Technology and digital solutions play a critical role in the administration and service of voluntary benefits. The COVID-19 pandemic has reinforced the importance of digital solutions, and in many ways, accelerated trends already underway.

Carriers and other providers, however, have limited resources to allocate to their technology investments. Where should they focus their efforts? Those organizations that can effectively align their offerings to the needs of the voluntary marketplace will differentiate themselves from the competition.

What do employers value most? Cost and plan features are often the drivers of carrier choice. But when all else is equal, it is in other areas such as customer service, benefits administration technology, and sales and enrollment support that organizations can distinguish themselves to create a competitive advantage. Relative to voluntary benefits, what do employers value most when it comes to the digital services that carriers provide to them and their employees? LIMRA recently surveyed over 1,400 employers to find out.

Table stakes

Digital solutions are commonplace in the administration of voluntary benefits. LIMRA research shows that a wide array of digital services used to administer voluntary benefits plans are available to employers. For example, more than 9 in 10 employers have access to online billing and downloadable plan documents, while tools such as electronic claim submissions and dedicated web portals to administer benefits are almost as common.

Related: The "new normal" in voluntary benefits

Mobile capabilities for benefits administration (e.g., census updates, life event changes, generating reports, etc.) and web chat are available to more than 7 in 10 employers. In general, employers are satisfied with the digital tools they use to administer their plans. Likewise, LIMRA research shows employers are happy with the quality of the digital tools made available to their employees. More than 8 in 10 employers rate the digital tools and services available to their employees as either 'good' or 'very good.'

Opportunity knocking

While many employers and their employees have access to these digital tools, there is an opportunity to gain better adoption. Services such as the ability for employees to download forms, access online educational materials, check electronic claim status, and complete and submit forms online are broadly available in the marketplace, yet there are still a significant number of employers that don't have them, but want them.

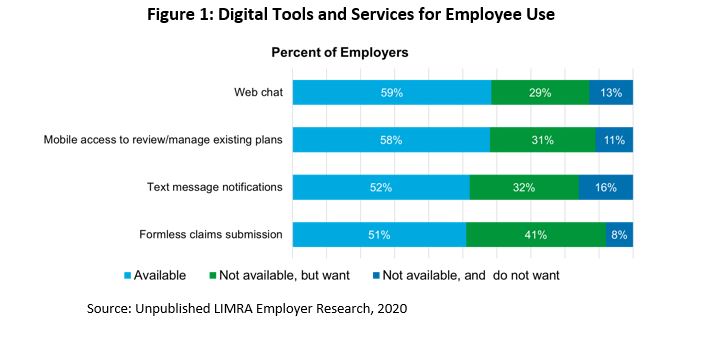

While more than 70 percent of employers indicate that their employees can access online educational materials, an additional 26 percent would like their employees to have this ability. This is the digital service capability most desired by employers that don't already have it. Recent LIMRA research shows digital services that have arrived more recently in the marketplace (e.g., formless claims submissions, text message notifications, mobile plan access, and web chat) are also appealing; many employers (regardless of their number of employees) do not have these tools available to them, but want them (Figure 1).

Figure 1: Digital Tools and Services for Employee Use

Source: Unpublished LIMRA Employer Research, 2020

In today's environment, it is more critical than ever for carriers, intermediaries, and other organizations to understand which tools employers — and their employees — need and use relative to voluntary benefits service and administration. LIMRA research provides valuable insights into how organizations can identify new opportunities around technology and digital solutions to help employers better manage their plans and enhance employees' customer experience. Organizations that can focus their efforts and investments in areas of most value to employers and their employees will create unique value in the marketplace. Will your clients be among them?

Patrick T. Leary, M.B.A., LLIF, is corporate vice president, workplace benefits research for LIMRA. This program provides research on the employee benefits marketplace, focusing on the products, markets, and distribution of a wide range of life, health and related employee benefits.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.