MIB is a nonprofit industry group that helps life insurers share some of the information used in the underwriting process. (Credit: MIB)

MIB is a nonprofit industry group that helps life insurers share some of the information used in the underwriting process. (Credit: MIB)

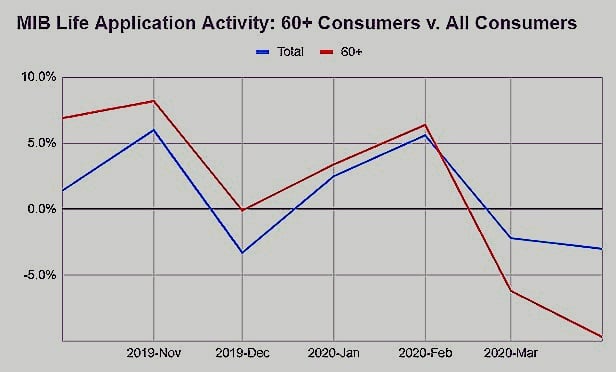

MIB Group Inc. has numbers suggesting that the COVID-19 shelter-in-place rules, and pandemic-related underwriting shifts, were tougher on older consumers than on younger consumers.

U.S. life insurance application activity fell a little for young consumers in April, more for middle-aged consumers, and a lot for older consumers, according to MIB's new application activity report.

Related: Life insurance: Not enough have it, and many don't have enough

The Braintree, Massachusetts-based group says overall application activity was 3% lower last month than in April 2018.

Here are the MIB activity numbers for each age group for April:

- Ages 0-44: -0.7%

- Ages 45-59: -2.4%

- Ages 60 and older: -9.7%

MIB is a nonprofit industry group that helps life insurers share some of the information used in the underwriting process.

- A copy of the latest MIB life application activity report is available here.

The application activity figures reflect trends in use of MIB databases.

In mid-March, many cities, and some states, responded to the COVID-19 pandemic by imposing shelter-in-place rules. The typical shelter-in-place program required workers at establishments classified as "non-essential" to work at home.

Regulators encouraged older people and people with health problems to be especially diligent about minimizing their number of contacts with other people.

Some life insurers tried to minimize their exposure by declining to cover people who seemed to be at especially high risk of contracting or dying from severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2), the virus that causes COVID-19.

Executives from many large publicly life insurers said during conference calls they held to go after first quarter results with securities analysts that their sales were strong through mid-March, then fell sharply.

MIB analysts say they believe their latest results reflect the effects of COVID-19 on life insurance sales.

"April's age groups distinctly display pandemic purchasing preferences with the slight dip in younger ages showing a greater comfort with online life insurance purchases and a sharp dip in older buyers (60+) showing the impact of COVID-19 on face-to-face sales and product changes at carriers," the MIB analysts write.

Read more:

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.