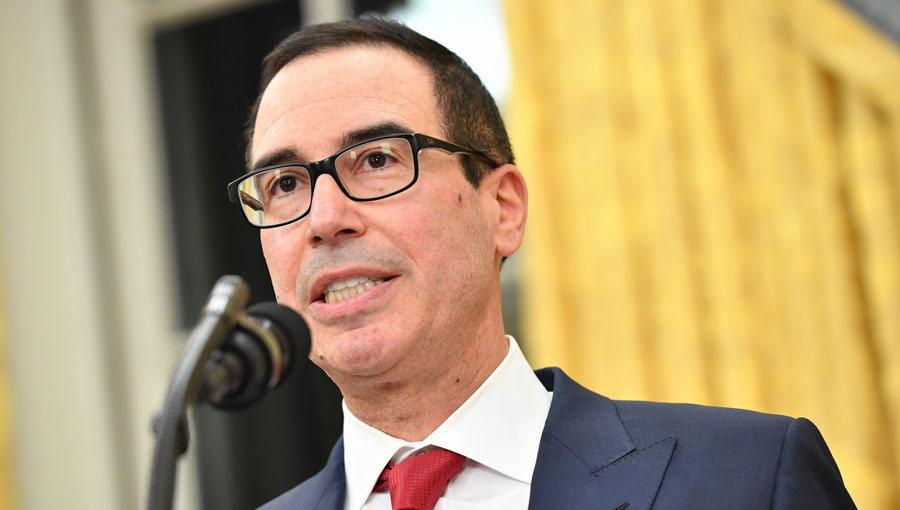

Treasury Secretary Steven Mnuchin. (Photo: AP)

Treasury Secretary Steven Mnuchin. (Photo: AP)

The Small Business Administration and Treasury Department issued an interim final rule on October 8 that provides a simpler loan forgiveness application for Paycheck Protection Program loans of $50,000 or less.

"The PPP has provided 5.2 million loans worth $525 billion to American small businesses, providing critical economic relief and supporting more than 51 million jobs," said Treasury Secretary Steven Mnuchin, in a statement.

Recommended For You

The action, Mnuchin said, "streamlines the forgiveness process for PPP borrowers with loans of $50,000 or less and thousands of PPP lenders who worked around the clock to process loans quickly."

Mnuchin said he continued to favor additional legislation to further simplify the forgiveness process.

SBA began approving PPP forgiveness applications and remitting forgiveness payments to PPP lenders on Oct. 2.

Policy analysts for Raymond James said in Friday morning email briefing that the streamlined forgiveness process was for small borrowers with one or more employee other than the owner.

Industry participants and legislators alike, the analysts said, "had been calling for, and hoping for, forgiveness of loans less than $150,000. While this new announcement is not what we were hoping for, given the gridlock in Washington the timing of a $150,000 forgiveness approval was uncertain, this is significant a step in the right direction."

Regional banking associations, other independent lobbying groups, and legislators "alike will continue to push for the larger $150,000 forgiveness threshold and a second round of PPP loans for the hardest hit industries," the analysts said.

SBA said it will continue to process all PPP forgiveness applications in an expeditious manner.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.