Certain policy changes over the years have provided more risk protection to low-income groups but have increased out-of-pocket risk for those in a higher-income group.(Photo: Shutterstock)

Certain policy changes over the years have provided more risk protection to low-income groups but have increased out-of-pocket risk for those in a higher-income group.(Photo: Shutterstock)

There is nothing like a pandemic to get people thinking about the high cost-sharing requirements in their health insurance coverage. But of course this is nothing new. High deductibles and out-of-pocket maximums, combined with out-of-network bills for physician services, leave many insured Americans facing very high out-of-pocket costs. According to federal data, average deductibles in employer plans more than doubled between 2008 and 2017. For many, this results in an unaffordable burden.

But a recent study released by The Commonwealth Fund found that there is a significant higher impact for those in a certain income level when it comes to out-of-pocket spend.

Related: Providers aren't preparing patients for out-of-pocket costs

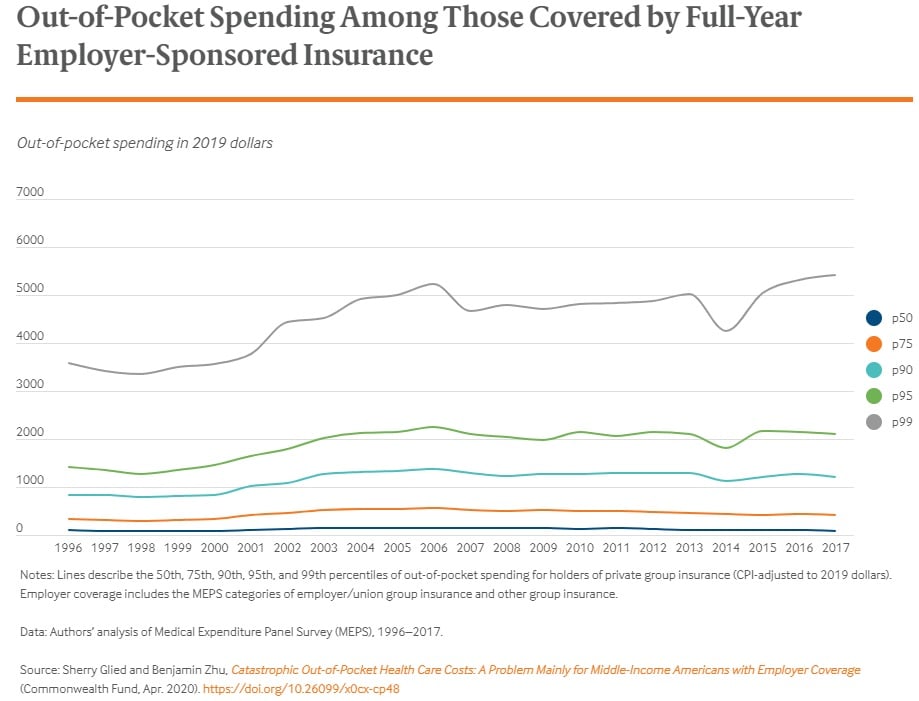

The study, Catastrophic Out-of-Pocket Health Care Costs: A Problem Mainly for Middle-Income Americans with Employer Coverage, examined "the trends in high out-of-pocket spending and the distribution and composition of this out-of-pocket spending over time." And to find the answer, the study analyzed Medical Expenditure Panel Survey (MEPS) data from 1996 to 2017 and focused on people under the age of 64. The analysis also excluded plans for dental care, home health care, and vision care.

Although the study shows that deductibles have doubled over the past decade, that increase has not impacted insureds out-of-pocket costs equally across the board. The data shows that some out-of-pocket expenses have actually gone down over that time period for those in a lower income bracket. But on the other hand, the data from the study also shows is that those insureds in a middle-class income bracket are the ones hit the hardest.

"The burden of out-of-pocket costs mostly affects those with employer coverage and those with income above 400 percent (and, in particular, above 600 percent) of the federal poverty level," according to the study. The reason, per the study, is partly due to the combination of "high deductibles and out-of-pocket maximums in private insurance," and "exposure to out-of-network bills for physician services." The study shows that certain policy changes over the years have provided more risk protection to low-income groups but have increased out-of-pocket risk for those in a higher-income group.

The ACA effect

One of the policy changes that has had a significant impact on this data is the implementation of the Affordable Care Act (ACA), according to the study. The ACA has mitigated out-of-pocket costs for those under that plan due to many of the provisions being designed to help reduce high out-of-pocket spending. And the study found that this has been effective for most Americans. However, the study also found that the out-of-pocket costs for the "highest out-of-pocket spenders (the 99th percentile)" has been increasing since 2014.

So why is this? The authors of the study explain that the reduction of the amount of uninsured individuals due to the ACA means "that a greater percentage of the highest out-of-pocket spenders today have employer-sponsored and individual health insurance coverage." In fact, among those in the top 1% of spenders, the report says, the proportion that had been insured all year rose from around 66% in 2009 to 80% in 2017.

The even more striking shift has occurred by income, especially since 2014.

"Most of the new coverage options available through the ACA expansions were targeted at those with incomes below 400 percent of FPL." In addition, "Improvements in the quality of coverage since 2014 also have benefited lower-income people. Medicaid expansions, cost-sharing subsidies, and improvements in the scope of private insurance under the ACA have led to absolute reductions in out-of-pocket spending among those with incomes below 400 percent of FPL within each insurance category," according to the study.

In sum, the results of the study show that overall out-of-pocket spending for most Americans has been flat or declining, and that for most people the ACA has reduced the risk of very high out-of-pocket spending. But that has created a small percentage of Americans that bear the brunt of high out-of-pocket costs and that "high deductibles and out-of-pocket maximums shift the burden of health care costs away from premiums paid by the average insured person to those with serious illnesses and substantial health service use."

The authors conclude that "this pattern undermines a principle purpose of health insurance: to protect people against catastrophic expenses."

Read more:

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.