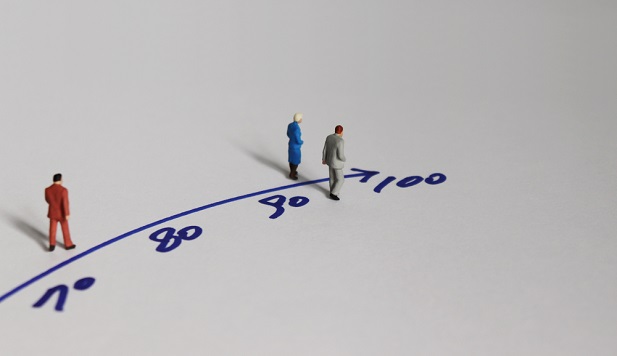

One of the most important factors in preparing financially for retirement is having an idea how long retirement savings will need to last. However, the vast majority of adults know little about how long people tend to live in retirement, which can dramatically impact how financially prepared they are.

Recommended For You

According to a report by the TIAA Institute and George Washington University's Global Financial Literacy Excellence Center, only 35% of Americans know the average lifespan of retirees, a worrisome knowledge gap that can keep them from saving enough money to last as long as they live. Only 12% of adults have strong longevity literacy, meaning they could correctly answer three longevity literacy questions, while 31% have weak longevity literacy, meaning they demonstrate a complete lack of understanding of the retirement planning horizon for 65-year-olds. Those with strong longevity literacy are more likely than those with weak literacy to plan and save for retirement while working and they tend to experience better financial outcomes in retirement, the report said.

An equally low share of men and women (only around 10%) show strong longevity literacy. However, significantly more men demonstrate weak longevity literacy compared to women, an interesting finding considering men outscore women in financial literacy. The report theorized that women might score better on longevity because they tend to spearhead health care decisions for their families and serve as caregivers for elderly parents.

Related: Time to reframe retirement readiness: Most Americans lack 'longevity literacy'

Poor longevity literacy isn't likely to be improved by simply providing individuals with information, the report said. Terminology is an obstacle, with only one-third of adults understanding the practical implications of the term 'life expectancy.'

"For many, discussing life expectancy can be a difficult prospect," said Surya Kolluri, head of the TIAA Institute. "They don't want to talk about when they will die. But when you talk about how long they will live, all of a sudden, there's a passion in their eyes. The data shows that the odds of at least one member of a male/female couple being alive at age 90 is 51%. The conversation becomes less 'eat your spinach – it's good for you,' and more 'enjoy the whole meal.' Or more plainly: 'Let's figure out how to plan for the likely length of your life.'

Employers can help employees improve their longevity literacy by encouraging them to engage with their retirement plan benefits," said Kolluri.

"If their plan includes access to retirement planning tools or meetings with financial advisors, then participants should take full advantage of their resources," he said. "Health and wealth are two sides of the same coin. Plan participants should treat their finances just like they do their health – get annual checkups and monitor it as needed. Employers can also explore ways to give their employees access to lifetime income. That way participants can never run out of money in their retirement."

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.