Of the 48 million people who will be affected by a job loss this year, 34% have insurance through a family member's job, while 27% are covered by Medicaid or CHIP. (Photo: Shutterstock)

Of the 48 million people who will be affected by a job loss this year, 34% have insurance through a family member's job, while 27% are covered by Medicaid or CHIP. (Photo: Shutterstock)

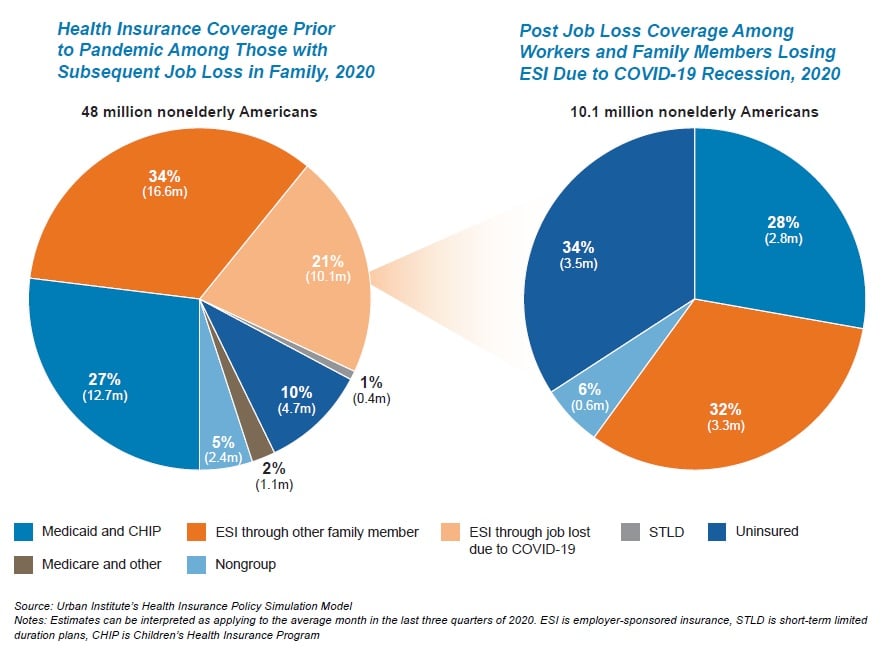

The COVID-19 pandemic has wreaked havoc on nearly every aspect of our health care system, including the group insurance market. As unemployment levels soar, an estimated 10.1 million people will lose their employer-sponsored insurance, according to a recent analysis from the Robert Wood Johnson Foundation and the Urban Institute.

This number is just a drop in the bucket, representing just one-fifth of the total unemployed population. "The COVID-19 recession has disproportionately affected the lowest-paid workers, who are the least likely to have work-based health insurance," said Katherine Hempstead, senior policy advisor at the Robert Wood Johnson Foundation. "The loss of jobs and coverage associated with the pandemic is a huge test for our safety net, but it may not be the inflection point for the employer market that many predicted."

Related: If ever there was a time to rethink employer-sponsored health plans, this is it

Of the 48 million people who will be affected by a job loss this year, 34% have insurance through a family member's job, while 27% are covered by Medicaid or the Children's Health Insurance Program (CHIP). Just 5% are enrolled in a non-group insurance plan, and 10% are uninsured, according to the analysis.

Overall, employer-sponsored health insurance enrollment is estimated to drop by 7.3 million, as many of those who lose their current coverage will switch to a family member's plan. As noted by other studies, many of those who lose their insurance will opt to enroll in Medicaid or purchase a plan on the ACA exchanges, and some will simply go without, adding to the current uninsured rate. According to the study, the uninsured rate is estimated to hit 9.2% in states that have expanded Medicaid, and 15.6% in states that have not.

"Our analysis projects that the ACA health insurance safety net is working as intended in states that expanded Medicaid eligibility, better protecting people from uninsurance," the study's authors write. "People living in states that have refused to expand Medicaid, however, are less protected."

The authors note that some factors not included in their model may affect the final outcome. These include instances where employers have continued to pay for furloughed workers' health insurance or worked with insurers to extend coverage.

Read more:

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.