(Photo: Susana Gonzalez/Bloomberg)

(Photo: Susana Gonzalez/Bloomberg)

The Treasury Department and Small Business Administration released updated guidance Wednesday stating that the SBA will deem all loans with original amounts under $2 million to be in good faith, meaning the loans won't be challenged.

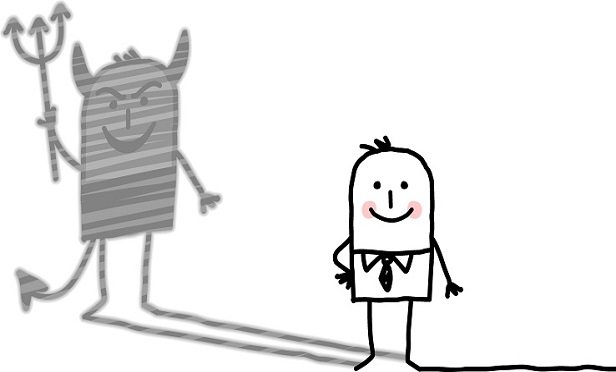

Debate is ensuing as to whether the guidance gives loan takers a license to steal or if it's a fair "walking back" of the SBA and Treasury's previous guidance.

Recommended For You

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking benefits news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now