Out-of-network billing may be more often the exception than the rule, but that's little comfort for patients unlucky enough to find themselves on the hook for tens of thousands in unexpected bills. (Photo: Shutterstock)

Out-of-network billing may be more often the exception than the rule, but that's little comfort for patients unlucky enough to find themselves on the hook for tens of thousands in unexpected bills. (Photo: Shutterstock)Surprise medical bills, which puts patients on the hook for medical care provided by an out-of-network provider, continue to be a key focus of health care reform. Often, patients are unaware that one of the specialists involved in a surgical procedure is not covered by insurance until they receive the bill months later.

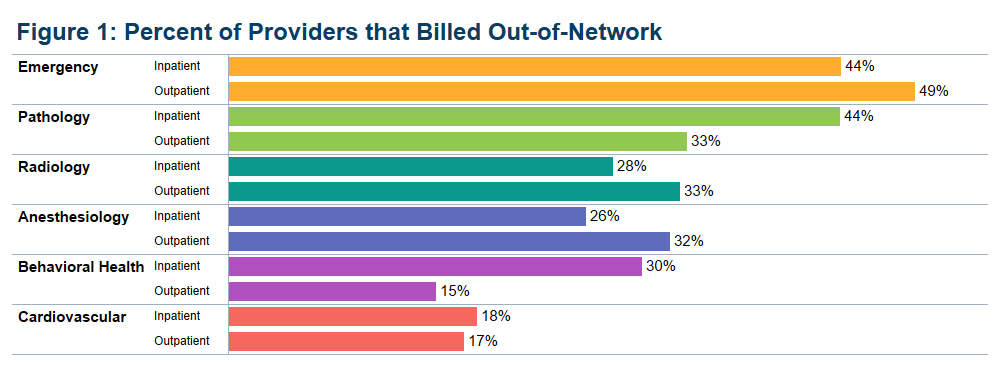

A recent analysis by the Health Care Cost Institute aimed to break down where surprise bills were most likely to come from. Using data from more than 13.8 million patient visits to identify the frequency of out-of-network billing among six specialties: emergency room visits, pathology, radiology, anesthesiology, behavioral health and cardiovascular.

Related: Covering even small financial "surprises" out of reach for many workers

The results? More than half of specialists never bill out of network, and those that do do so less than 10% of the time. There are, however, some specialists for whom out-of-network billing makes up more than 90% of their business.

Source: Health Care Cost Institute

Source: Health Care Cost InstituteAmong the specialty categories, out-of-network billing was most common for emergency medicine visits. Pathology is the second most common area for out-of-network bills, though the analysts note that balance-billing in this category is driven by a smaller percentage of providers that are sending out-of-network bills more than 90% of the time.

Though the findings suggest that out-of-network billing may be more often the exception than the rule, it's little comfort for patients unlucky enough to find themselves on the hook for tens of thousands in unexpected bills.

"Understanding the variation in how frequently providers bill out-of-network across specialties can help stakeholders craft targeted policy solutions when addressing the adverse effects of out-of-network bills," the analysts write. "This is important to ensure that people are not unfairly saddled with medical bills for unknowingly receiving services from an out-of-network provider."

Read more:

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to asset-and-logo-licensing@alm.com. For more information visit Asset & Logo Licensing.