In June of 2020 our annual publication on our view of interest rates was published in BenefitsPRO, which was an interesting time in the economy due to the ongoing pandemic. The Fed had moved the Fed Funds rate to 0.00% – 0.25%, unemployment spiked up to 15%, and credit spreads had widened out considerably. We've since moved through a US presidential election, had multiple vaccines approved for distribution to combat COVID-19, and continued to see equity markets provide positive returns. This quick update looks at what changed in the second half of 2020 and our thoughts on what might happen with interest rates based on where we're at today.

The yield curve

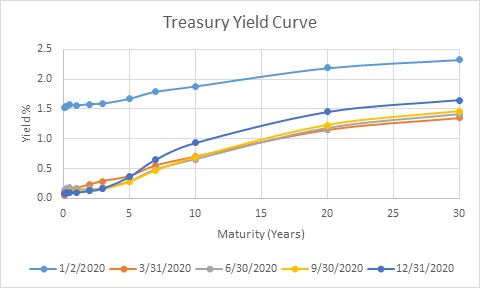

In early 2020, the Treasury yield curve took a nose dive, especially at the short end of the curve. For many maturities, yields reached all-time lows. However, early in Q4, we saw the Treasury curve begin to steepen with longer term rates increasing 0.20% – 0.25%, while the short end of the curve held steady. The 10-Year Treasury yield flirted a couple of times with the current top end of our predicted range of 1.00%, but ultimately it didn't break through until early January 2021.

The Treasury Yield Curve. Source: www.treasury.gov

The Treasury Yield Curve. Source: www.treasury.gov Recommended For You

The high quality, corporate bond yield curve that many institutional investors use to value interest-rate sensitive liabilities also saw quite a bit of movement during 2020, but did not really change shape in the last half of the year. While long-term Treasury yields were increasing in Q4, credit spreads were also tightening up. The FTSE Pension Liability Index (a measure of corporate pension discount rates) actually moved lower during the second half of 2020 by roughly 0.20%.

FTSE Pension Discount Curve. Source: FTSE

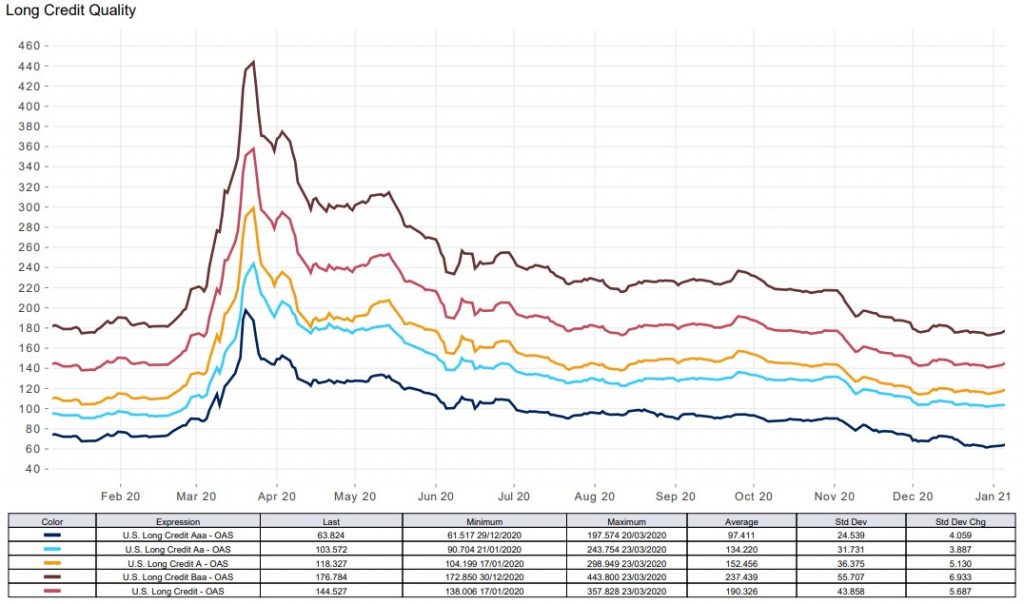

FTSE Pension Discount Curve. Source: FTSE Why have discount rates fallen? As Treasury rates fell more than 1% back in March, credit spreads (the difference between Treasury yields and corporate bond yields) rose by more than the Treasury rates fell (see chart below).

