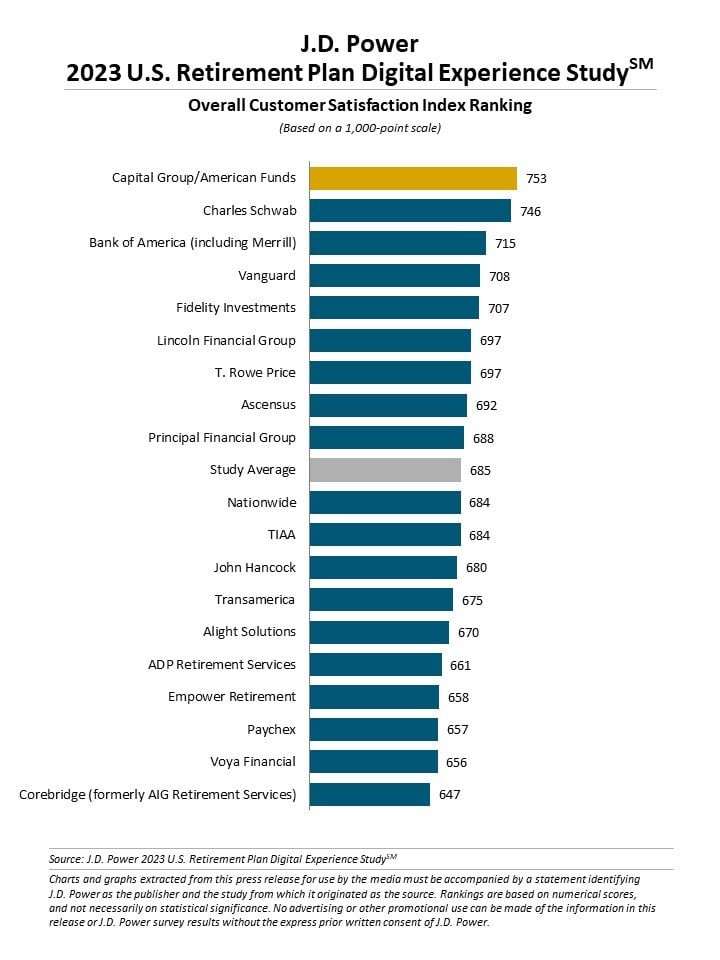

Courtesy of J.D. Power. The study shows that downloads and usage of mobile retirement apps have increased substantially over just the past couple years. Nearly half (47%) of participants reported downloading their retirement plan's mobile app, up from 35% in 2021, while 38% have used the mobile app in the past 30 days, up from 27% in 2021. However, even though overall satisfaction with retirement plan digital experiences has increased from 663 in 2022 to 682 in 2023, only 38% of retirement plan participants give their plans high marks for digital capabilities. Moreover, other industries have achieved higher levels of overall satisfaction with their digital experiences, including wealth management and property and casualty insurance.

Courtesy of J.D. Power. The study shows that downloads and usage of mobile retirement apps have increased substantially over just the past couple years. Nearly half (47%) of participants reported downloading their retirement plan's mobile app, up from 35% in 2021, while 38% have used the mobile app in the past 30 days, up from 27% in 2021. However, even though overall satisfaction with retirement plan digital experiences has increased from 663 in 2022 to 682 in 2023, only 38% of retirement plan participants give their plans high marks for digital capabilities. Moreover, other industries have achieved higher levels of overall satisfaction with their digital experiences, including wealth management and property and casualty insurance. Related: Make it personal! Touting retirement plan options tailored to employees' needs is key

Improving these digital offerings is vital, whatever the vicissitudes of the market may be, Martin says. "The effects of the digital experience to the business are impossible to ignore and will only become more important when an inevitable market downturn occurs and satisfaction is affected." The study's results bear this out: More than one third (34%) of retirement plan participants who give their provider the highest marks for digital experience have rolled over money from other retirement accounts, compared with the 20% who give their experiences a poor rating. Additionally, 48% of those participants giving their plans the highest marks for digital said they "definitely will" keep assets with their current provider even if they change their job. Only 15% of those with low digital satisfaction reported staying with their providers. See our slideshow above for the mobile apps with the highest overall satisfaction ratings.

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking benefits news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.