Some health insurers are offering advance payments to providers to help keep the doors open, but even those measures are a Band Aid for a larger problem that needs to be addressed. (Photo: Shutterstock)

Some health insurers are offering advance payments to providers to help keep the doors open, but even those measures are a Band Aid for a larger problem that needs to be addressed. (Photo: Shutterstock)

Across the country, businesses are suffering. Whether it's closure due to stay-at-home orders, decreased demand, increased supply costs or a shortage of key materials, very few industries are immune to the COVID-19 pandemic. Some businesses won't reopen when the rest of the economy does, and some jobs and industries will never look the same.

One sector in particular that is at risk of going away: primary care providers. While the financial plight of hospitals and major health systems has been well documented over the past few months, independent and smaller primary care providers have been struggling in relative silence.

Related: Health care industry saw 43,000 layoffs in March

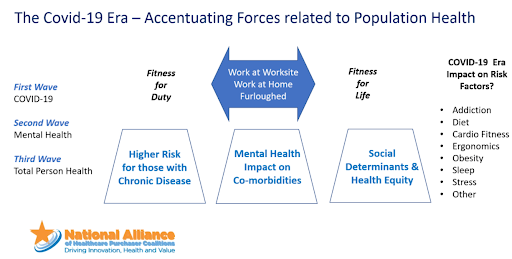

"Primary care has actually gotten decimated by COVID," Mike Thompson, president and CEO of the National Alliance of Healthcare Purchaser Coalitions said in a recent webinar. "We've had calls at the national level from groups that are very concerned about survival. Volume is down, they're not getting reimbursed in the fee-for-service well. Even telehealth reimbursements aren't the same."

Like other businesses, lack of patients and income could spell doom for smaller primary care providers, many of whom may be forced to close down. Others, however, could be bought up by larger primary care providers or health systems. "We can't afford to lose this primary care infrastructure, or small practices being acquired by large systems, because prices are going to go up," said Ann Greiner of Primary Care Collaborative.

Some health insurers, such as Blue Cross Blue Shield of Arizona, are offering advance payments to providers to help keep the doors open, but even those measures are a Band Aid for a larger problem that needs to be addressed. Panelists pointed to the need to break free from a fee-for-service model and to fight for improved reimbursement rates for providers–particularly when it comes to telehealth.

"Within a couple of weeks, providers did this pivot to virtual health," Greiner said. "And yet there is not proper remuneration for that. Private plans should step up and start paying for telephonic visits. Telehealth is helping to meet patient demand, but it's not successfully meeting all patient demand."

The need to support and reform the primary care model will become more apparent in the weeks and months to come. According to survey data, two thirds of primary care providers expect to see a huge unmet demand for mental health services, as well as increased demand for preventive care, chronic care, substance abuse treatment and domestic violence incidents.

"This is really important to think about so that we can avoid a second health crisis," Greiner said. "We have got to start paying attention to this care that is being delayed or avoided, both in chronic care and prevention but absolutely on the mental health front."

For employers worried about their health care spending in years to come, the shortage of primary care essentially pulls the rug out from under them. Without early intervention, chronic conditions will become more common and costly. In addition, health care industry leaders are already expecting to see a surge in late-stage cancer as a result of delayed screenings and doctor visits.

"The next stimulus package needs to have more targeted support for primary care," Greiner said. "Make sure that the doors are not closed, virtually or otherwise. Private payers have to step up … private payers have to use some of the largess they have to advance payments to primary care and make sure they remain variable, particularly the independents."

Read more:

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.