These offsetting movements kept discount rates flat and in some cases moved them slightly higher. As 2020 progressed, Treasury rates began to rise, but this rise was more than offset by credit spreads that began to tighten. Stimulus from the Fed and improving economic outlook along with the need for yield have been the primary drivers of this spread compression.

Credit Spreads. Source: Bloomberg Barclays

Credit Spreads. Source: Bloomberg Barclays The shape of the Treasury yield curve suggests multiple years of 0% Fed Funds rates with a relatively slow ramp up when the Fed does begin to raise rates. Credit spreads indicate an anticipation of continued Fed stimulus for investment grade companies and a full-scale recovery from the pandemic (i.e., fewer bankruptcies than would otherwise occur). However, there are scenarios that could derail the market expectations such as inflation rising faster than anticipated or the Fed signaling a pullback of economic support – both of which would increase rates faster than expected.

The Fed and inflation

With the anticipated growth from businesses reopening and jobs coming back, along with the additional stimulus from the Fed and the government (current and future), the markets will begin to focus on interest rates. The key question will be, "When will the Fed raise interest rates?" The Fed Chairman, Jerome Powell, has said that the Fed will keep short rates low for a number of years to support the economy. However, the market may start pricing in a move in interest rates ahead of any Fed action. We have seen a bit of this already reflected in the steepening of the yield curve since the successful vaccines were announced.

The Fed's dual mandate of controlling inflation and keeping unemployment low will definitely be tested as the economy ramps up. However, the timing for the economy to reopen is still a big unknown and looks like it will take months, if not longer, before everything is fully operational. Vaccine distribution and effectiveness will be key drivers of the timeframe for fully reopening.

As we've said previously, what happens with permanent vs. temporary job losses will also be telling as to how the overall global economy rebounds. Given this, and the Fed's current stance on the Fed Funds rate, we believe that short-term rates will remain anchored throughout 2021, but long rates may move higher as economic activity improves and additional stimulus is made available.

Anticipated inflation will also be a key driver of longer-term interest rates. The Fed has said that it will tolerate a fair bit of inflation before increasing rates. While this may allow long rates to rise a bit, we believe that these rates will move into new ranges, somewhat higher than the ranges we discussed last year with the 10-Year and 30-Year Treasury rates moving into ranges of 1.0% – 1.5% and 2.0% – 3.0%, respectively.

What kind of rollercoaster is this? Update

With all the forces at play in the current economic environment, it's difficult to see how pension discount rates move back to 2018 and 2019 levels in 2021 on a sustainable basis. However, what we may see is a temporary inflation scare driving the back end of the yield curve higher as reopenings and supply shortages drive prices a bit higher along with the possibility for fiscal stimulus given the outcome of the elections.

However, longer term forces, such as demographics and technology improvements, should limit sustained increases in inflation and interest rates over time. This could ultimately lead to 2021 being a great year for pension funding levels, even though the improvements in rates may be fleeting.

The shutdowns have put substantial pressure on the ability to service debt and it will be telling to see how many highly leveraged companies survive over the next year. Credit defaults and the ability to borrow will be key drivers of credit spreads. A prolonged pandemic, or even a double dip recession (more likely outside the US), will put additional pressure on credit spreads. Our view is that spreads will continue to shrink as economic activity improves, but only to a limited degree. This is largely due to the expected light at the end of the tunnel for the pandemic and the expectation that companies that have made it this far will ultimately survive.

For institutional investors with interest rate sensitive liabilities, we expect some movement in discount rates with the improvement in economic activity, but not back to sustained levels of 3.5% – 4.0% from a few years back. Conditions may be ripe to see a temporary spike in rates, but other forces will most likely push them back down.

Michael Clark is a Managing Director and Consulting Actuary in River and Mercantile's Denver office and is the Immediate Past President of the Conference of Consulting Actuaries.

Phil Gorgone is a Managing Director and Head of Investments in River and Mercantile's Boston office.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.