For now, 15% of employers expect their 2020 health care costs will be on par with what they've budgeted, while 46% are unsure. (Photo: Shutterstock)

For now, 15% of employers expect their 2020 health care costs will be on par with what they've budgeted, while 46% are unsure. (Photo: Shutterstock)

This year is not shaping up quite the way anyone expected. As such, the IRS in May issued a rare guidance giving employers the option to allow their employees to make changes to their health insurance and benefits enrollment.

The guidance was not mandatory, and employers could opt to leave their benefits plan for the year-as is. But with so much else going on, how many employers have actually taken that step?

Related: Social distancing, PPE and cleaning on tap as employers prepare to return to work

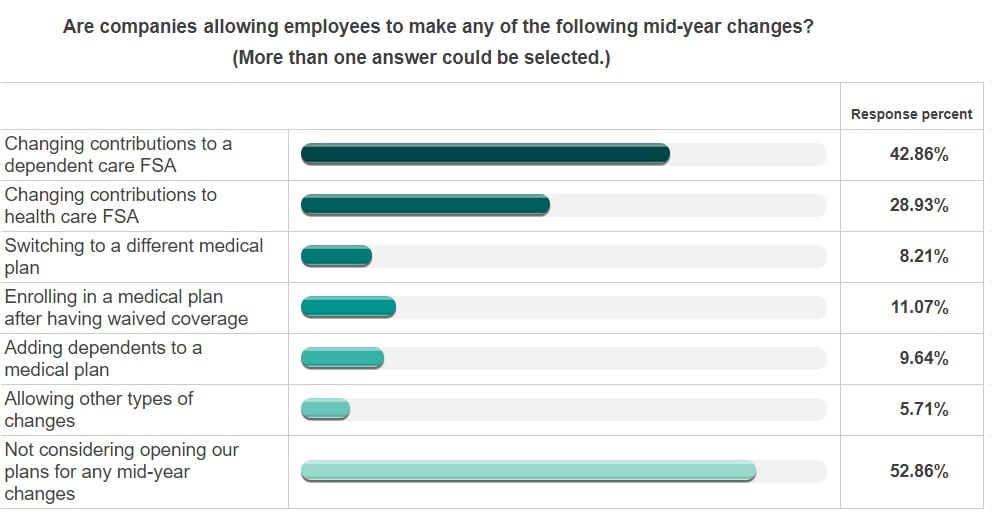

According to a recent survey from Mercer, 47% are allowing some type of change, with changes to dependent care FSAs (43%) and health care FSAs (29%) the most popular choices. Allowing employees to switch to a new plan, enroll in a plan or add dependents are less common options.

(Source: Mercer)

(Source: Mercer)"Allowing participants to change their contributions to dependent care or health FSAs can be a relatively simple way for employers to support employees coping with COVID-19 related issues, said Jay Savan, Partner in Mercer's Health business. "Permitting enrollment changes mid-year in core medical plans, however, brings with it much greater risk to the sponsor, such as incurring high cost claims and generally enabling adverse selection."

For now, 15% of respondents expect their 2020 health care costs will be on par with what they've budgeted, while 46% are unsure. Again, half are taking a wait-and-see approach when it comes to estimating 2021 benefits costs and making changes.

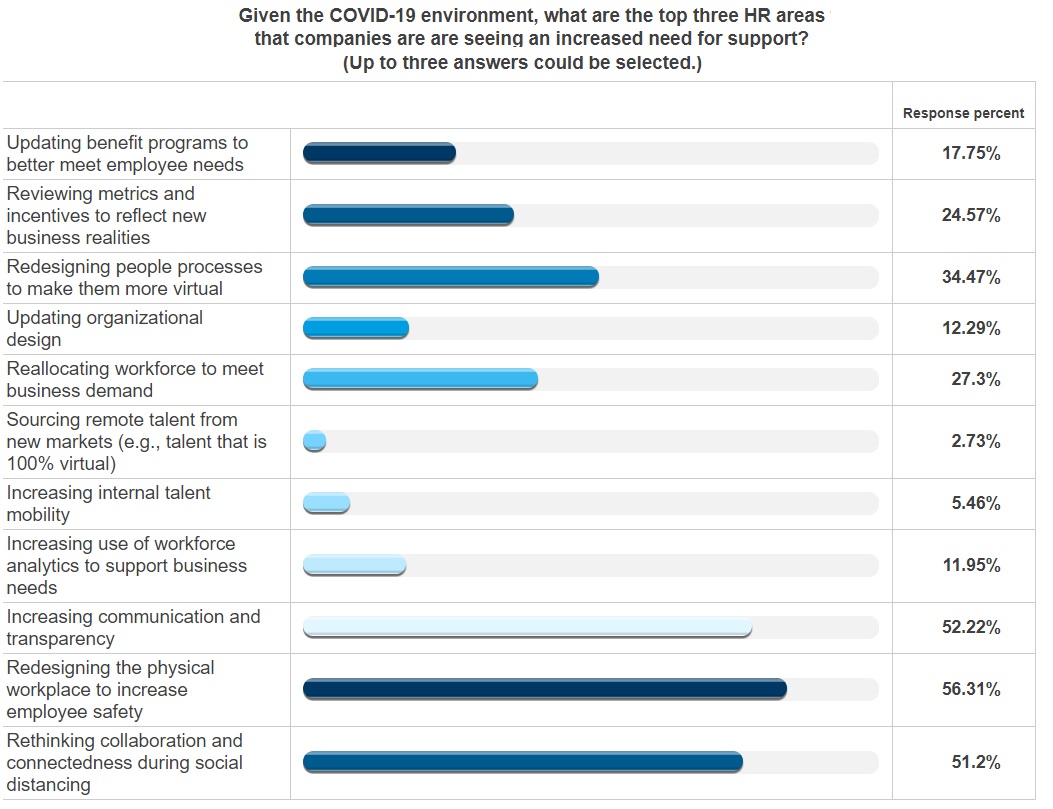

So what are employers and their HR departments focusing on instead? According to the Mercer survey, redesigning the physical workspace for employee safety is top of mind, followed by increasing communication and transparency and rethinking collaboration and connectedness. Until it's safe to return to the office, 49% of respondents saying they'll continue to encourage remote work, and 23% planning to continue it through at least the end of the year.

(Source: Mercer)

(Source: Mercer)When it is time to come back to the workplace, a majority of respondents say it will involve splitting employees into different groups based on criteria. They're also considering giving employees the option to continue to work remotely and limiting the mixing of employees within the workplace.

Read more:

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.