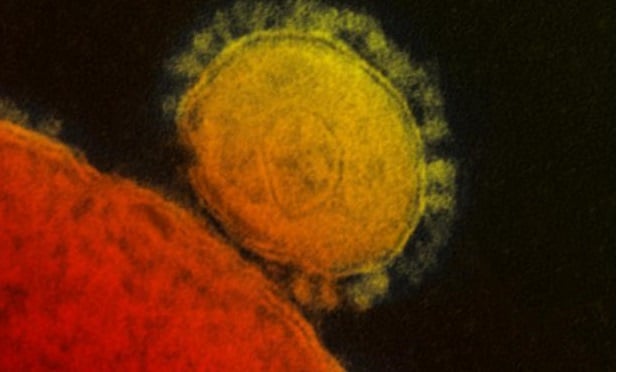

All of the major health insurers have said they will cover COVID-19 testing without imposing co-payments or deductibles on the patients, and most say they are covering telehealth services. (Credit: National Institute of Allergy and Infectious Diseases)

All of the major health insurers have said they will cover COVID-19 testing without imposing co-payments or deductibles on the patients, and most say they are covering telehealth services. (Credit: National Institute of Allergy and Infectious Diseases)

Some commercial health insurers are responding to the COVID-19 crisis by beefing up enrollee benefits — and the agency that runs Medicare is beefing up immediate cash support for providers.

All of the major health insurers have said they will cover COVID-19 testing without imposing co-payments or deductibles on the patients, and most say they are covering telehealth services without cost-sharing.

Related: COVID-19 will add to employers' already increasing health care costs

A new federal law, the Families First Coronavirus Response Act, has closed one potential testing benefits gap, by requiring self-insured employer plans to cover testing without cost-sharing. Before the act became law, some state insurance regulators had emphasized that the COVID-19 testing benefits at self-insured plans were outside their jurisdiction.

Here's a look at some of the changes commercial health insurers are making, drawn from the company's own announcements and a list compiled by America's Health Insurance Plans.

Aetna, a part of CVS Health, says it will eliminate cost-sharing for all in-network inpatient COVID-19 care through June 1.

Blue Cross Blue Shield of Massachusetts is eliminating co-payments for COVID-19 treatments at doctor's offices, emergency rooms and urgent care clinics.

Bright Health is offering members transportation to their doctors.

CareFirst is eliminating cost-sharing for in-network or out-of-network COVID-19 treatment.

The Centers for Medicare and Medicaid Services, the agency that runs Medicare, says it will speed up payments to providers and make payments in advance, to help providers make the purchases they need to prepare for a surge in the number of COVID-19 patients.

Cigna Corp. is eliminating cost-sharing for all COVID-19 treatment through May 31. Cigna will reimburse out-of-network Medicare providers at Medicare rates, and out-of-network commercial plan enrollee providers at Cigna's standard in-network rates. Cigna will administer that kind of benefit arrangement for the self-insured employers, but those employers can opt out.

Florida Blue is letting in-network primary care doctors and specialists bill for online visits as if the visits were office visits.

Humana is eliminating cost-sharing for COVID-19 treatment for all people it insures, whether the providers are in or out of network, even if a patient does not have a test-confirmed case of COVID-19. The policy is retroactive to Feb. 4 and has no scheduled end date.

L.A. Care is eliminating cost-sharing for medically necessary COVID-19 treatment.

Physicians Health Plan of Northern Indiana says it's eliminating cost-sharing for all medically necessary COVID-19 testing. Even before federal law required self-insured plans to cover testing without cost-sharing, it was going to require sponsors of the self-insured plans to cover testing without cost-sharing.

UnitedHealth's UnitedHealthcare unit is adding its own, voluntary special enrollment period for commercial customers through April 6, and it's letting hospitals transfer recovering patients to skilled nursing facilities or other post-acute care facilities without prior authorization.

Read more:

- Insurers offer free coronavirus coverage, but you might pay for it next year

- Coronavirus coverage stumps most health insurance enrollees

- Amid coronavirus outbreak, telemedicine provides vital link to care and prevention

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.