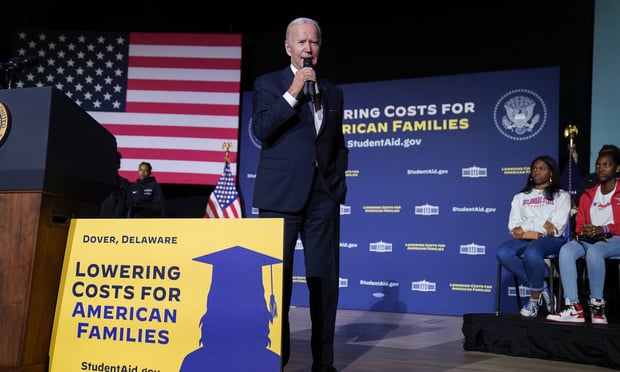

President Joe Biden speaks about student loan debt relief. (AP Photo/Evan Vucci)

President Joe Biden speaks about student loan debt relief. (AP Photo/Evan Vucci)

The Biden administration has taken another incremental step toward eliminating student debt. On Thursday, the U.S. Department of Education announced a plan that would enable the federal government to consider life challenges that prevent certain borrowers from making progress on their loans when assessing if that person is eligible for student loan forgiveness.

"The ideas we are outlining today will allow us to help struggling borrowers who are experiencing hardships in their lives, and they are part of President Biden's overall plan to give breathing room to as many student loan borrowers as possible," Undersecretary James Kvaal said.

Recommended For You

Factors that would be considered include whether a borrower has a disability or other high-cost burdens for essential expenses, such as costs related to health care or caring for a loved one. A borrower's household income, assets and age also would be considered.

The administration initially attempted to cancel up to $20,000 for an estimated 43 million people with incomes below $125,000. After the U.S. Supreme Court ruled that the president overstepped his authority, Biden asked the Education Department to develop a new plan with a different legal basis. The new proposal is narrower, focusing on several categories of borrowers who could get some or all of their loans canceled. The proposed regulations include automatic relief up to the entire outstanding federal loan balance for borrowers who are considered highly likely to be in default in two years

Additional borrowers would be eligible for relief under a wide-ranging definition of financial hardship for amounts up to the outstanding balance of their loans. Those factors include but are not limited to a person's relative loan balance and payments compared to their total income. Other considerations include whether a borrower has high-cost, unavoidable expenses such as paying for child care or health care. The proposed regulations also state that "any other factors of hardship identified by the secretary" also may be considered. Borrowers may be eligible for relief either automatically or through an application.

Related: Biden announces 'immediate' student loan forgiveness for some borrowers

Although the White House said it couldn't immediately identify exactly how many borrowers the proposal could affect, advocates said the proposal could pave the way for relief for tens of millions of borrowers. However, the proposal will go through a rulemaking process that is expected to take months to finalize, and a legal challenge is almost certain.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.